MAR

-1.03%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

COIN

+7.12%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DKNG

+1.33%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DDOG

+2.63%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

LYFT

+1.96%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ROKU

+1.16%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SHOP

+3.25%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ANET

+2.32%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLK

+1.37%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

META

-0.40%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+1.25%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

HAS

-0.18%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NDX

+1.01%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SONY

-0.41%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MGM

+0.67%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

JNPR

+0.22%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

KO

-0.45%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

KHC

-1.37%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DE

-1.17%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CSCO

+0.31%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

MSFT

+1.56%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

-0.14%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

+0.57%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CPI inflation, retail sales, producer prices, and more earnings will be in focus this week.

Arista Networks (NYSE:ANET) is a buy with a strong beat-and-raise quarter expected.

Deere (NYSE:DE) is a sell with disappointing guidance on deck.

Looking for more actionable trade ideas? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

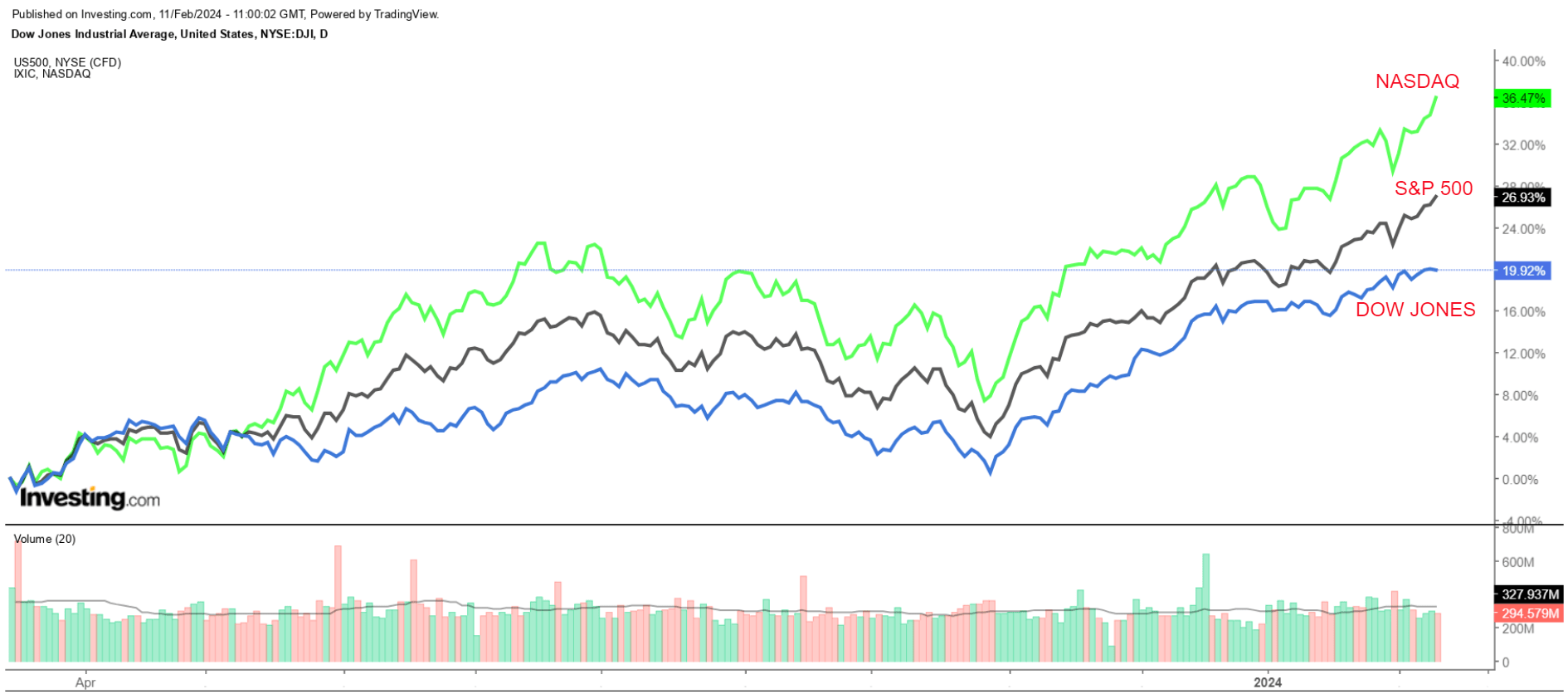

Stocks on Wall Street closed higher on Friday to notch another winning week as the S&P 500 ended above the key 5,000-point level for the first time ever amid an ongoing rally in mega-cap tech shares.

