BTC/USD

+7.85%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ETH/USD

+4.49%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

SOL/USD

+7.81%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

BTC/USD

+7.37%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Bitcoin is on the rise and faces resistance at $60K before targeting all-time highs.

Ethereum could follow suit with the potential launch of a spot ETF in the offing.

Meanwhile, can Solana overcome hurdles to unleash its hidden potential?

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

After breaking the key $57K resistance, the world’s largest cryptocurrency, Bitcoin, appears to be aiming at a new all-time high, with the psychological $60 barrier as the primary test above.

But while BTC has been on a solid uptrend – rallying some 34% since the start of the year – other cryptocurrencies are also presenting great growth potential.

For instance, Bitcoin’s main competitor, Ethereum, has boasted a 43% YTD return. Meanwhile, Solana, currently the fifth-largest digital currency by market capitalization, has posted an 8% gain since the beginning of January.

Optimism in the crypto space primarily stems from Bitcoin’s upcoming halving, historically known to generate significant demand before and after the event. Additionally, the recent launch of ETFs has attracted funds into Bitcoin, reflecting positively on its spot price.

Fundamentally, hopes of rate cuts by the Fed could continue to fuel gains in the sector in the coming months.

In this piece, we will take a look at three ways to benefit from Bitcoin’s attempt to reach new all-time highs.

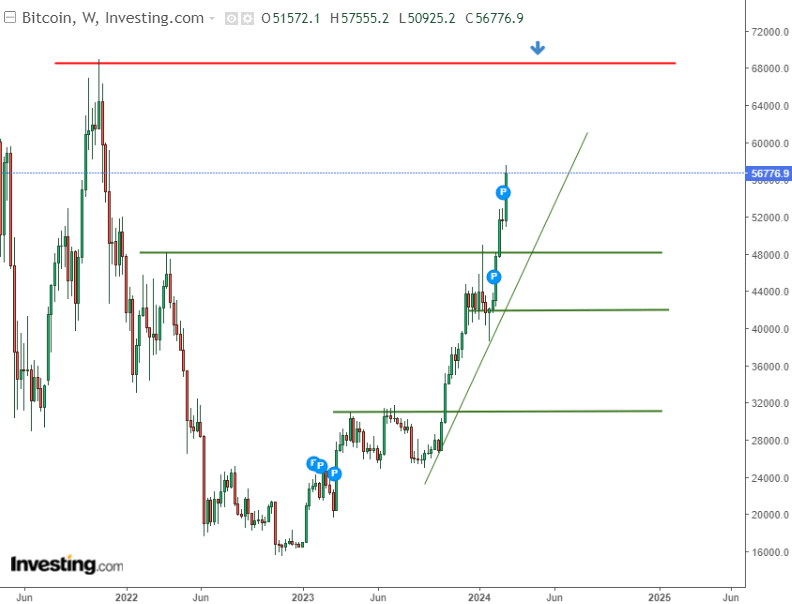

Bitcoin Approaches $60,000, Eyes All-Time Highs

Bitcoin has been on the rise in recent weeks, making it challenging to find a better entry point at a lower price.

If Bitcoin manages to surpass the next psychological barrier of $60,000, it will pave the way for an attempt to reach the historical peak around $69,000.

Bitcoin Weekly Chart

Bitcoin Weekly Chart

MicroStrategy (NASDAQ:MSTR), a key investor in Bitcoin, has once again raised its exposure on the demand side.

Currently, its total coin holdings are valued at $6.09 billion, with an additional $155 million added in just the past few days.

Moreover, there’s a continuous flow of funds into newly launched ETFs. Since January 10, when they were introduced, the total funds allocated have already reached $6.1 billion.

Ethereum Nears Crucial Resistance: Can it Break Higher?

From a technical point of view, Ethereum bulls face a serious test in the region of $3400 per coin before a potential attack on all-time highs.

Ethereum Daily Chart

Ethereum Daily Chart

Only if the indicated area is broken, the buyers can confidently consider reaching new highs.

Additionally, two other factors are noteworthy: the upcoming Dencum update and the potential launch of a spot ETF on Ethereum. This could create a similar demand effect as seen with Bitcoin.

Solana Consolidates With Breakout in Sights

Solana, in contrast to Bitcoin or Ethereum, began the year with a consolidation phase.

The primary challenge faced by the entire ecosystem currently is network failures and outages, hindering its full potential.

However, Solana’s trading volume on decentralized exchanges (DEX) surpassed Ethereum’s early in the month, signaling sustained interest.

To resume consistent growth, Solana needs to surpass its recent high, situated around $124 per coin.

Solana Daily Chart

Solana Daily Chart

If bulls succeed, they are likely to target the highest point in April 2022, which is around $144.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Subscribe Today!

Subscribe Today!

Now with CODE INWESTUJPRO1 you can get as much as a 10% discount on InvestingPro annual and two-year subscriptions.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com