EBAY

-0.55%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SQ

+0.23%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

TWLO

-0.12%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Surging hype and excitement around artificial intelligence has been one of the main drivers of the stock market in recent months.

While most of the focus is on the mega-cap tech stocks, such as Nvidia, Microsoft, and Alphabet, there are several companies set for robust growth amid their innovations in AI.

As such, investors should consider adding Twilio, Block, and eBay to their portfolios as the AI frenzy continues.

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Amidst the ongoing surge of interest in artificial intelligence (AI) technologies, investors are eagerly seeking out opportunities in the stock market that promise significant growth potential.

While the current market frenzy may focus on high-profile tech giants, such as Nvidia (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT), and Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), investors should not overlook the potential of lesser-known companies harnessing the power of AI.

Luckily, our predictive AI stock-picking tool, ProPicks, can help you find such winners. With six strategies proven to beat the market, ProPicks combines the long-term history of the stock market with state-of-the-art fundamental analysis to offer you every month 70+ potential winners.

Join now for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

Now let’s take a look at three stocks worth considering thanks to their growing involvement in AI and fresh initiatives in the rapidly evolving space.

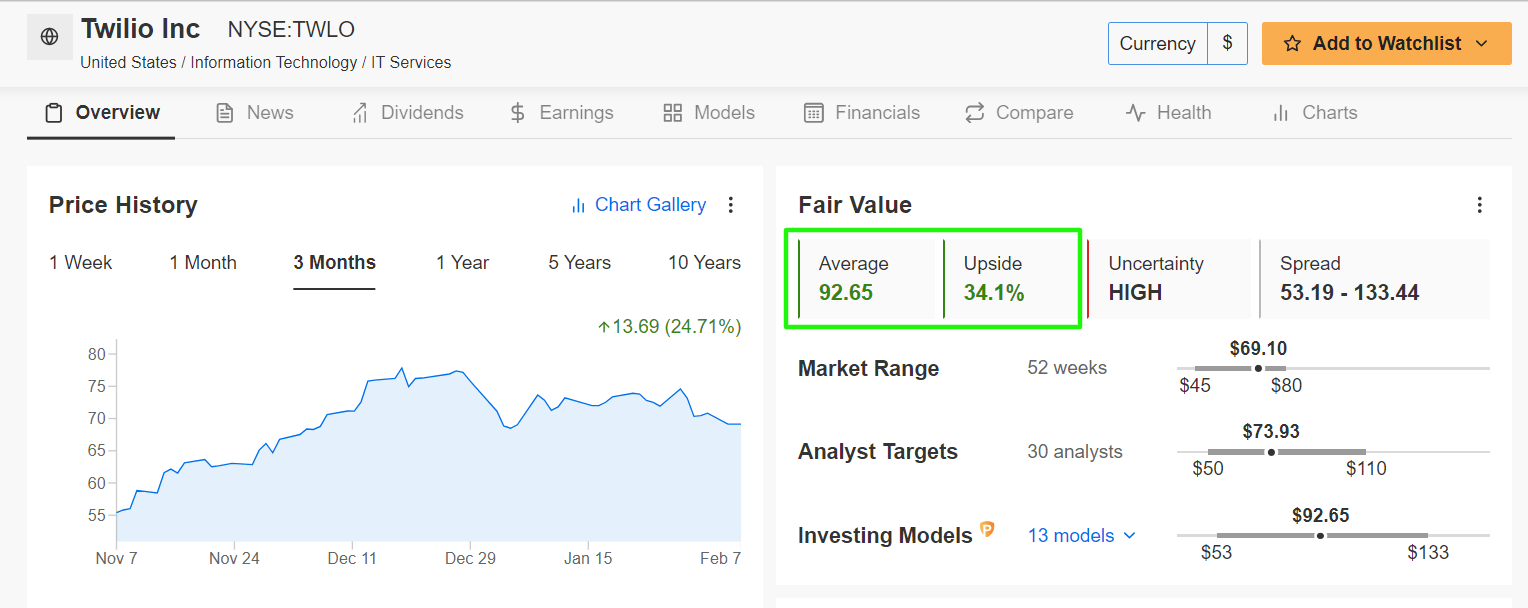

1. Twilio

Twilio (NYSE:TWLO), a cloud communications platform, has been integrating AI into its services to provide advanced customer engagement solutions.

