LRN

+0.49%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CFLT

+3.13%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The magnificent 7 have dominated the headlines in the past couple of years.

Small and mid-cap stocks have struggled amid a high-interest-rate environment, but signs of recovery emerged at the end of last year.

With potential interest rate cuts on the horizon, some high-quality small-cap stocks could make a great addition to your portfolio.

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The market has been dominated by the magnificent 7, driving key indexes upward in 2023 and 2024. Meanwhile, smaller asset classes, such as small and mid-caps, have struggled due to the high interest-rate environment.

However, signs of recovery have emerged since the end of last year, though the true turning point will likely coincide with the first cuts, provided the economy remains strong.

Now, let’s examine a couple of stocks that could benefit from the first cuts and could make a great addition to your portfolio at current levels.

1. Stride

Stride (NYSE:LRN) operates in educational services, offering online curriculum for schools.

In its latest quarterly report, the company achieved record levels on its balance sheet, signaling positive prospects.

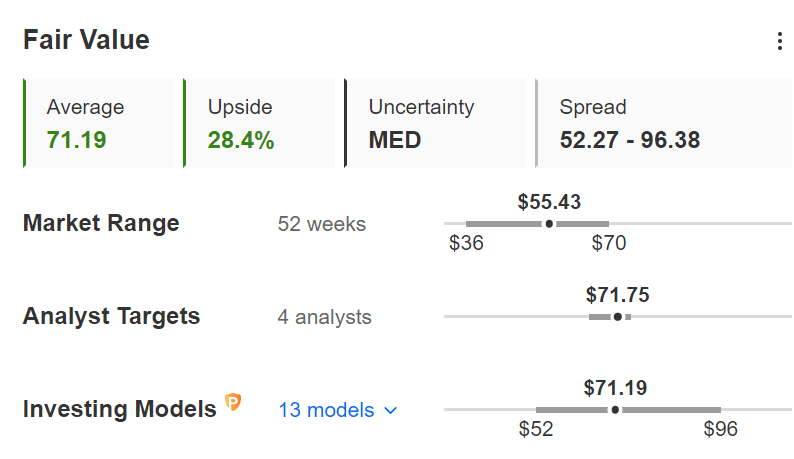

Currently, InvestingPro rates the company’s overall health at 4 out of 5, with the estimated intrinsic value nearly 30 percent higher than its current value.

Fair Value Stride

Fair Value Stride

Source: InvestingPro

Earnings and revenue growth have also shown an upward trend, with valuations, however, suffering lately from the general decline throughout the industry.

P/E Ratio, Net Income

P/E Ratio, Net Income

Source: InvestingPro

2. Confluent

Confluent Inc (NASDAQ:CFLT) is a ‘cloud-based company that operates a streaming platform both in the U.S. and internationally.

The charts indicate that the latest quarterly report gave a very positive boost. The image below shows an interesting gap up supported by good volumes.

Confluent Price Chart

Confluent Price Chart

Taking a more cautious stance, there may be opportunities to buy with stops at appropriate levels.

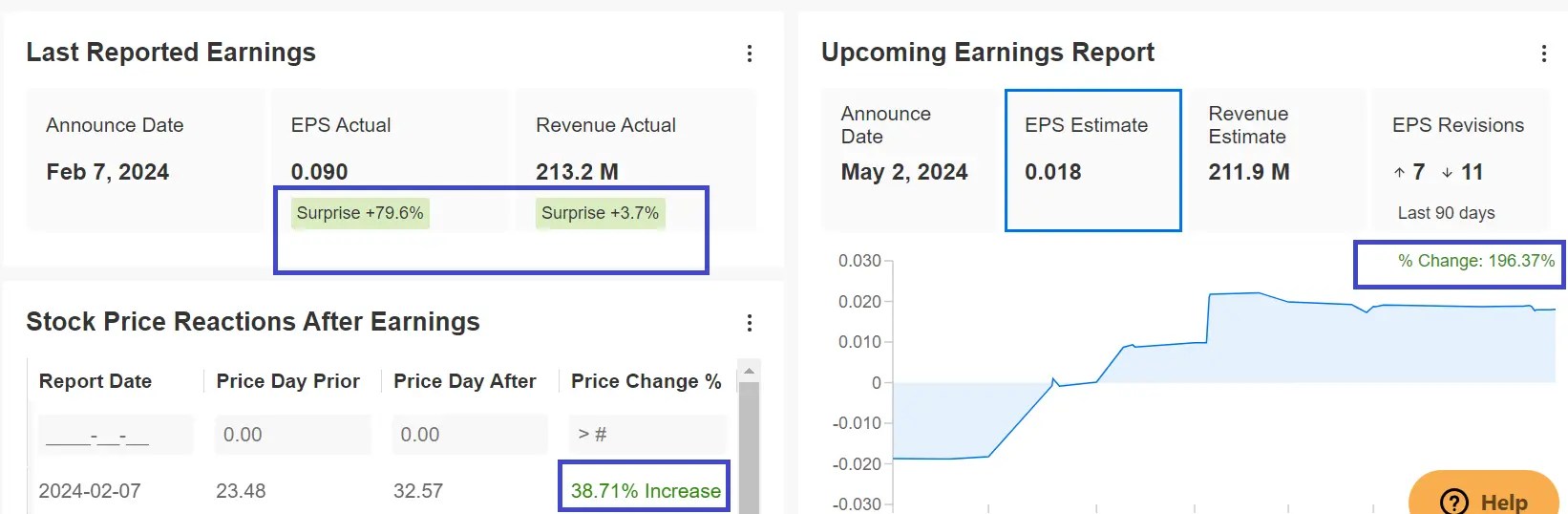

The stock surpassed analyst estimates, sparking a rally. InvestingPro reports that the stock’s price target is now being revised upwards for the next quarter.

Previous and Next Earnings

Previous and Next Earnings

Source: InvestingPro

Handling small/mid caps requires a proper strategy and a thorough assessment of all associated risks.

Looking ahead to a potentially more favorable scenario in the second half of 2024, there could be interesting prospects.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Subscribe Today!

Subscribe Today!

Don’t forget your free gift! Use coupon code pro2it2024 at checkout to claim an extra 10% off on the Pro yearly and 2-year plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com