US500

+0.80%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

+0.23%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NVDA

+4.00%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

AMD

+5.25%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+1.14%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

META

+2.48%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

The U.S. stock market is off to its best start to a year since 2019.

The rally could be tested in March amid several major market-moving events.

Market focus will be on commentary from leading Fed officials, the nonfarm payrolls report, inflation data, and the FOMC policy meeting.

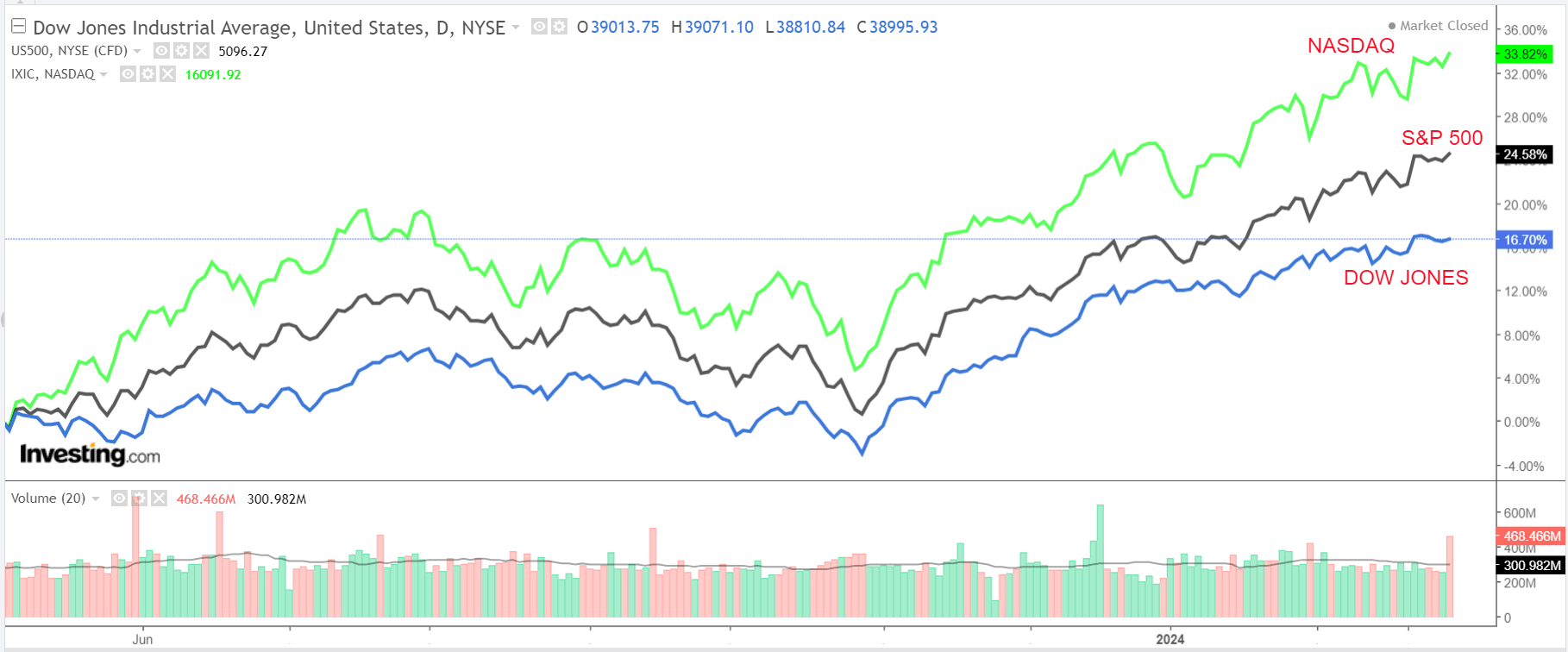

February was another terrific month for the stock market as the S&P 500 and Nasdaq wrapped up their fourth winning month in a row to notch their best start to a year since 2019.

The gains came as tech shares extended their rally amid mounting optimism and excitement about growth prospects related to artificial intelligence.

