ORCL

+1.86%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

COST

+0.75%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

TGT

+1.56%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

FL

+0.49%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Costco: Analysts slightly lowered EPS estimates ahead of Q2/24. Our Fair Value models suggest a potential 26.6% decrease in stock price.

Oracle: The stock might be priced slightly higher ahead of Q3/24. Fair value analysis indicates a 3.4% downside, against a more optimistic analyst view of a 9.2% increase.

Target: EPS estimates slightly lowered before Q4/24.

Subscribe to InvestingPro now for under $9 a month and never miss another bull market again!

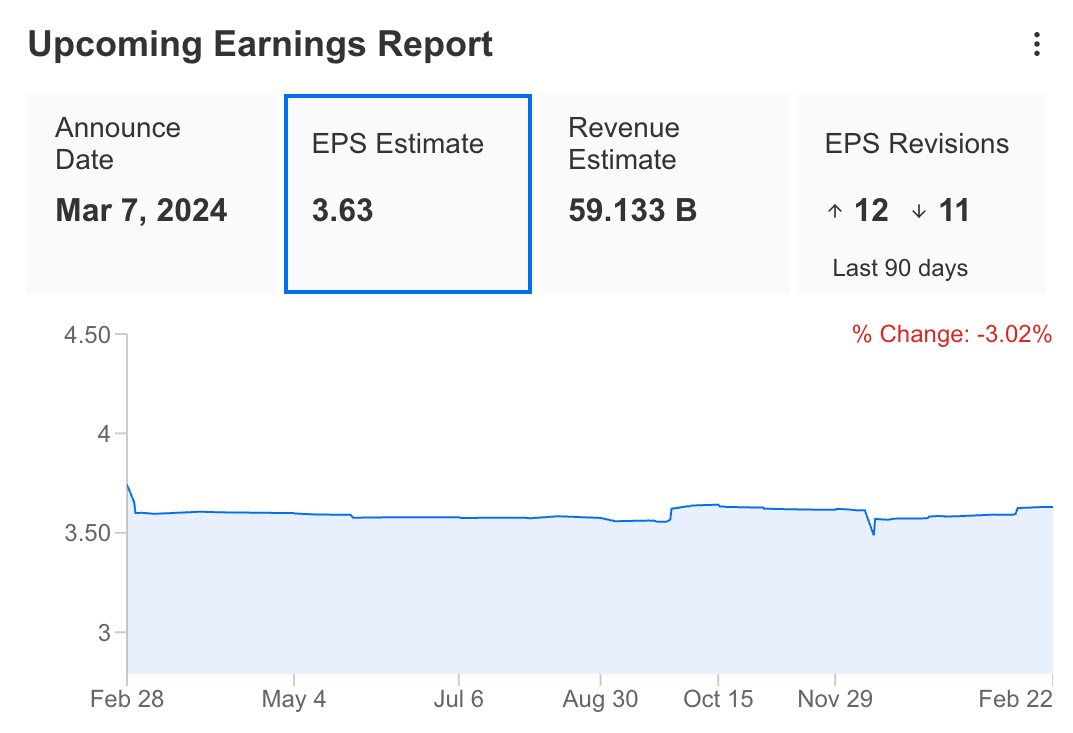

Costco Wholesale (NASDAQ:COST) is set to release its Q2/24 earnings on March 7, after the market close.

Analysts’ consensus currently stands at an EPS of $3.63 and revenues of $59.13 billion.

InvestingPro’s analysis of EPS Forecast Trends indicates a minor negative adjustment in expectations for the upcoming quarter’s EPS, with a decrease of 3.0% from an initial estimate of $3.74 to $3.63 over the past year. This adjustment comes even though Costco surpassed its EPS and revenue forecasts in the previous two quarters.

