US500

+0.06%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

+0.13%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+0.24%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NYCB

-6.58%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Major U.S. indexes break new historic records, S&P500 just a hair away from 5,000 points.

But, potential headwinds loom as US banking crisis fears come back to the fore.

In this piece, we will take analyze the key US indexes from a technical perspective.

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The bull market rages on, so far undeterred by the likely delay in interest rate cuts and hawkish statements from Fed officials.

Several factors have contributed to this resilience. Primarily, there’s the increasingly probable scenario of a soft landing in the U.S. economy.

Additionally, a positive overall Q4 earnings season has given the market further breath, showing that the better-than-feared economy conditions are resulting in similarly strong corporate profitability. On top of that, the AI narrative has maintained interest in tech companies strong, as investors anticipate further inflows of speculative capital into the segment as financial conditions improve.

On the downside, however, we’re also witnessing the potential spark of the next installment of the banking crisis, with New York Community Bancorp (NYSE:NYCB) facing problems.

The commercial real estate sector, too, is under scrutiny. Recently, Federal Reserve Chairman Jerome Powell acknowledged that some small banks may need to be taken over or closed.

As the market weights in the fundamental factors supporting the current price action, let’s have a look at the technical indicators that will likely present interesting trading opportunities.

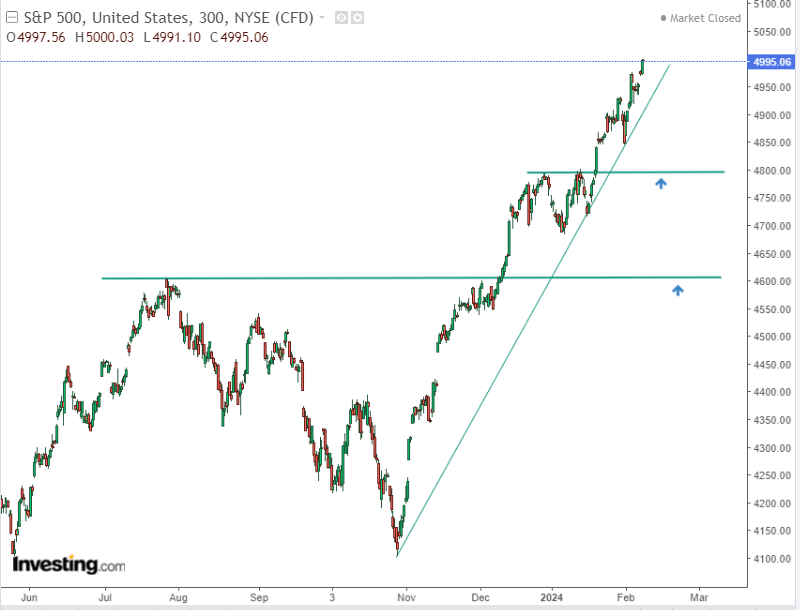

S&P 500: Will 5000 Milestone Hinder Upward Momentum?

As the S&P 500 continues its upward trajectory, recent rebounds have been relatively flat, offering limited opportunities for connections to the main trend at more favorable prices.

Presently, investor attention should be focused on the 5000-point level, where a potential reaction and deceleration could occur.

S&P 500 5-Hour Chart

S&P 500 5-Hour Chart

The first signal of a larger correction will be the breakout of the upward-sloping trend line and the descent below 4900 points. The first area of support to look at in terms of joining the train is the area around 4800 points.

Nasdaq Approaches 16000 Mark: What’s Next?

We are dealing with an almost identical situation to that on the S&P 500 on the main US index of technology companies, the Nasdaq.

In this case, however, we witnessed a correction that tested the local support located in the price area of 15200 points.

Nasdaq 5-Hour Chart

Nasdaq 5-Hour Chart

This region is currently the main reference point for a possible rebound, the signal of which will also be the breaking of the upward trend line.

The natural target for the demand side is the nearest round level of 16000 points.

The scenario of a deeper correction will be possible in the event of a descent below 15000 points, which opens the way for an attack on 14500 points.

Dow Jones: Can the Index Catch Up?

Unlike the two analyzed above, the oldest U.S. stock market index, which is the so-called Dow Jones Industrial Average, failed to improve on its historical maxima in recent days.

However, this does not change the technical situation to a greater extent, which indicates a strong upward trend so far with no signs of a possible breakdown.

Dow Jones 5-Hour Chart

Dow Jones 5-Hour Chart

If we see another reaction in the 38800 price area, a double peak formation will be formed, which is a clear signal heralding a corrective movement.

As for the ranges for declines, we have two potential support areas located around 37800 and 37200 points.

The main target level for the bulls is now the important round barrier of 40000 points, which is a resistance area due to the lack of historical reference points.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Subscribe Today!

Don’t forget your free gift! Use coupon code OAPRO1 at checkout for a 10% discount on the Pro yearly plan, and OAPRO2 for an extra 10% discount on the by-yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com