But despite the solid uptrend, many investors did not manage to profit accordingly as the broad-based rally was, once again, driven by a handful of winners.

That’s where our predictive AI stock-picking tool, ProPicks, came in handy.

By compiling a multitude of factors, including the long-term history of the stock market and state-of-the-art fundamental analysis, our models were able to provide its users with a solid selection of winners for unrivaled market outperformance for under $9 a month.

In the following article, we will understand where the market stands right now and what investors should pay attention to looking ahead in March.

Where We Stand Now

The Nasdaq Composite, which reached its first closing record since November 2021 last night, was the top performer during the month of February, surging 6.1%.

Nasdaq Vs. Dow Jones Vs. S&P 500Source: Investing.com

Nasdaq Vs. Dow Jones Vs. S&P 500Source: Investing.com

The tech-heavy index was boosted by strong performances from Nvidia (NASDAQ:NVDA), Meta Platforms (NASDAQ:META), AMD (NASDAQ:AMD), and several other companies linked to AI.

Meanwhile, the benchmark S&P 500 and the blue-chip Dow Jones Industrials Average rose 5.1% and 2.2%, respectively.

March will likely be a repeat of the last few months in terms of what markets will be looking at to dictate price action, including commentary from leading Fed officials, the monthly jobs report, the latest inflation figures, as well as the upcoming FOMC policy meeting.

With investors continuing to gauge the outlook for interest rates, inflation, and the economy, a lot will be on the line in the month ahead.

*By the way, our strategies have just rebalanced for the month ahead, with 30+ new market-beating picks added to the six different strategies and 30 others labeled a sell.

Subscribe now for under $9 a month and never miss another bull market by not knowing which stocks to buy!

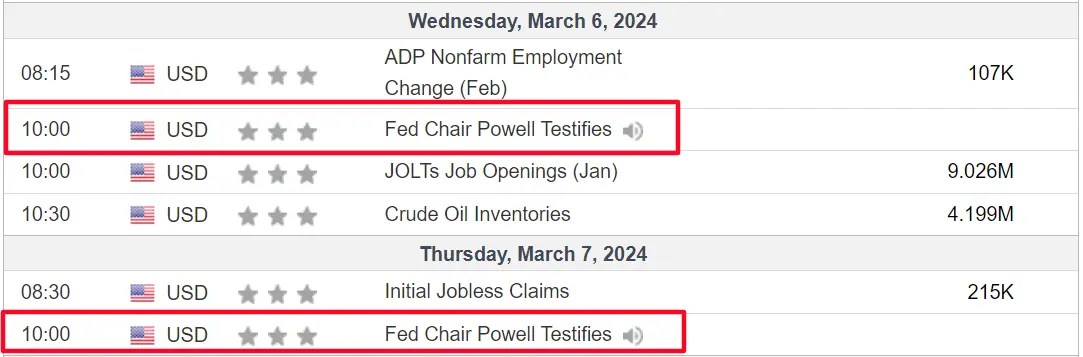

1. Powell Testimony: Wednesday-Thursday, March 6-7

Federal Reserve Chair Jerome Powell will deliver his semi-annual monetary policy testimony before Senate and House committees in Washington DC during the first week of March.

The Fed chief is scheduled to testify on the economy before the House Financial Services Committee at 10:00AM ET on Wednesday, March 6. On Thursday, he will appear in front of the Senate Banking Committee, also at 10AM ET.

Powell Testimony Dates

Powell Testimony Dates

Source: Investing.com

Powell’s comments will be monitored closely for any new insight into his views on the economy and inflation and how that can affect monetary policy in the months ahead.

After raising borrowing costs by 525 basis points since March 2022, many market participants are growing more confident that the Fed’s policy tightening campaign is all but over and that rate cuts are now on the horizon.

For a while, financial markets were betting that the U.S. central bank could start lowering interest rates as early as its March meeting. But those bets have been pushed back to June following a recent batch of upbeat economic data.