COST

COST

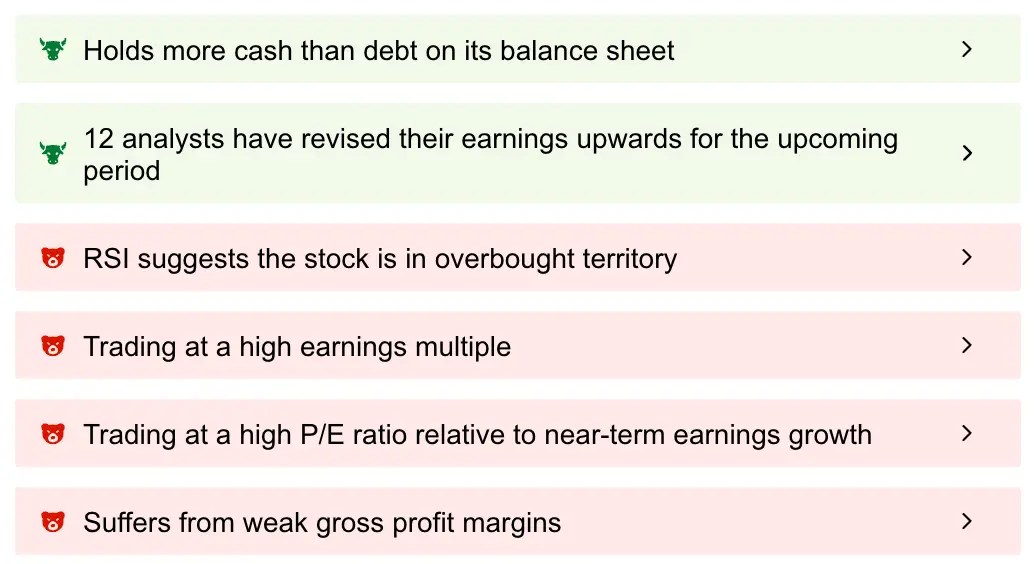

Our ProTips highlights several cautionary points for Costco, including indications that the stock may be overbought according to the RSI, its valuation at a high earnings multiple, a high P/E ratio compared to its near-term earnings growth, and concerns about its weak gross profit margins.

COST

COST

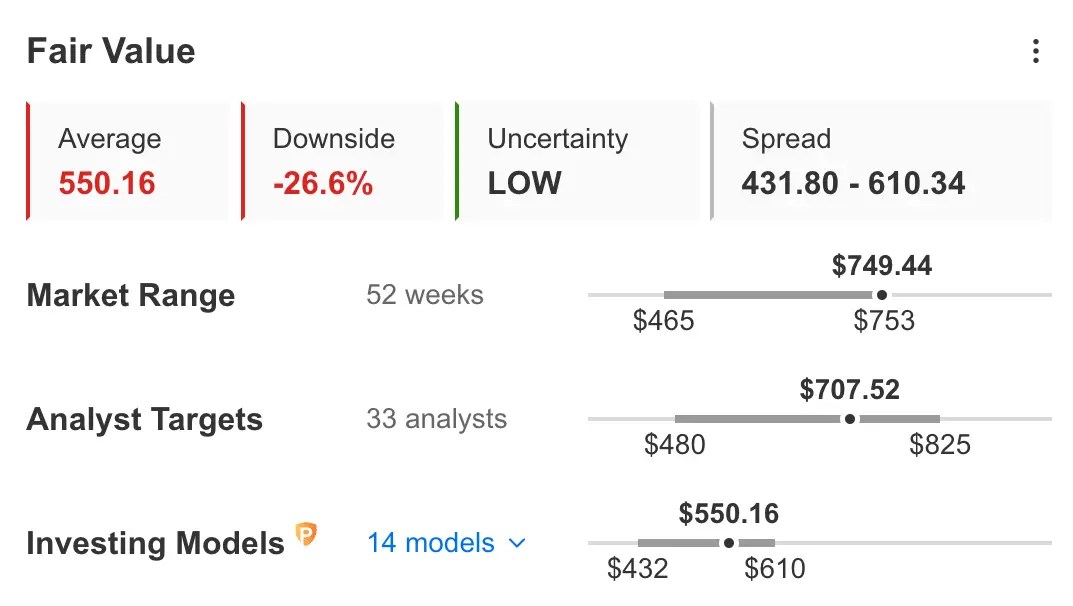

Furthermore, our Investing Models suggest that Costco’s stock might be overpriced, estimating its fair value at $550.16. This valuation points to a potential 26.6% decrease from its last closing price. Analyst targets also indicate a potential 5.5% decline.

