NDX

-0.37%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

+0.03%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NVDA

+0.36%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US5YT=X

-0.41%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US7YT=X

-0.49%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US30Y…

-0.59%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

WING

+1.43%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US20Y…

-0.69%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Stocks finished the week higher following the Nvidia-led rally on Thursday.

However, the Nasdaq 100 failed to advance and clear key technical resistance. This could be important this week, especially if the index fails to surpass resistance early, as the risks turn unfavorable as we move through the week.

This week will feature important economic data, including the PCE report on Thursday, and Friday will feature the ISM manufacturing report and the University of Michigan consumer sentiment and inflation expectations.

We will get new home sales and S&P Caselogic housing prices early in the week, with GDP revisions on Wednesday.

It will be a week filled with Treasury auctions, with the 2-year auction on Monday at 11:30 AM ET and the 5-year auction later that day at 1 PM ET. Then, on Tuesday, we also get the 7-year Treasury action at 1 PM ET.

Treasuries Rates Plunge

Last week, the 20-year and 30-year TIPS auctions were not strong, and both tailed.

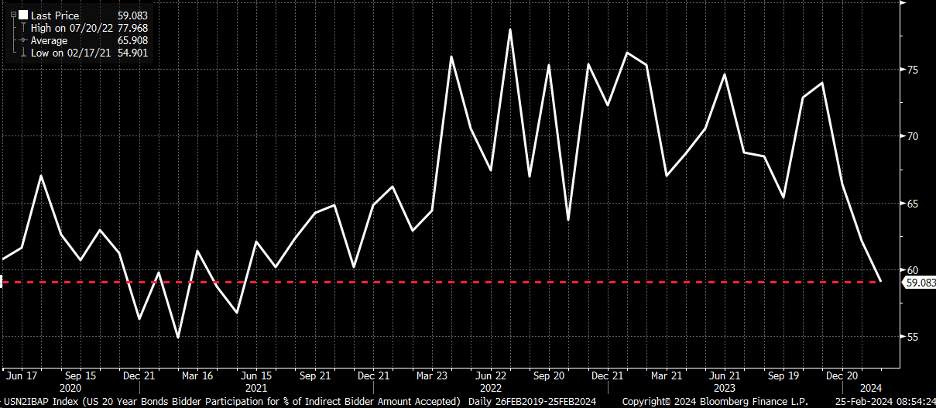

The 20-year auction was particularly weak, with a bid-to-cover ratio down to 2.39% from 2.53% last month, while indirect acceptance rates plunged to 59.1% from 62.2%. That was the weakest indirect acceptance rate since June 2021.

US 20-Year Bond Chart

US 20-Year Bond Chart

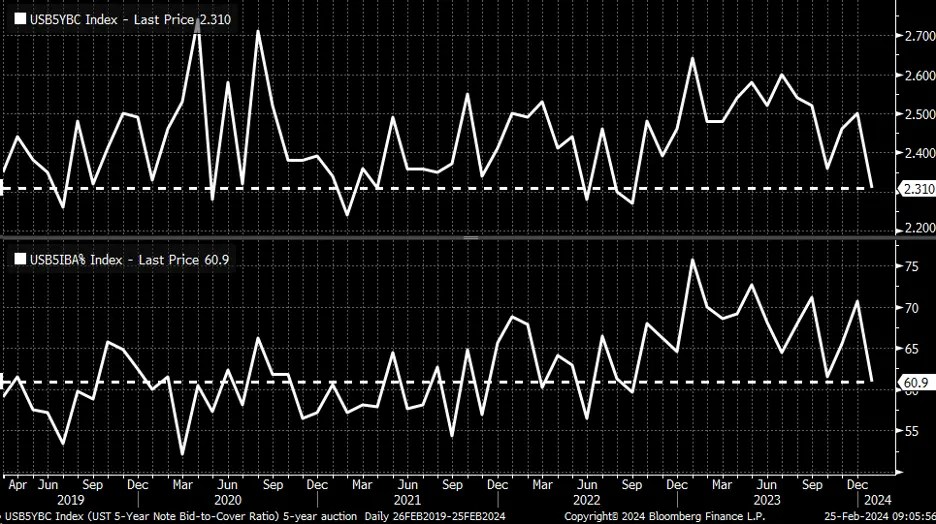

The 5-year Treasury auction last month was fairly weak, with a low bid-to-cover ratio of 2.31% and a weak 60.9% indirect acceptance rate.

So this week’s 5-year auction will be something to watch when it takes place. If the numbers come in weaker than last month, that will be a sign of weak demand and could lead to higher rates.

US 5-Year Treasury Bid-to-Cover Ratio Chart

US 5-Year Treasury Bid-to-Cover Ratio Chart

We need to worry about yields at this point, mostly because of where they are on the charts.

The 7-year Treasury for example has been trading around resistance at 4.36%, since the CPI report, and has been respecting that level of resistance.

The same example is happening across the curve; clearly, the market is waiting for something to determine whether rates should be higher.

US 7-Year Bond Yield-Daily Chart

US 7-Year Bond Yield-Daily Chart

But the last time the 7-year got above the 4.35% resistance level, the S&P 500 and NDX fell sharply in the third quarter, and when the 7-year went back below 4.35%, the stock indexes rebounded.

So this 4.35% level on the 7-year seems like an important spot, and this week seems like a week that we could see the 7-year break higher, especially with the auction and PCE report and the ISM data.

US 7-Year Bond Yield-Daily Chart

US 7-Year Bond Yield-Daily Chart

Nvidia Saves the Day for Nasdaq

The diamond pattern on the NDX worked fairly nicely last week, I say fairly, because the breaking of the diamond took us down to the 78.6% retracement level, and then Nvidia’s (NASDAQ:NVDA) results saved the day.