For the week, the benchmark S&P 500 rose 1.4%, the tech-heavy Nasdaq Composite advanced 2.3%, and the blue-chip Dow Jones Industrial Average added 0.1%.

All three major averages notched their fifth straight winning week and their 14th positive week in 15.

The week ahead is expected to be another eventful one as markets continue to weigh the Fed’s rate plans for the months ahead.

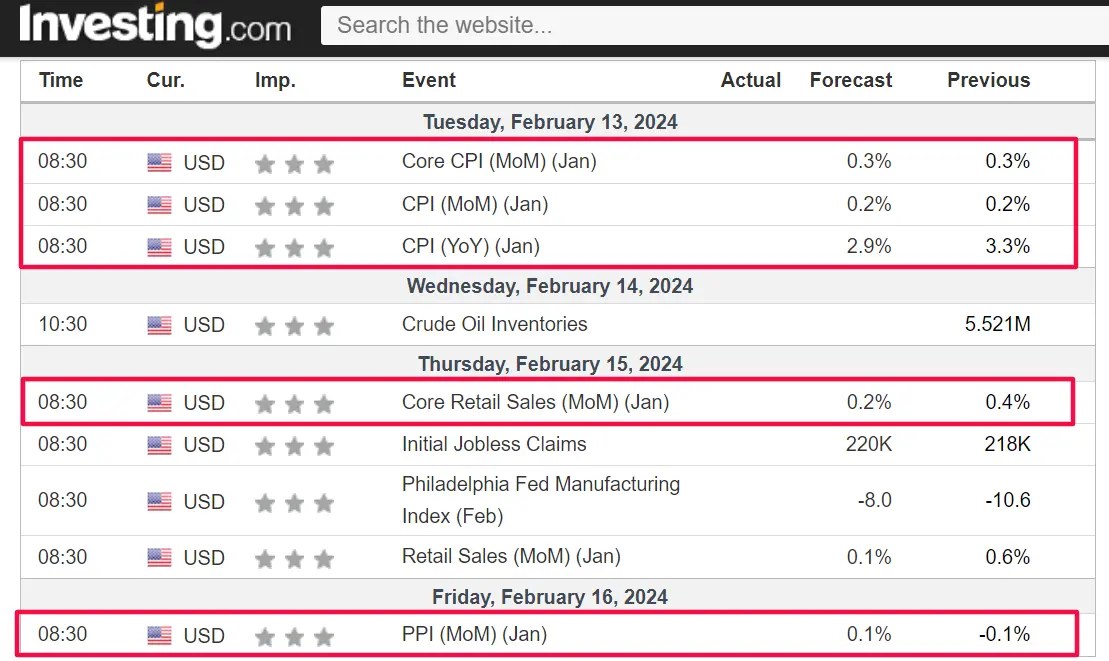

On the economic calendar, most important will be Tuesday’s U.S. consumer price inflation report for January, which is forecast to show headline annual CPI slowing to 2.9% from the 3.3% increase recorded in December.

The CPI data will be accompanied by the release of the latest retail sales figures as well as a report on producer prices, will help fill out the inflation picture.

Weekly Economic Calendar

Weekly Economic Calendar

Source: Investing.com

Those releases will be accompanied by a heavy slate of Fed speakers, with the likes of district governors Thomas Barkin, Mary Daly, Neel Kashkari, Austan Goolsbee, and Raphael Bostic set to make public appearances.

As of Sunday morning, financial markets see just a 16% chance of the Fed cutting rates in March, according to the Investing.com Fed Monitor Tool. Looking out to May, investors believe there is a roughly 61% chance rates are lower by the end of that meeting, down from over 95% just a few weeks ago.