As of Friday morning, financial markets see about a 70% chance of a 25-basis point rate cut in June, as per the Investing.com Fed Rate Monitor Tool.

One thing is for certain: given how inflation and the economy are behaving, the fewer promises Powell makes the better.

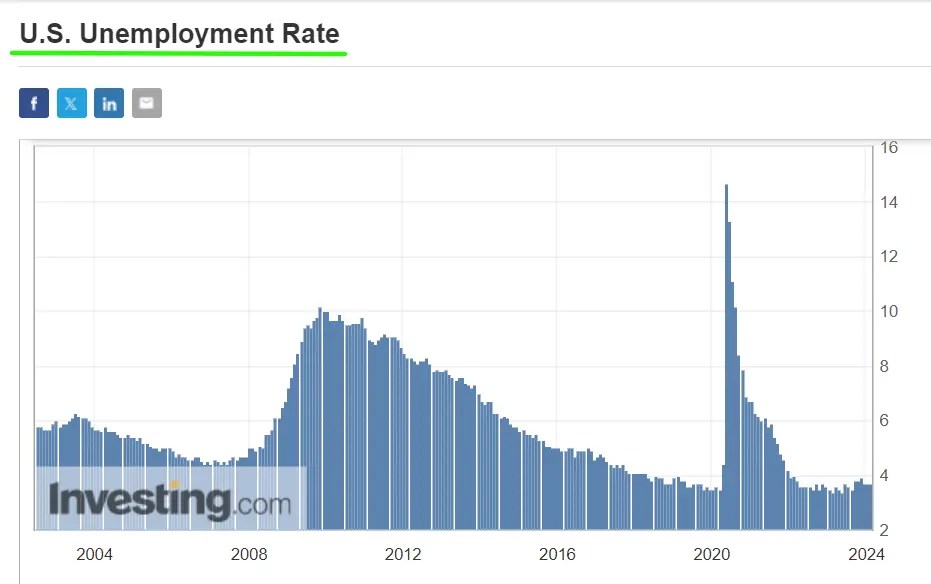

2. U.S. Jobs Report: Friday, March 8

The U.S. Labor Department will release the February jobs report at 8:30 AM ET on Friday, March 8, and it could be key in determining the timing of the Federal Reserve’s first rate cut.

Forecasts center around a continued solid pace of hiring, even if the increase is smaller than in previous months.

The consensus estimate is that the data will show the U.S. economy added 188,000 positions, according to Investing.com, slowing from jobs growth of 353,000 in January.

The unemployment rate is seen holding steady at 3.7%, not far from a recent 55-year low of 3.4%. It’s worth noting that the unemployment rate stood at 3.6% precisely a year ago in February 2023.

Unemployment Rate

Unemployment Rate

Source: Investing.com

Meanwhile, average hourly earnings are expected to rise 0.2% month-over-month, while the year-over-year rate is forecast to increase 4.2%, which is still too hot for the Fed.

Prediction: I believe the February nonfarm payrolls report will underscore the remarkable resilience of the labor market and support the view that the Fed is in no rush to cut rates.

Fed officials have signaled in the past that the unemployment rate needs to be at least 4.0% to slow inflation, while some economists say the jobless rate would need to be even higher.

Either way, low unemployment – combined with healthy job gains and strong wage growth – do not point to imminent rate cuts in the months ahead.