The software-as-a-service company’s AI-powered chatbots and virtual assistants enable businesses to automate customer interactions and provide personalized support, enhancing overall customer experience.

Furthermore, Twilio’s AI capabilities enable data-driven insights into customer preferences, allowing businesses and organizations to tailor their offerings and drive revenue growth through increased customer satisfaction and retention.

With its cutting-edge AI-driven customer engagement solutions set to drive growth, the average ‘Fair Value’ price target for TWLO stock implies 34.1% upside over the next 12 months according to insights from InvestingPro.

Twilio Stock Data

Twilio Stock Data

Source: InvestingPro

As can be seen above, such a move would take shares to $92.65 from last night’s closing price of $69.10.

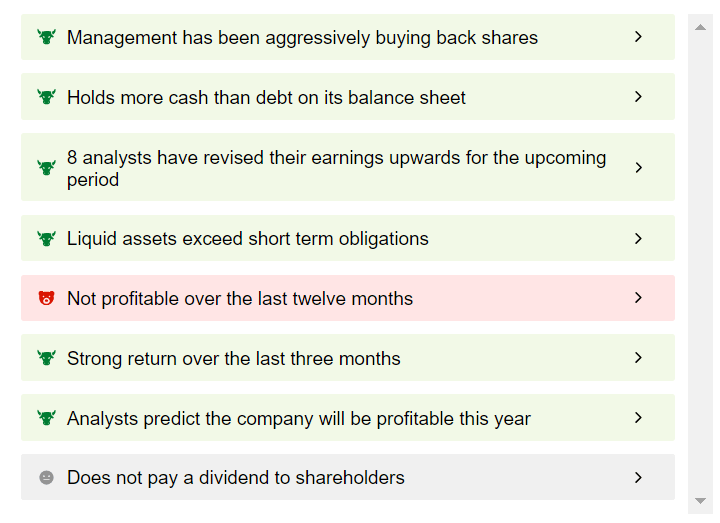

Additionally, ProTips highlights several tailwinds that would helpfully push the cloud communications specialist higher in the months ahead, including consistently increasing earnings per share, accelerating sales growth, and a healthy balance sheet.

It also mentions that Twilio’s management has been aggressively buying back shares in recent months.

InvestingPro ProTips

InvestingPro ProTips

Source: InvestingPro

The San Francisco, California-based cloud communications software and services provider next reports financial results on Wednesday, February 14.

Consensus calls for a profit of $0.58 per share for the fourth quarter, surging 163.6% from $0.22 per share in Q4 of last year. Revenue, meanwhile, is forecast to tick up 2.2% to $1.04 billion.

Upcoming Earnings

Upcoming Earnings

Source: InvestingPro

Wall Street is extremely optimistic ahead of the Q4 update, as per an InvestingPro survey, with analysts increasing their EPS estimates 25 times in the past three months to reflect a gain of almost 470% from their initial expectations.