Elsewhere, the earnings season continues, with the list of heavyweights due to report including Cisco Systems (NASDAQ:CSCO), Sony (NYSE:SONY), Shopify (NYSE:SHOP), Coinbase (NASDAQ:COIN), DraftKings (NASDAQ:DKNG), Roku (NASDAQ:ROKU), Arista Networks, and Datadog (NASDAQ:DDOG).

Some of the other notable reporters include Coca-Cola (NYSE:KO), Kraft Heinz (NASDAQ:KHC), Airbnb (NASDAQ:ABNB), MGM Resorts (NYSE:MGM), Marriott International (NASDAQ:MAR), Lyft (NASDAQ:LYFT), Hasbro (NASDAQ:HAS), and Deere.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, February 12 – Friday, February 16.

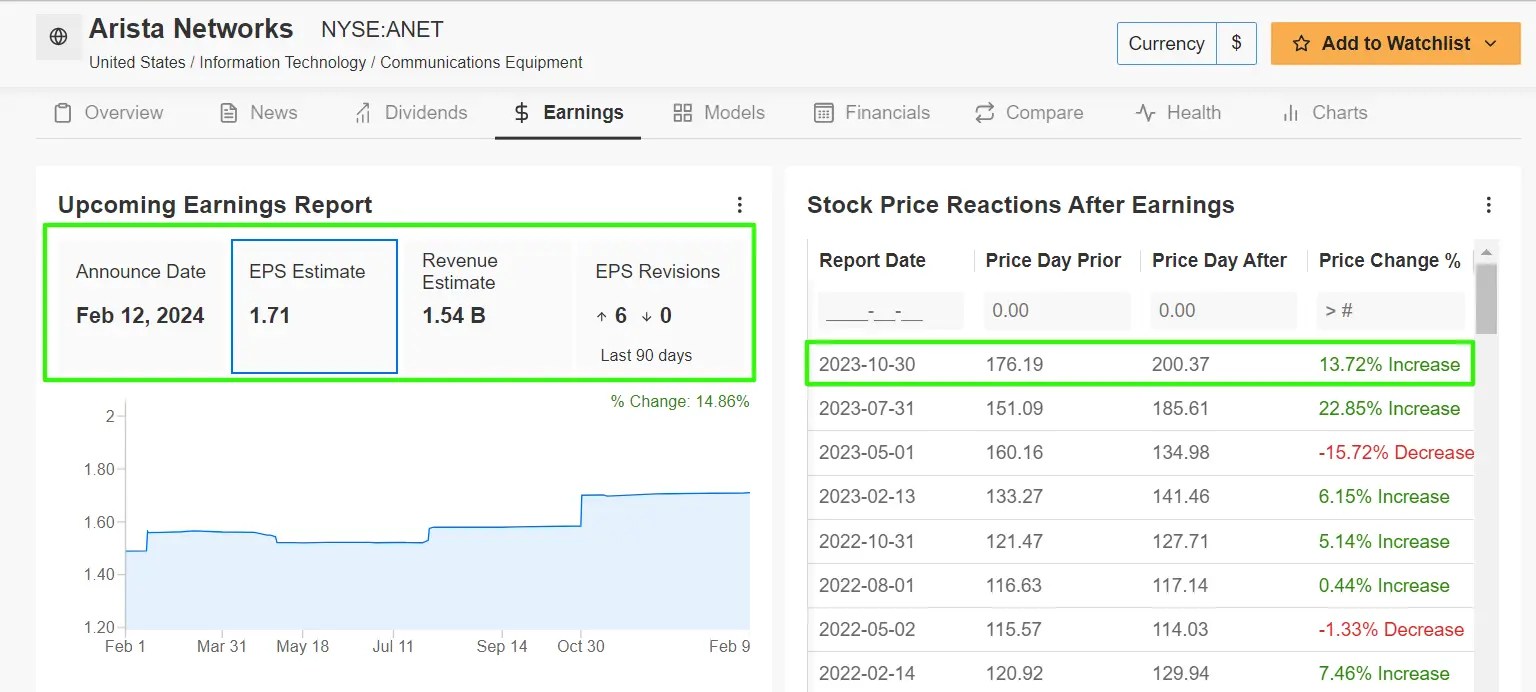

Stock To Buy: Arista Networks

After ending at a new all-time high on Friday, I expect another strong performance for Arista Networks (NYSE:ANET) this week as the networking-infrastructure company will likely deliver another quarter of strong bottom-line and top-line growth and provide an upbeat outlook.