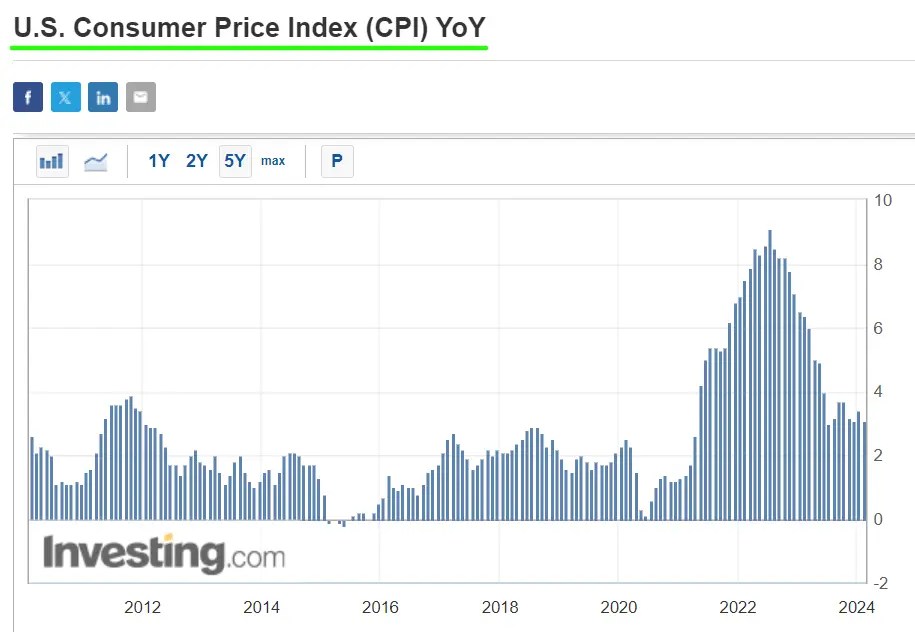

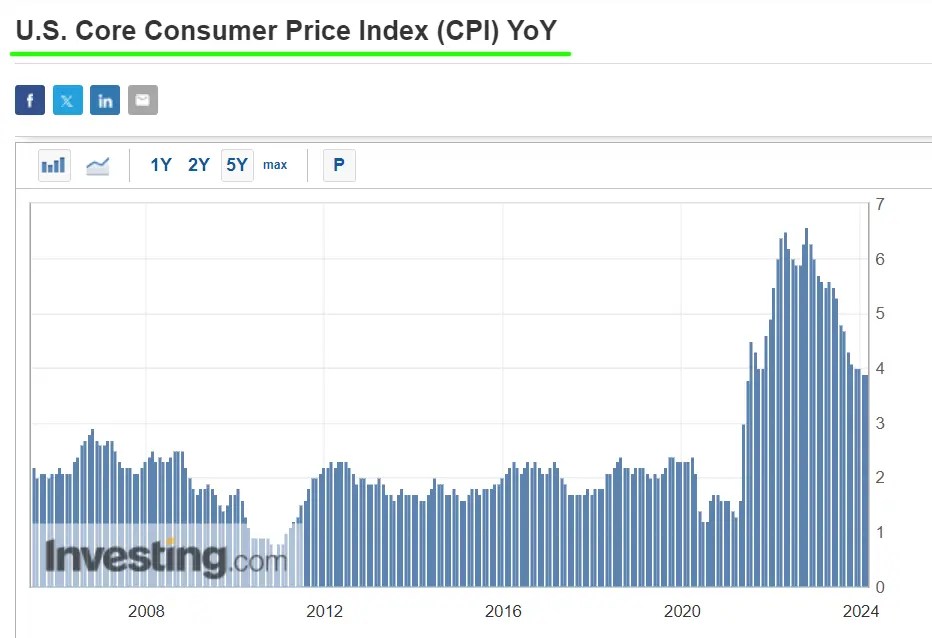

3. U.S. CPI Report: Tuesday, March 12

The U.S. government will release the February CPI report on Tuesday, March 12, at 8:30 AM ET and the data will likely reveal that inflation continues to rise far more quickly than what the Fed would consider consistent with its 2% target range.

While no official forecasts have been set yet, expectations for annual CPI range from an increase of 2.9% to 3.3%, compared to a 3.1% annual pace in January.

CPI Y/Y

CPI Y/Y

Source: Investing.com

The closely watched consumer price index has come down substantially since the summer of 2022, when it peaked at a 40-year high of 9.1%, however, inflation is still increasing at a pace nearly twice the central bank’s target.

Meanwhile, estimates for the year-on-year core CPI figure – which does not include food and energy prices – center around 3.7%-4.1%, compared to January’s 3.9% reading.

