US500

-0.09%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

+1.75%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IWM

+1.81%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

-0.30%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

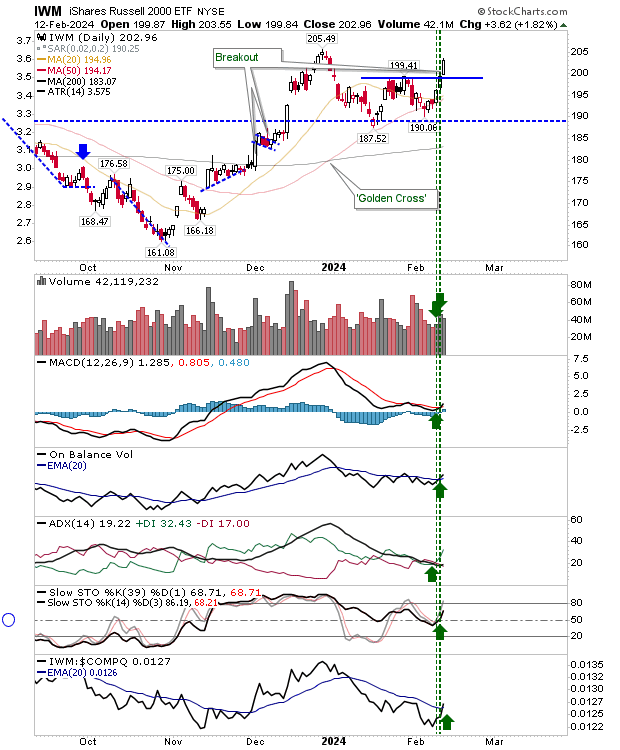

Friday left the Russell 2000 (IWM) primed for a breakout and Monday delivered on that setup. By the close of business, the Russell 2000 was left with a bullish “three white soldiers” setup and the potential for more upside.

So while the Nasdaq and S&P 500 are near market “extreme” tops, the Russell 2000 is still trading well within itself.

Technicals for the Russell 2000 ($IWM) are net bullish and improving, but Monday’s volume didn’t register as accumulation.

IWM-Daily Chart

IWM-Daily Chart

The Nasdaq eased off its high, but the losses didn’t do a whole lot of technical damage.

It has been several months since the index last tested its 50-day MA, so if the selling was to continue then I would be looking at a test of this moving average.

COMPQ-Daily Chart

COMPQ-Daily Chart

The S&P 500 finished with a doji like the Nasdaq. What applies to the Nasdaq also applies to the S&P 500.

SPX-Daily Chart

SPX-Daily Chart

After yesterday’s action indices have shown their hand.

We have bearish doji in the Nasdaq and S&P 500 that should deliver lower prices in the coming days, but the Russell 2000 ($IWM) may pause today, but I would be looking for gains to resume.

Source: Investing.com