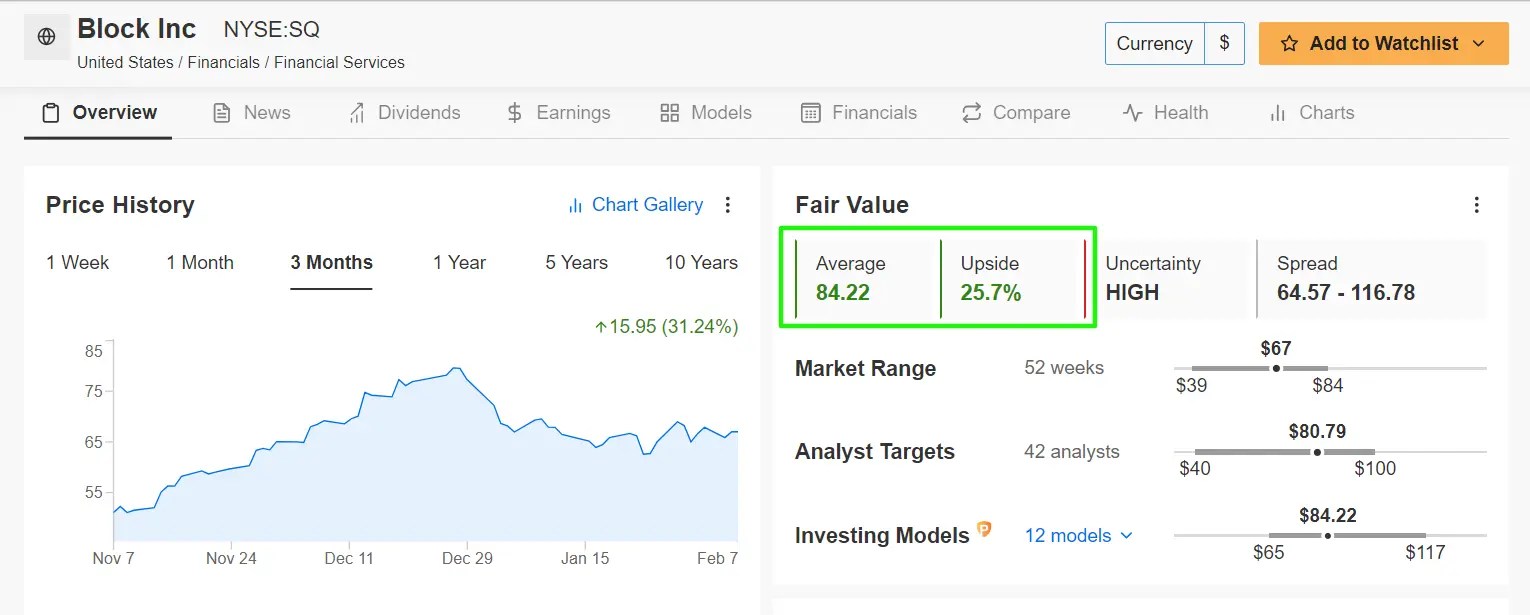

2. Block

Block (NYSE:SQ), formerly known as Square, has been actively investing in AI to enhance its financial services offerings.

The fintech company’s AI initiatives, which include AI-powered fraud detection algorithms, are expected to drive cost savings and efficiency gains, leading to improved profitability.

In addition, the digital payment provider’s AI-driven insights into consumer behavior and spending patterns enable targeted marketing efforts and personalized financial services, which could result in increased revenue streams.

With strong growth across its booming Cash App ecosystem and what appears to be a long runway ahead, Block is a strong buy recommendation according to the quantitative models in InvestingPro, which point to a gain of 25.7% in SQ stock in the next 12 months.

Block Stock Data

Block Stock Data

Source: InvestingPro

That would bring shares closer to their Fair Value of $84.22, compared to the current price of $67.00.

As ProTips points out, Block’s company profile is fairly positive, with several bullish tailwinds working in its favor, including a robust profitability outlook and strong free cash flows.

The company, which is run by former Twitter CEO Jack Dorsey, is widely considered one of the leaders in the fast-growing mobile payment processing industry.

InvestingPro ProTips

InvestingPro ProTips

Source: InvestingPro

Block is slated to report fourth quarter earnings on Thursday, February 22.

Consensus estimates call for the San Francisco, California-based company to report earnings per share of $0.58, jumping 168.2% from EPS of $0.22 in the year-ago period.

Revenue is forecast to increase 22% year-over-year to $5.70 billion.

Upcoming Earnings

Upcoming Earnings

Source: InvestingPro

Earnings estimates have been revised upward six times in the last 90 days, according to an InvestingPro survey, compared to seven downward revisions.

