The Asian styrene monomer market looked set to move upwards in its usual peak demand season in the third quarter, with a further boost from massive plant turnarounds in the region, but prices took a downturn instead.

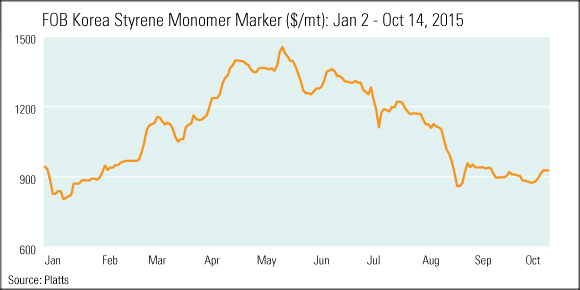

The FOB Korea SM marker over Q3 fell 29.86% from July 1 to $885.50/mt on September 30, according to Platts data.

There has been a slight recovery in prices in October, at $927/mt FOB Korea on October 14, but still a 26.57% drop from July 1.

Asian SM prices were expected to get a boost in Q3 from the massive plant turnarounds in Asia and the Middle East, returning demand from the downstream acrylonitrile-butadiene-styrene and polystyrene markets over July-September, and the peak manufacturing season ahead of Christmas and New Year holidays.

But demand did not pick up according to market expectations.

LACKLUSTER Q3 DEMAND

Seasonal peak demand for SM from the downstream ABS and PS markets in Q3 ahead of the Christmas and New Year holidays was nearly absent this year, hit by bearish upstream crude oil prices as well as weaker global economies.

China’s bearish macroeconomic environment, following the yuan’s devaluation and a weaker purchasing managers index, contributed to the fall in the country’s SM demand.

China’s Caixin PMI fell to a six-and-a-half year low of 47.2 in September, compared with 47.3 in August.

The country’s manufacturing industry was hit — production of air conditioners in August slid 5.2% year on year to 10.531 million sets, according to China’s National Bureau of Statistics.

Its refrigerator output in August was also down 3.6% year on year to 7.191 million sets. ABS and PS are used to make the air conditioners and refrigerators.

Increasing SM supplies in the region also had a hand at reversing the expected uptick in Q3 prices. Supplies got a boost from rising stocks and an increased flow from the US to Asia.

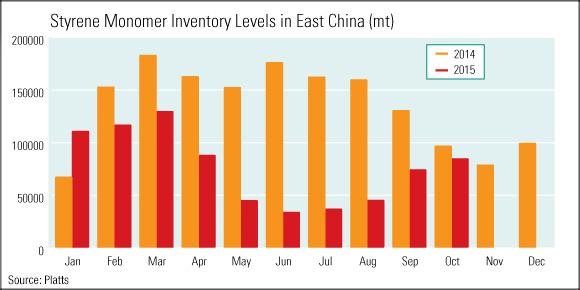

The weekly SM inventory level in east China on October 2 had jumped 14.48% week on week to 83,000 mt, which is around 33.67% higher than the four-year average of 62,093.75 mt in the same month.

The US-Asia SM arbitrage had re-opened in September as weaker European SM prices diverted US-origin SM from Europe to Asia.

EARLIER EXPECTATIONS FOR Q3

The market was earlier expecting an uptick in Q3 SM prices as Asia and the Middle East was estimated to lose around 525,300 mt of SM supply in the second-half of the year, with a total 23.8 million mt/year of production capacity shut for maintenance during the period, according to Platts calculations based on information from market and company sources.

The turnarounds were scheduled at major SM plants in the Middle East, Taiwan, Japan and China over August-December.

In 2014, Middle Eastern SM accounted for about 25.5% of China’s total SM imports, making it the second biggest supplier after South Korea, which supplied 38%. Taiwan and Japan each supplied 12.7%, according to Chinese customs data.

Looking ahead, many market players said they were expecting a weaker SM market in the fourth quarter of this year, due to an increased flow of US-origin SM in an effort to clear stocks by year-end, with lackluster demand for SM continuing to be seen from downstream markets — especially expandable polystyrene, which is used largely in the construction sector — during the traditional off-peak season over winter.