Core CPI Y/Y

Core CPI Y/Y

Source: Investing.com

The underlying core figure is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

Prediction: Overall, while the trend is lower, I believe the CPI report will show that headline CPI is not falling fast enough for the Fed to put a stop to its inflation-fighting efforts.

Additionally, core inflation is proving stickier than expected and is anticipated to remain well above the Fed’s target for the foreseeable future.

Therefore, I hold the opinion that the current environment is not indicative of a Fed that is ready to cut rates and there is still a long way to go before policymakers are ready to declare mission accomplished on the inflation front.

Taking that into consideration, the Fed’s inflation battle is far from over.

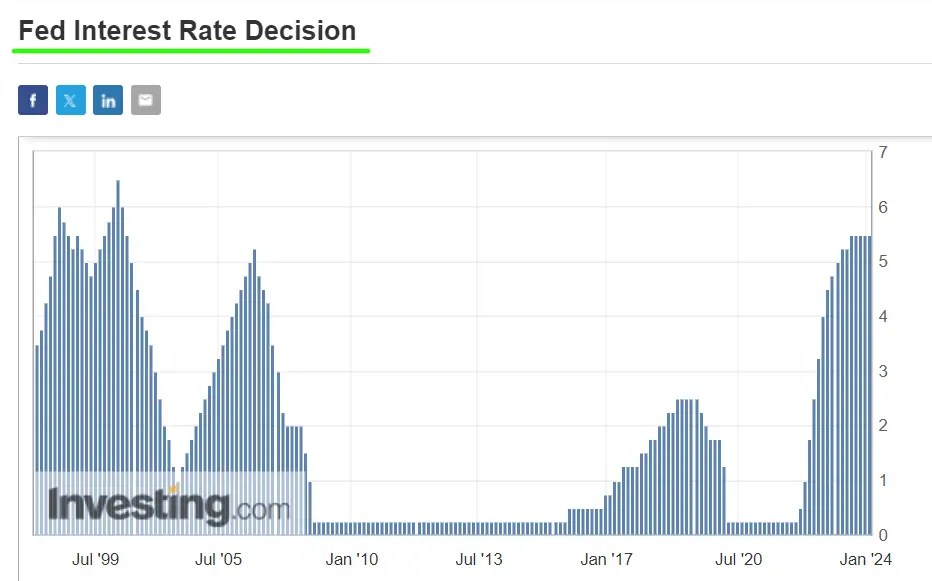

4. Fed FOMC Policy Meeting: Wednesday, March 20

The Federal Reserve is scheduled to deliver its latest policy decision on Wednesday, March 20 at 2:00 PM ET, and it is almost certain to keep interest rates unchanged after its two-day FOMC meeting.

That would leave the benchmark Fed funds target range between 5.25% and 5.50%, where it has been since July, as officials continue to assess signs of a resilient economy and slowing inflation.

Fed Funds Rate

Fed Funds Rate

Source: Investing.com

Fed Chair Jerome Powell will hold what will be a closely watched press conference half an hour after the conclusion of the FOMC meeting at 2:30 PM ET, as investors look for fresh clues on when the U.S. central bank might start lowering borrowing costs.

The Fed will also release new forecasts for interest rates and economic growth, known as the “dot plot”, which will reveal greater signs of the Fed’s trajectory for interest rates through 2024 and 2025.

Prediction: Contrary to the market’s view for a June rate cut, I believe there is a substantial risk the Fed could strike a hawkish tone as the economy holds up better than expected, the labor market remains strong, and inflation stays elevated.

As such, Powell is likely to push back against market expectations for an imminent rate cut in his post-meeting press conference and reiterate that officials will remain dependent on incoming economic data in determining their next move.

Any indications or shifts in the Fed’s tone could trigger significant market movements and investor sentiments. Taking that into consideration, market participants are advised to remain vigilant, exercise caution, and diversify portfolios to hedge against potential market fluctuations.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

InvestingPro Special Offer

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com