NDX-100-Daily Chart

NDX-100-Daily Chart

However, even with the NDX gapping higher on Friday, it couldn’t hold the gains and finished lower on the day, closing below resistance and the highs seen on February 9.

This sets up what could be a 2b topping pattern, and obviously, there needs to be confirmation of this pattern, and that confirmation only comes by moving lower and not surpassing the highs of Friday.

There is no reversal pattern if the Nasdaq can gap higher on Monday and take out that high seen on Friday. But as of the close on Friday, the opportunity for that 2b topping pattern appears to be in place.

A sharp drop today would pretty much confirm it, and it could result in the NASDAQ dropping back 17,450 and erasing the gap opening from Thursday over this week.

Nasdaq 100 Index-Hourly Chart

Nasdaq 100 Index-Hourly Chart

Chicken Wing AI

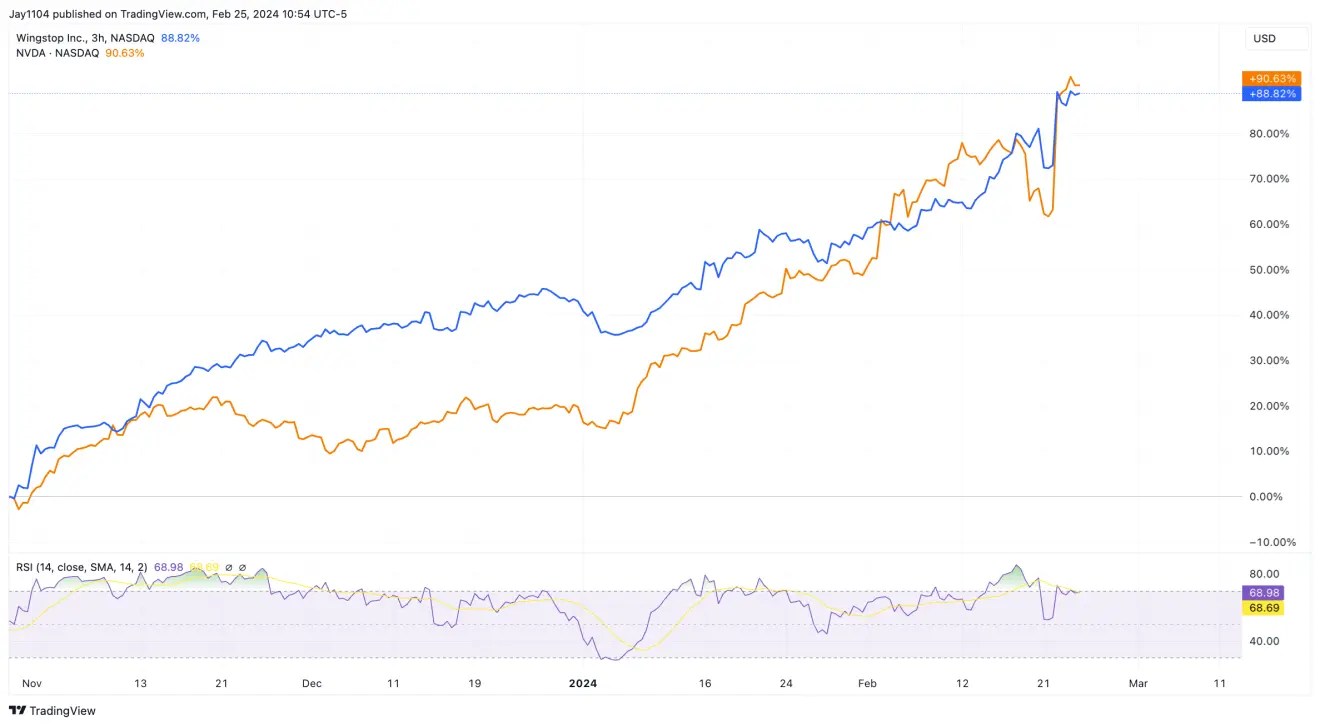

What did the Chicken say to the GPU? I don’t know, but AI and Chicken Wing are in vogue. It seems that, for some reason, Wingstop (NASDAQ:WING) and Nvidia’s stocks have a lot in common these days.

I’m not sure what exactly that is. Still, after trading inversely to one another for some time over the summer, both stocks finally got on the same page on October 30, and both Nvidia and Wingstop, the chicken wing restaurant, have been linked.

Maybe the AI is helping throughput at the restaurants, or the chickens are helping build the GPUs. I’m not sure, but I find it odd that businesses on literally opposite sides of the spectrum that had an inverse relationship are now linked at the hip.

Wingstop Inc-3-Hour Chart

Wingstop Inc-3-Hour Chart

Not only that, but both stocks have seen nearly the same gains in percentage terms since October 30, at nearly 90%.

Wingstop Inc-3-Hour Chart

Wingstop Inc-3-Hour Chart

Sure, Wingstop is expected to have some solid revenue and earnings growth over the next few years, and quarterly results were better than expected.

But I have also been doing this long enough to know that when things like this happen, there is something more going on that speaks to the mindset of the market and not so much the fundamentals of the market.

WING is forecast to grow earnings by 19.5% in 2024 and revenue by 19.6% in 2024, while Nvidia is expected to grow earnings by 85% in fiscal 2025 and revenue by 76.8%, yet both trade for around 18 times sales.

They seem to have too many strange coincides for me.

NVDA US Equity

NVDA US Equity

See you later

Original Post

Source: Investing.com