US500

+0.08%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+0.05%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLK

+0.22%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

+0.27%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NVDA

+0.51%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Investors face a pivotal decision as markets stand at a crossroads, torn between maintaining bullish positions or bracing for a potential correction.

In this piece, we will try and identify a potential trend change with the help of three key indicators

While indicators can hint at possible trend changes, it is crucial to understand that no indicator can act as a crystal ball for markets.

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Investors are currently grappling with a dilemma with markets at a crossroads: should they maintain bullish bets or step to the sidelines, anticipating a correction?

Nvidia (NASDAQ:NVDA) is a prime example of this scenario. Despite expectations for a deep retracement, the company swiftly achieved a $2 trillion market value in just nine months.

The chipmaker grew at a staggering speed, outpacing both Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT).

This remarkable growth is attributed to the surging demand for chips, particularly in the field of generative artificial intelligence, where Nvidia emerged as a market leader.

So, investors are currently questioning whether the recent market rally toward all-time highs will continue or come to an end.

Therefore, in this piece, we will talk about three indicators that can help investors make a decision.

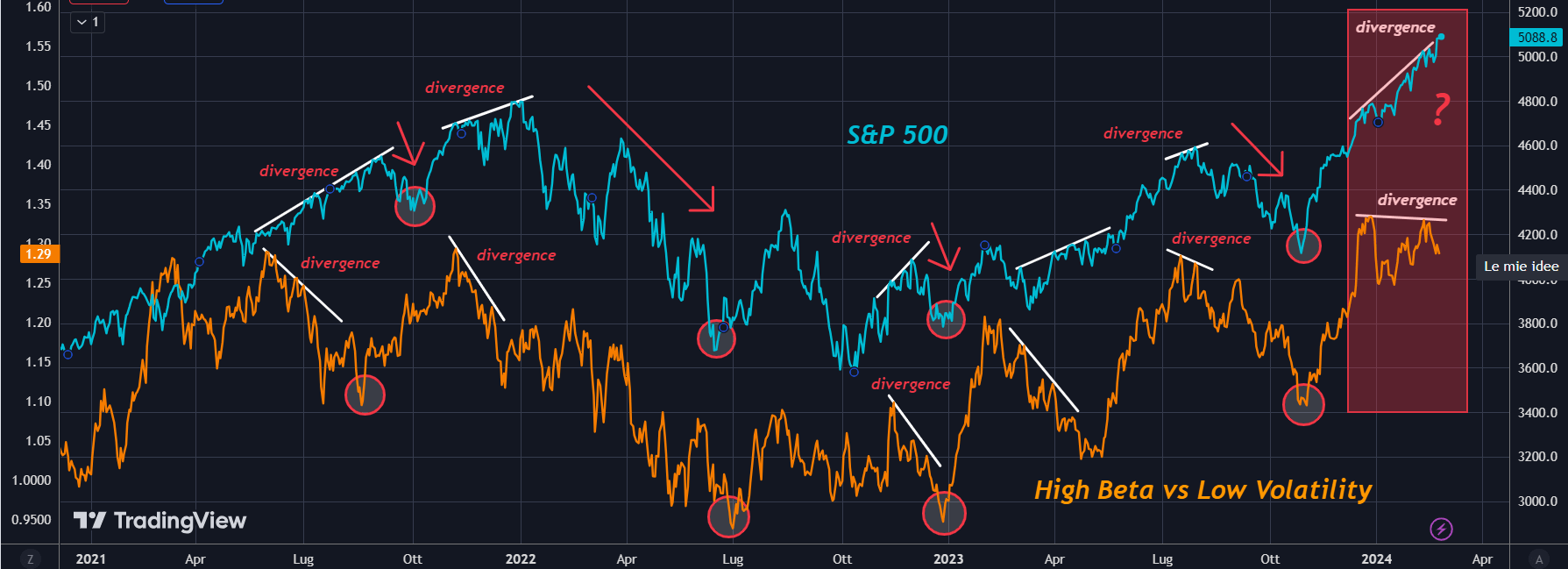

1. High-Beta Vs. Low Volatility Stocks

In retrospect, identifying the end of a trend seems straightforward, but in real-time, it’s a complex task. The frequent occurrences of false breakouts and misleading market movements contribute to the intricacy.

Despite the allure of markets making new all-time highs, there’s uncertainty in the air: a trend-change is imminent after an extended uptrend.

We have recently seen S&P 500, Dow Jones Industrial Average, and Nasdaq achieve all-time highs.

However, it’s worth noting that with each new high, fewer stocks are actively contributing to the ascent, signaling potential cautionary signs amid the prevailing sea of green.

S&P 500 High-Beta Vs. Low-Volatility Stocks

S&P 500 High-Beta Vs. Low-Volatility Stocks

The ratio of high beta vs. low volatility stocks this week was at its lowest level since mid-January 2024.

Compared to the S&P 500, the ratio created a bearish divergence in favor of low-volatility stocks. Specifically, if we look at previous divergences, they have often been bearish signals on the S&P 500.

2. XLK Vs. SPY Divergence With RSI

Additionally, this week, the tech sector (NYSE:XLK)has returned to the same levels observed in December 2023. Specifically, using the 21-period RSI (Relative Strength Index) indicator, we observe a bearish divergence once again.

XLK vs SPY

XLK vs SPY

The indicator initially reached overbought levels and subsequently declined (moving towards oversold), while the ratio continued its upward trend in favor of the tech sector.

Historically, these divergences in weekly time frames have indicated potential retracements, signaling a reversal that no longer favors tech stocks, indicating weakening.

Given that the technology sector constitutes 30% of the S&P 500 and 50 percent of the Nasdaq, its performance significantly impacts overall market trends.

Potential volatility and weakness in this sector could influence the index’s positive trajectory.

3. S&P 500’s Key Fibonacci Levels

Finally, let’s apply the Fibonacci extension to the S&P 500. This helps us not just predict how much further the trend might go but also pinpoint areas where the price could potentially reverse.

S&P 500 Chart

S&P 500 Chart

One key level to watch is the 0.618% mark. If the price crosses above it, the trend may continue. However, if it acts as a psychological barrier, we might see a retracement, especially after the strong uptrend of recent months.

Additionally, let’s look at the 21-period RSI (Relative Strength Index) on a weekly timeframe again.

In the past, when RSI hit high overbought levels, it signaled the end of bullish trends. We’re seeing similar high levels now.

Could this be a hint of a possible trend change?

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Subscribe Today!

Subscribe Today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com