US500

+1.26%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NVDA

+12.59%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The S&P 500 was lower most of the day but caught a miracle bid into the close as implied volatility melted, perhaps as investors got cold feet heading into Nvidia’s (NASDAQ:NVDA) results.

In the meantime, Nvidia reported results; they were good, but I don’t know if they justified the rally we have seen since the beginning of the year.

Revenue came in at $22.1 billion, 8.2% better than expected, while data centers came in at $18.4 billion, about 7% better than estimates. Meanwhile, guidance came in at $24 billion for the fiscal first quarter, better than estimates for $21.9 billion.

So, at least after hours, the stock is trading up just under 8% to about $725, which was pretty much where it was trading on Friday when I last updated, and the market was implying an 11% post-earnings move.

The only difference between now and the last time we touched base was that the stock was at $725. Yesterday, the stock closed at just below $675, and now the stock is trading back to $725ish.

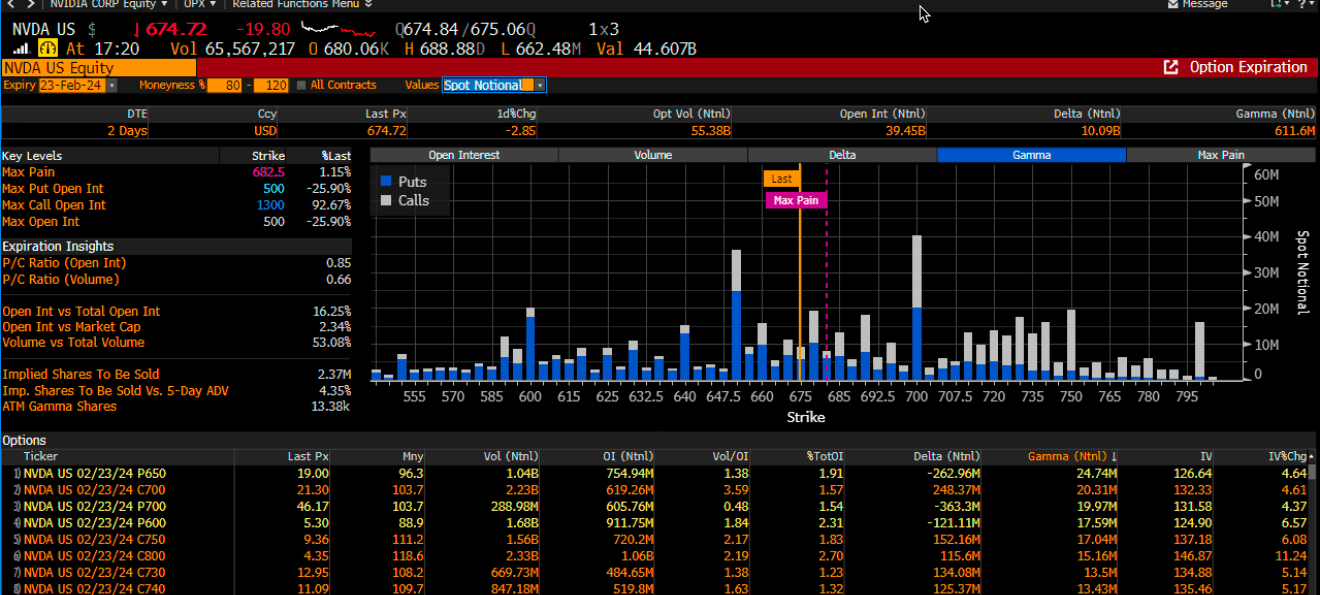

But the problem, for the most part, is that big gamma at $750 has not shifted, and so the call values at $750 are going to be losing value, and for the most part, most everything between $720 and higher in terms of calls will lose value as well.

Because a $720 call was trading at $15.35 at the end of trading on Wednesday, which gives it the breakeven price of $735.35, and with the stock trading for $725 as of this writing, the premium on those calls will be down today.

NVDA Equity Volume

NVDA Equity Volume

It is probably not by chance that the stock got as high as $744 in the after-hours, and to this point, the stock has held there and traced lower. So, pretty much nothing has changed from the perspective over the weekend.

Expect that because the stock declined heading into results, put options gained some value, and perhaps new bearish bets were placed, and those put options burnt up after hours, which allowed the stock to rally back to the upper end of the range.

NVIDIA Corp Stock Chart

NVIDIA Corp Stock Chart

If the stock can’t get over $750 today during regular trading, I think it will be in trouble because of the higher-level calls that will decay. If it can meaningfully clear $750, it probably can run to the next gamma level at $800.

My guess is, is that $750 holds.

Original Post

Source: Investing.com