Arista is scheduled to report fourth quarter earnings after the closing bell on Monday at 4:05PM EST, with both analysts and investors growing increasingly bullish on the cloud networking solutions provider, which is known for its computer network switches that speed up communications in data centers.

The last six EPS revisions from analysts have all been to the upside, while 26 out 30 analysts covering ANET have either a Buy-equivalent or Hold-rating on the stock.

Market participants expect a sizable swing in ANET shares following the print, as per the options market, with a possible implied move of about 12% in either direction. The stock soared 13.7% after the company’s last earnings report in late October.

Arista Networks Earnings Data

Arista Networks Earnings Data

Source: InvestingPro

Consensus expectations call for the Santa Clara, California-based tech company to post Q4 earnings per share of $1.71, rising 21.3% from EPS of $1.41 in the year-ago period.

Meanwhile, revenue is forecast to jump 20.3% year-over-year to $1.54 billion, reflecting robust demand for cloud infrastructure from large corporations, small businesses, government agencies and educational institutions.

But as is usually the case, it is more about guidance than results. Taking that into account, I reckon Arista CEO Jayshree Ullal will provide an upbeat outlook for the months ahead as the company continues to benefit from growing demand for its suite of cloud-based networking products and data center solutions.

Arista has carved a niche in the networking technology sector with its innovative solutions and has been successful in grabbing market share from chief rivals Cisco Systems (NASDAQ:CSCO) and Juniper Networks (NYSE:JNPR). It counts Meta Platforms (NASDAQ:META), and Microsoft (NASDAQ:MSFT) as its two largest customers.

Arista Networks Daily Chart

Arista Networks Daily Chart

ANET stock ended Friday’s session at $282.45, above the prior record high close of $275.89 from a day earlier. At current levels, Arista Networks has a market cap of roughly $88 billion.

Shares are up 19.9% since the start of the year, after ending 2023 with a whopping gain of 94%.

As InvestingPro’s ProTips points out, Arista Networks sports a near perfect InvestingPro ‘Financial Health’ score thanks to its strong earnings and sales growth trajectory, robust cash flow, and pristine balance sheet.

