XAU/USD

+0.19%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Gold

+0.08%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

EUR/USD

+0.10%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DX

-0.05%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The prospect that the Fed’s pivot might come in May has kept gold under pressure and strengthened the dollar.

However, forecasts point to continued stable demand for gold in 2024

$1940 per ounce is a key demand zone and could present a buying opportunity for investors.

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

At the start of December last year, gold prices reached a new all-time high of $2,135 per ounce.

Since then, however, the yellow metal struggled to maintain this level amid a rebounding US dollar, mostly boosted by robust US economic data that could delay the Fed’s pivot from March to May.

But despite the correction, bullion still hovers around the $2,000 line, indicating that the positive outlook for the medium and long term persists.

Fundamentally, the yellow metal is poised to continue attracting robust demand from central banks, retail investors keen on both physical gold and ETFs, and the burgeoning jewelry industry.

Against this backdrop, buying into gold’s dip may be a smart, safe play for long-term investors. But at which level?

Let’s take a deeper look at all the factors to better answer that question.

US Dollar Strength Temporary?

Although the US dollar has exhibited short-term strength this month as seen in the EUR/USD pair dropping from 1.11 to nearly 1.08, it is still a local uptrend.

The stronger-than-expected data supports the Fed’s hawkish stance, but it is likely a temporary strengthening, with the pivot expected later in the first half of the year.

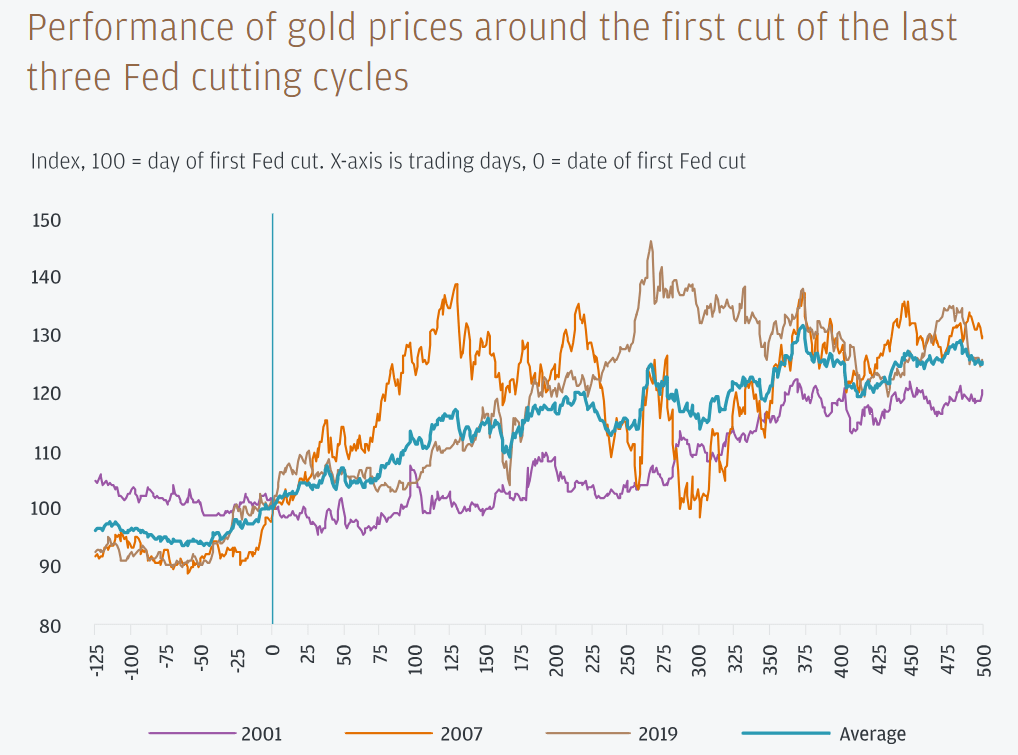

Previous instances of Fed pivots have shown an upward trajectory in gold prices in the subsequent months.

Gold Price Performance Around First Rate Cut

Gold Price Performance Around First Rate Cut

Source: jpmorgan.com

There is no indication that this scenario will be different this time.

Gold appears poised to sustain its upward trajectory, bolstered by escalating conflicts, particularly in the Middle East, which tends to drive investors toward safe-haven assets.

The demand outlook for the precious metal remains optimistic.

Will Central Banks Continue to Have an Appetite for Gold in 2024?

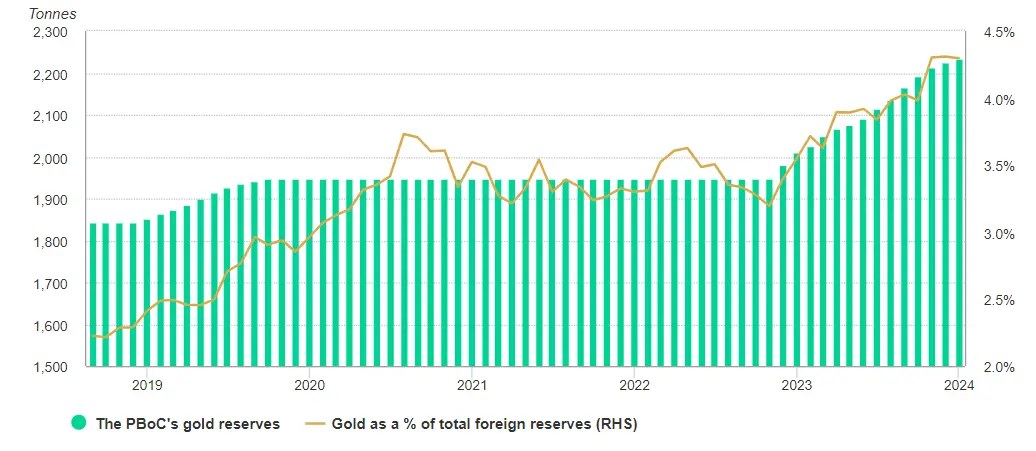

A key factor contributing to gold’s positive outlook is the continued appetite of Central Banks for the metal.

In 2023, Central Banks were active in gold purchases, accumulating around 800 tons. China emerged as a leader, acquiring 287 tons in 14 months and concluding the year with a reserve level of 2235 tons.

JP Morgan Research forecasts that global demand from Central Banks in 2024 could further increase to 950 tons.

PBOC Gold Reserves

PBOC Gold Reserves

Source: gold.org/worldgoldcouncil

Over the past few years, however, it is demand from the jewelry industry that has accounted for the largest share when it comes to the demand side globally.

According to data for the first half of 2023, the industry accounted for just under 50% of total demand for the commodity.

Gold Technical View: Correction to Deepen – Buy Zone Around $1940 Is Key

Given at least the short-term strength of the US dollar currently, there is a high probability of a deepening of the correction in gold.

The strength of the supply side will face a crucial test in its attempt to breach the psychological barrier of $2,000 per ounce.

A successful break below this level could pave the way for a continuation of the downward movement.

Gold Futures Price Chart

Gold Futures Price Chart

The key target area for the bears will be the demand zone located in the price region of $1940 per ounce.

The strength of this region is because it initiated a strong upward impulse taking the price to a new all-time high.

The negation of the bearish scenario will be when the price breaks the key supply zone around $2050 per ounce.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans,” which outperformed the market by a lofty 952% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here for up to 50% off as part of our year-end sale and never miss a bull market again!

Claim Your Discount Today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor

Source: Investing.com