NDX

+0.71%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MSFT

+1.15%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

LLY

+0.61%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GOOGL

+1.46%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AAPL

+0.31%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AMZN

+1.91%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NVDA

+2.54%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

TSLA

+1.45%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

META

-0.00%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

PANW

+3.12%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLK

+1.09%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

GOOG

+1.37%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

UBER

-1.07%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The stock market continues to rally to new heights, with the S&P 500 hitting the 5,000-mark for the first time in history.

While most of the focus is on the ‘Magnificent 7’ mega-cap tech stocks there are quite a few companies that have seen their shares climb to new highs.

As such, investors should consider adding the three stocks we plan to discuss in this article to their portfolio as the stock market rally continues.

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

In a market dominated by the ‘Magnificent 7’ group of mega-cap tech stocks, investors often overlook other market leaders poised for significant growth.

By diversifying beyond Nvidia (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT), Meta (NASDAQ:META), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOG), Apple (NASDAQ:AAPL), and Tesla (NASDAQ:TSLA), investors can potentially unlock significant returns.

Fortunately, our innovative predictive AI stock-picking tool, ProPicks, is here to assist you in identifying such opportunities. With a track record of success backed by six strategies that consistently outperform the market, ProPicks integrates historical stock market data with cutting-edge fundamental analysis techniques to presents over 70 potential winning stocks every month.

Join now for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

*Readers of this article enjoy an extra 10% discount on the yearly and by-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

While the ‘Magnificent 7’ stocks may dominate headlines, investors should not overlook this trio of market leaders with strong growth prospects.

1. Eli Lilly

Eli Lilly’s (NYSE:LLY) robust portfolio of blockbuster drugs, coupled with its focus on research and development, positions it for sustained growth, making it a compelling investment choice beyond the ‘Magnificent 7’ stocks.

Investors have placed high hopes on the pharmaceutical company’s progress with its promising obesity drug pipeline. Lilly’s hopeful candidates in Alzheimer’s disease and immunology have also boosted investor confidence.

