© Reuters.

USD/INR

+0.01%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NSEI

-0.97%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

BSESN

-1.00%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

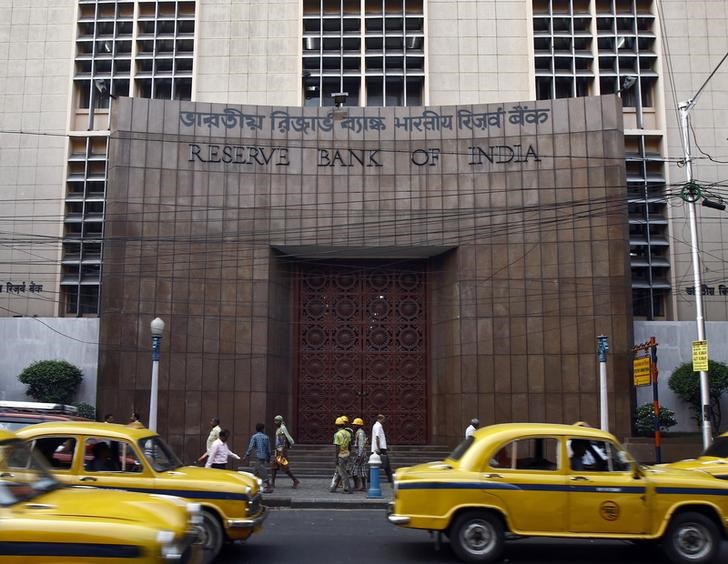

Investing.com– The Reserve Bank of India kept interest rates steady on Thursday as widely expected, and said that it will continue to focus on keeping inflation in check amid accelerating economic growth in the country.

The RBI kept its policy repo rate at 6.5% for a fifth consecutive meeting, after having signaled an end to its hiking cycle in mid-2023.

Governor Shaktikanta Das said in a livestream that the bank will continue to keep policy tight in order to bring inflation more in line with its 4% target. Das also noted that the Indian economy was expanding at a rapid pace, and would likely continue to outpace its global peers in the coming years.

The RBI Governor forecast real gross domestic product (GDP) for the current fiscal year to March 31, 2024, at 7.3%. Real GDP growth for fiscal year 2025 is projected at 7%, with the Indian economy set to vastly outpace its global peers.

India was the fastest-growing major economy over the past two years, amid increased government spending and foreign investment. Consumer spending, particularly in India’s urban centers, was also a key driver of growth.

But Das noted persistent risks from inflation, and stressed on the need to keep inflation balanced and under control to facilitate continued economic growth.

The RBI’s decision comes just a few days before Indian consumer price index inflation data, which is expected to show price pressures remaining sticky and well above the RBI’s 4% annual target in January.

Food price inflation- particularly vegetables and grains- has remained a key point of contention for Indian inflation, after irregular monsoons through 2023 sparked shortages in some parts of the country.

“The inflation trajectory going forward will be shaped by food inflation, about which there is considerable uncertainty,” Das said.

Das said that CPI inflation was projected at 5.4% for the current fiscal year, and was projected at 4.5% for fiscal 2025, assuming a stable monsoon.

The Indian rupee rose 0.1% after the RBI decision, while the Nifty 50 stock index tread water.

Source: Investing.com