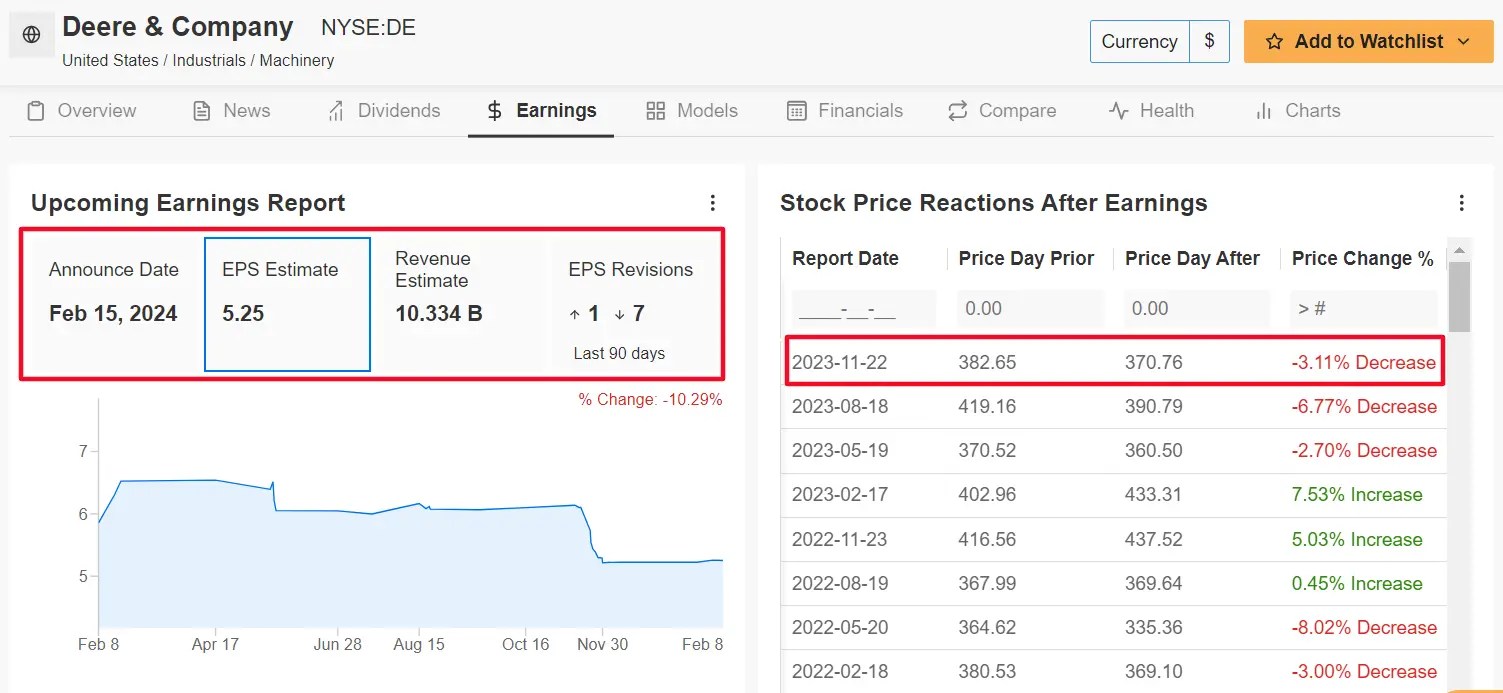

Stock to Sell: Deere

I foresee a weak performance for Deere (NYSE:DE) this week, as the agriculture-and-heavy machinery equipment maker’s latest earnings and outlook will disappoint due to declining industry demand trends and an uncertain fundamental outlook.

Deere’s fiscal first quarter report is slated to come out before the opening bell on Thursday at 6:45AM ET and results are likely to take a hit from slowing agricultural machinery demand amid weakening crop prices.

Corn futures, for instance, are down about 37% over the past 12 months, while prices for wheat and soybeans are both off by around 24% over the same timeframe.

Not surprisingly, seven out of the eight analysts surveyed by InvestingPro have cut their earnings estimates in the 90 days leading up to the print, as Wall Street turned cautious on the tractor maker’s prospects.

As per the options market, traders are expecting a move of 5.1% in either direction for DE stock following the release. Shares dropped 3.1% after its fiscal Q4 report came out in November.

Deere Earnings Data

Deere Earnings Data

Source: InvestingPro

Deere, which is widely viewed as the bellwether for agricultural markets, is seen earning $5.25 a share for its fiscal Q1, tumbling 19.9% from EPS of $6.55 in the year-ago period.

Meanwhile, revenue is forecast to fall 18.3% annually to $10.33 billion, reflecting slowing demand for its wide range of agricultural, mining, and construction equipment amid a soft agricultural commodities market.

If that is confirmed, it would mark the second straight quarter of declining sales, with more pain seen ahead in 2024 and 2025.

As such, it is my belief that Deere’s management will disappoint investors in their forward guidance and strike a cautious tone given the uncertain outlook for farm and mining machinery sales.

Deere Daily Chart

Deere Daily Chart

DE stock closed at $381.32 on Friday, earning the Moline, Illinois-based agriculture equipment maker a valuation of $106.8 billion. Deere shares are off to a weak start in 2024, falling 4.7% year-to-date to vastly underperform the broader market.

It should be noted that ProTips paint a mostly bearish picture of Deere’s stock, due to concerns over profit and sales growth prospects.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com