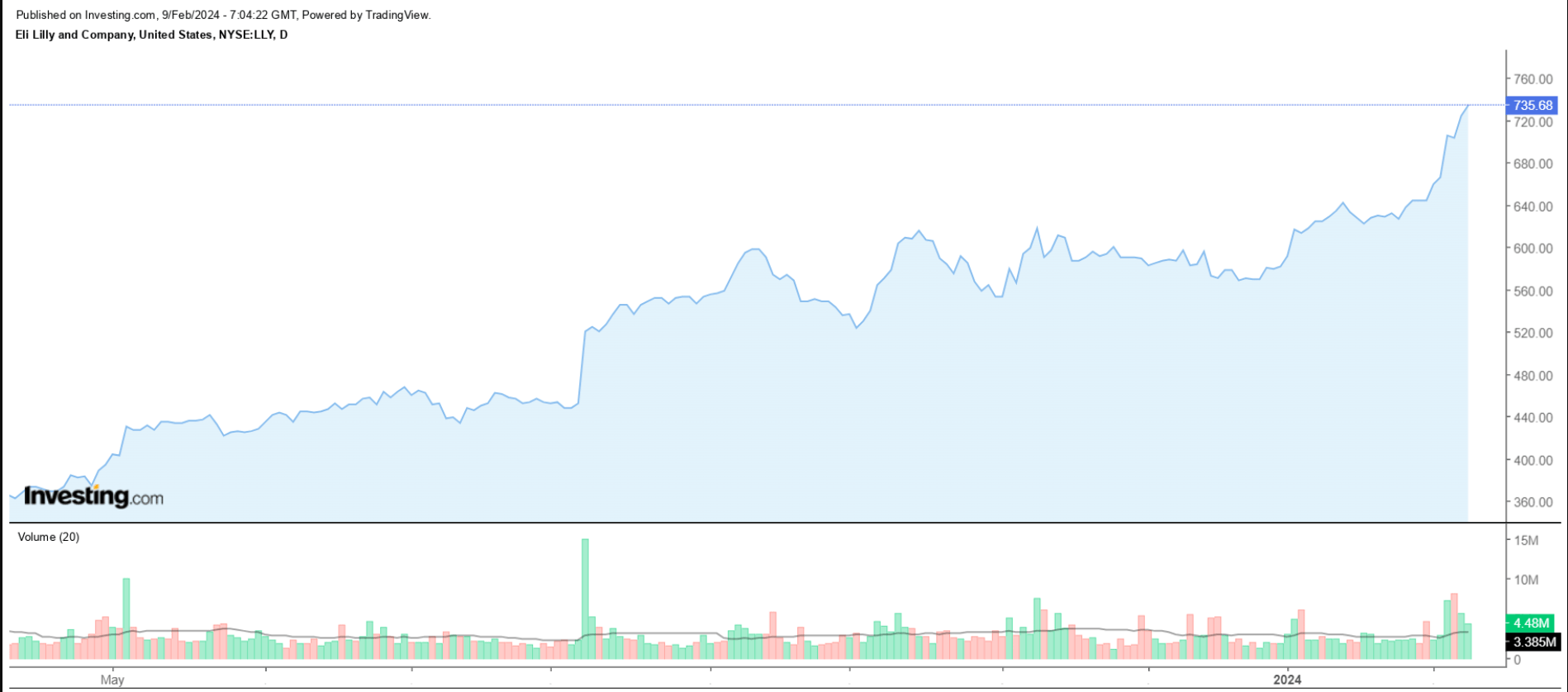

The pharma giant has experienced a surge in its stock price over the past year, driven by strong sales growth in key therapeutic areas.

Shares of the Indianapolis, Indiana-based healthcare juggernaut, which ended at an all-time high of $735.68 last night, are up 116% over the past 12 months.

Eli Lily Daily Chart

Eli Lily Daily Chart

With a market cap of $661 billion, Eli Lilly is the world’s most valuable healthcare firm and the eighth-biggest company trading on the U.S. stock exchange.

Eli Lilly is well positioned for further gains, with many expecting it to become the first healthcare company with a $1 trillion valuation, as it benefits from strong fundamentals, which will help fuel future growth in earnings, sales, and free cash flow.

In a sign of how well its business is performing, Eli Lilly delivered blowout fourth-quarter earnings and revenue this week, fueled by surging demand for its new weight loss drug, Zepbound, and higher prices for its blockbuster diabetes treatment, Mounjaro.