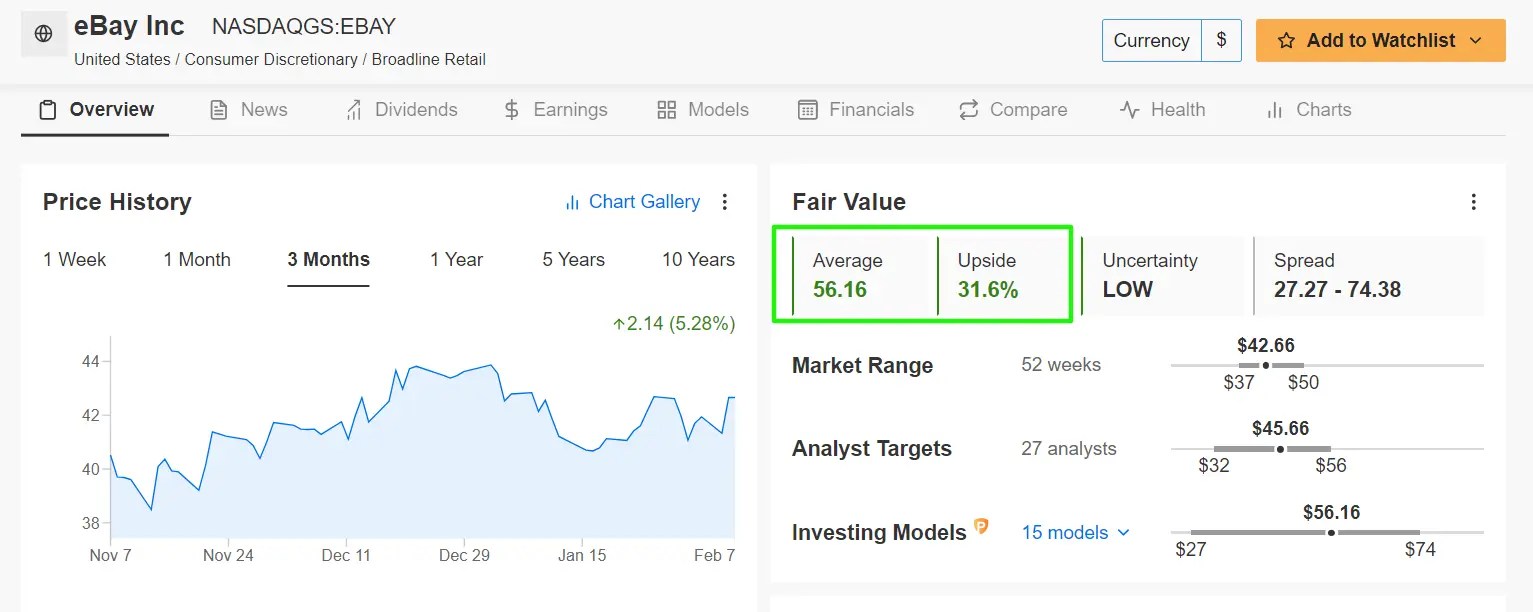

3. eBay

eBay (NASDAQ:EBAY), a leading e-commerce platform, has been making great strides in leveraging AI to enhance its marketplace capabilities. The online retailer’s AI algorithms analyze vast amounts of data to personalize product recommendations for users, improve search relevance, and optimize pricing strategies for sellers.

Moreover, eBay’s AI-driven initiatives are expected to increase user engagement and transaction volume on its platform, ultimately contributing to both its top-and-bottom lines.

It should be noted that EBAY stock is extremely undervalued according to InvestingPro and could see an increase of 31.6% from last night’s closing price of $42.66.

eBay Stock Data

eBay Stock Data

Source: InvestingPro

That would take shares within proximity of their ‘Fair Value’ price target of $56.16.

Demonstrating the strength and resilience of its business, ProTips mentions that eBay is in great financial health condition thanks to strong earnings and sales growth prospects, combined with its attractive valuation. In addition, it notes that eBay’s management has been aggressively buying back shares and that the company has raised its dividend payout for five consecutive years.

InvestingPro ProTips

InvestingPro ProTips

Source: InvestingPro

The San Jose, California-based tech firm is forecast to release its fourth quarter financial results on Tuesday, February 27.

Wall Street sees eBay delivering a profit of $1.03, a tad lower than EPS of $1.07 in the year-ago period. Sales are expected to clock in at $2.51 billion, compared to $2.50 billion last year.

Upcoming Earnings Report

Upcoming Earnings Report

Source: InvestingPro

It should be noted that 15 of the 18 analysts surveyed by InvestingPro have downwardly revised their earnings forecast in the weeks leading up to the print to reflect a decline of 9% from their initial estimates.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here and never miss a bull market again!

Subscribe Here!

Don’t forget your free gift! Use coupon code PROTIPS2024 at checkout for a 10% discount on the Pro yearly plan, and PROTIPS20242 for an extra 10% discount on the bi-yearly plan.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com