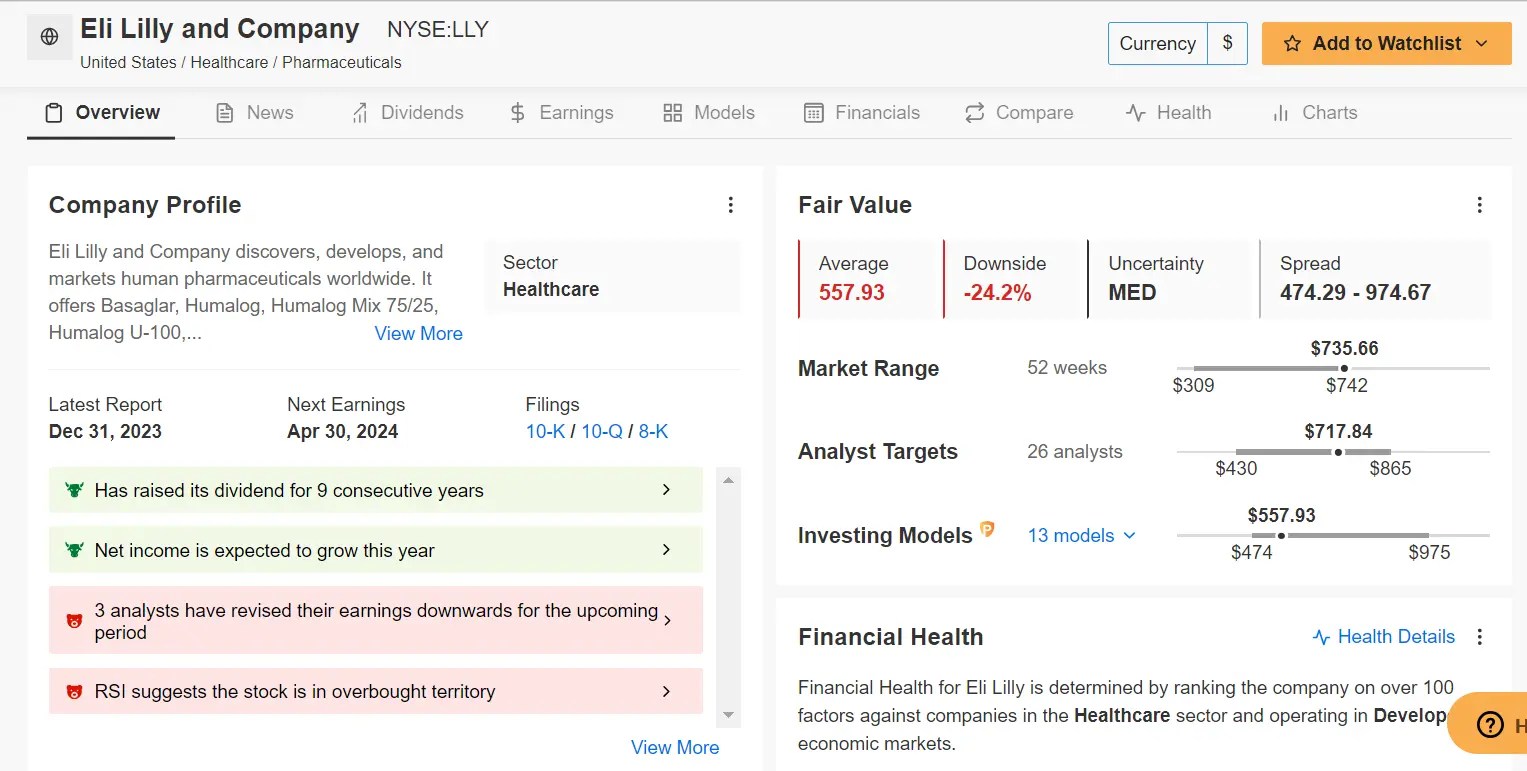

As ProTips points out, Eli Lilly is in great financial health condition, thanks to its robust earnings prospects and high free cash flows which have allowed it to maintain its dividend for 54 consecutive years.

Eli Lily Data

Eli Lily Data

Source: InvestingPro

On the downside, ProTips highlights that LLY stock trades at high earnings and revenue multiples, underlining risks associated with overvaluation.

With that being noted, Eli Lilly’s stock appears to be trading at a hefty premium according to several valuation models on InvestingPro, which implies a potential downside of -24.2% from current levels.

2. Palo Alto Networks

Palo Alto Networks (NASDAQ:PANW) is widely considered one of the leading names in the cybersecurity software industry.

Its core product is a platform that includes advanced threat detection and prevention solutions, cloud security, and endpoint protection.

The cyber specialist has seen its stock soar 121% over the past year as cybersecurity threats continue to evolve and businesses prioritize digital security, driving strong revenue growth and market share expansion.

PANW stock ended at a record high of $367.02 on Thursday, earning the global cybersecurity leader a market valuation of around $116 billion.

Palo Alto Daily Chart

Palo Alto Daily Chart

The Santa Clara, California-based cybersecurity company is scheduled to deliver its fiscal second-quarter earnings and revenue update on Monday, February 26 and sell-side confidence is brimming.

In a sign of increasing optimism, EPS estimates have seen 35 upward revisions in the last 90 days, according to InvestingPro, as the company benefits from increased cybersecurity spending amid the rampant surge in cyberattacks.

Palo Alto Networks is forecast to earn $1.30 per share, rising 23.8% from the year-ago period. Meanwhile, revenue is seen increasing 15.6% year-over-year to $1.97 billion, reflecting robust demand for its various cloud-delivered security services.

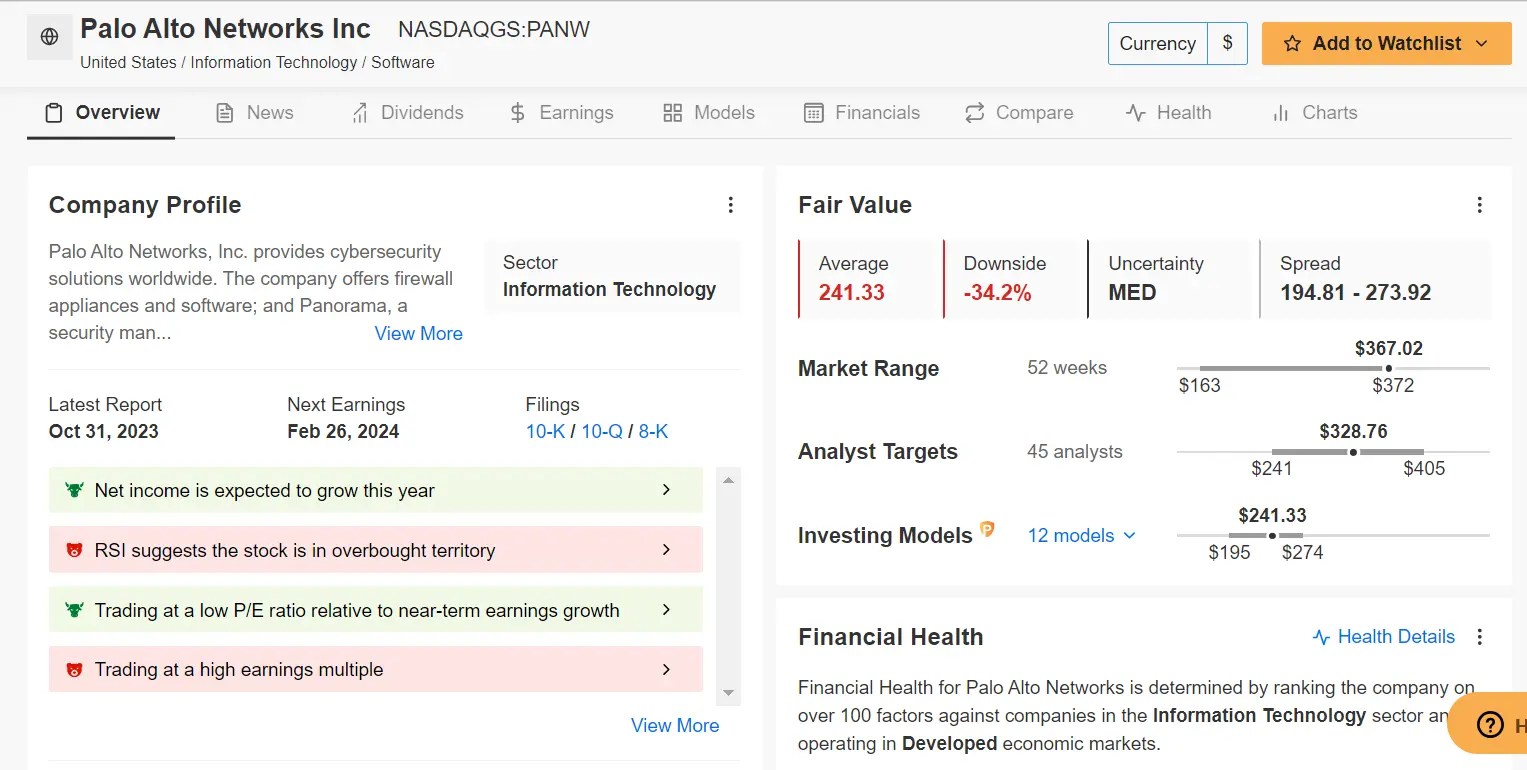

InvestingPro’s ProTips underscore Palo Alto Network’s promising outlook, emphasizing its favorable positioning in the cybersecurity sector and strong profitability outlook.

Palo Also Stock Data

Palo Also Stock Data

Source: InvestingPro

Nevertheless, concerns loom as ProTips points out the company’s high revenue valuation multiples and a lofty price-to-book ratio, raising questions about its current valuation.

Indeed, PANW stock could see a potential decline of -34.2% from its current market value, as per the quantitative models in InvestingPro, bringing shares closer to their ‘Fair Value’ of $241.33.

3. Uber

Uber (NYSE:UBER), a pioneer in the ride-hailing and food-delivery industry, has experienced a resurgence in its stock price thanks to improving mobility trends and mounting demand for its ride-sharing and food-delivery services.

Shares of the San Francisco, California-based mobility-as-a-service company have run about 94% higher during the past 12 months, far outpacing the comparable returns of the broader market over the same timeframe.

At current levels, Uber has a market cap of roughly $147 billion after closing Thursday’s session at a fresh record peak of $71.61.

Uber Daily Chart

Uber Daily Chart

The ride-hailing and delivery specialist’s strong market presence, diverse revenue streams, and relentless focus on achieving profitability through cost-cutting measures are likely to continue driving its stock to new heights in the months ahead.

Indeed, Uber’s fantastic fourth-quarter update released this week made it clear that the company is executing well and delivering solid growth amid the existing economic climate of elevated inflation and high-interest rates.

The company’s revenue for the quarter was up 15% from the same quarter last year to $9.94 billion, while gross bookings came in at $37.6 billion, up 22% year-over-year.

There were 2.6 billion trips completed on the company’s platform during the period, an increase of 24% from the year-ago period.

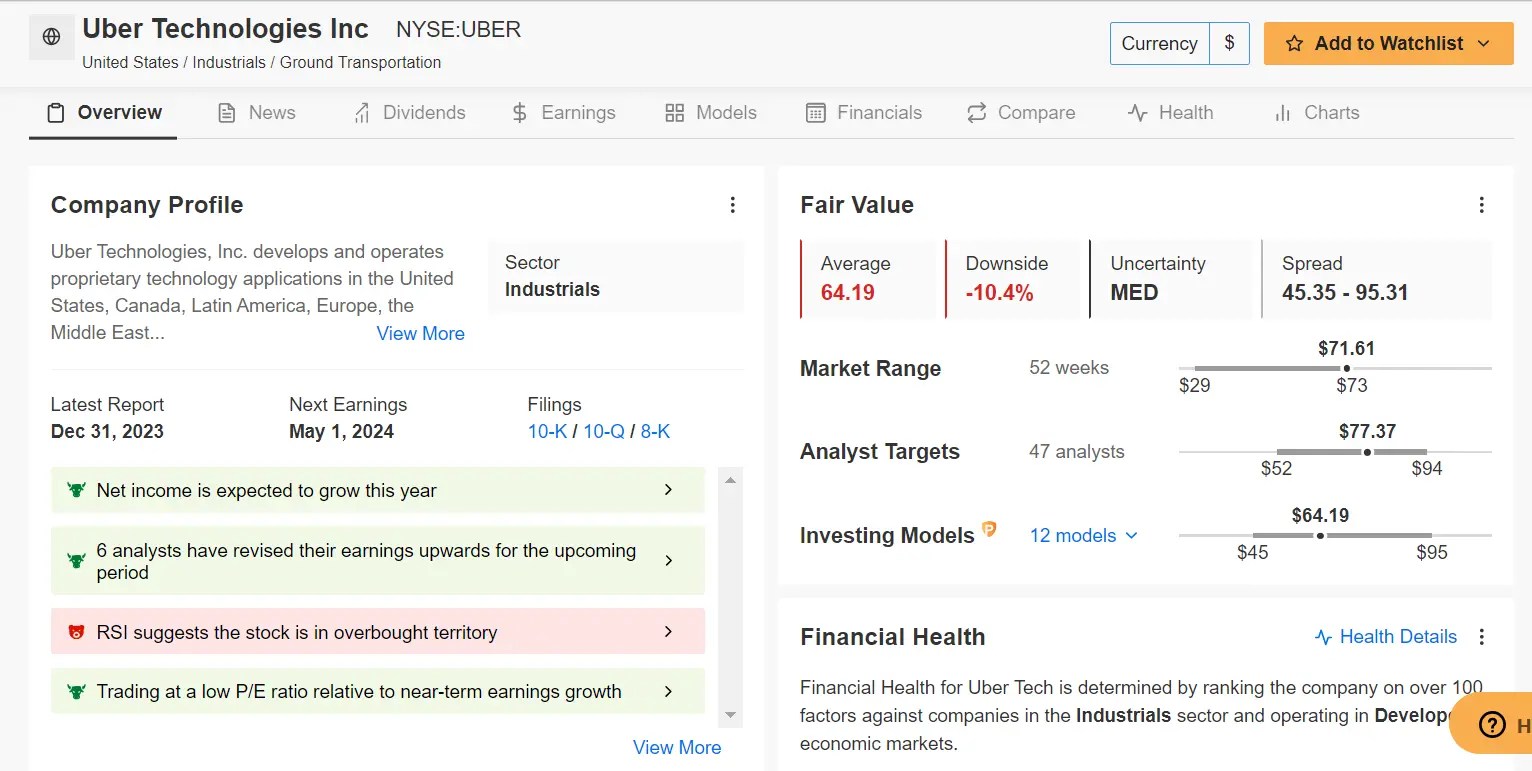

Not surprisingly, ProTips paints a mostly positive picture of Uber’s stock, citing its strong market presence and healthy earnings and sales growth prospects.

Uber Stock Data

Uber Stock Data

Source: InvestingPro

However, caution is advised as ProTips highlights concerns about Uber’s valuation metrics, which suggest the stock is in overbought territory.

It’s worth noting that InvestingPro suggests UBER shares are rather overvalued at present, potentially facing a decline of -10.4%. Such a correction would bring the stock more in line with its ‘Fair Value’ target of $64.19.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here and never miss a bull market again!

Subscribe Today!

Don’t forget your free gift! Use coupon code PROTIPS2024 at checkout for a 10% discount on the Pro yearly plan, and PROTIPS20242 for an extra 10% discount on the bi-yearly plan.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com