COST

COST

Oracle

Oracle (NYSE:ORCL) is scheduled to announce its Q3/24 on March 7, following the market’s close. The consensus among analysts forecasts an EPS of $1.38 with revenue expectations of $13.29B.

Over the previous two quarters, Oracle has exceeded EPS estimates but reported revenues that fell short of Wall Street’s expectations.

ORCL

ORCL

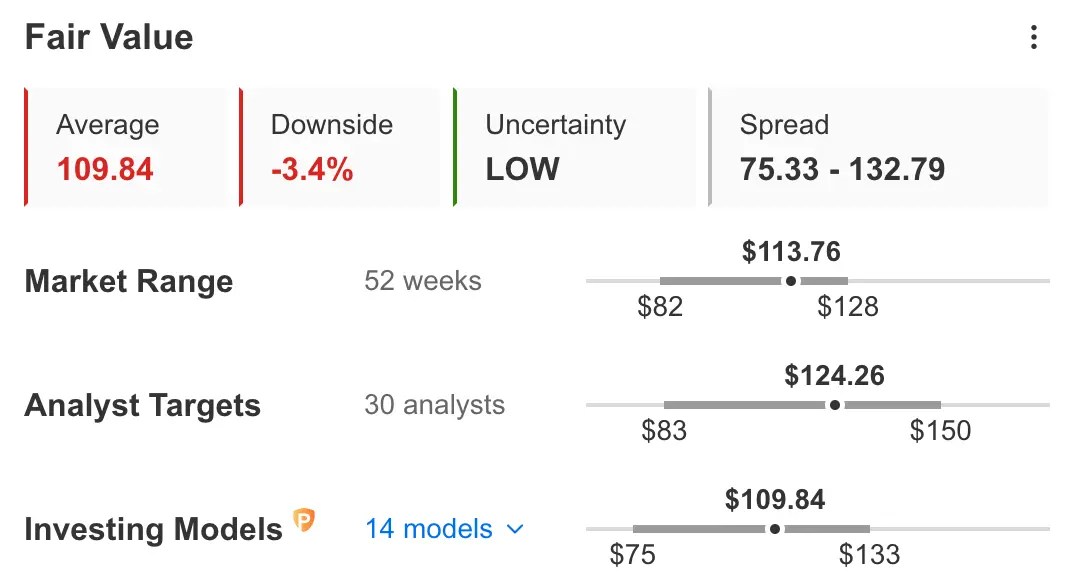

InvestingPro’s Fair Value analysis indicates that Oracle’s stock might be priced slightly higher, with an estimated fair value of $109.84. This estimate suggests a 3.4% downside from its most recent closing price. Conversely, analyst projections point towards a potential 9.2% increase.

ORCL

ORCL

Oracle is ranked for Good Performance in the Pro’s Financial Health, which is determined by ranking the company on over 100 factors against companies in the Information Technology sector and operating in Developed economic markets.

ORCL

ORCL

Target

Target (NYSE:TGT) is set to reveal its Q4/24 on March 5, before the market opens. Analysts are predicting an EPS of $2.42 and anticipate revenues to be around $31.86B.

InvestingPro’s review of EPS Forecast Trends highlights a downward revision in the expected EPS for the upcoming quarter, showing a 7.2% drop from the initial forecast of $2.60 to $2.42 over the last twelve months.

TGT

TGT

Recently, in February, Target received several upgrades from Wall Street firms. Goldman Sachs raised Target’s rating from Buy to Conviction Buy, setting a price target of $176.00. Additionally, Gordon Haskett raised its rating from Hold to Buy, adjusting its price target to $170.00, up from $120.00.

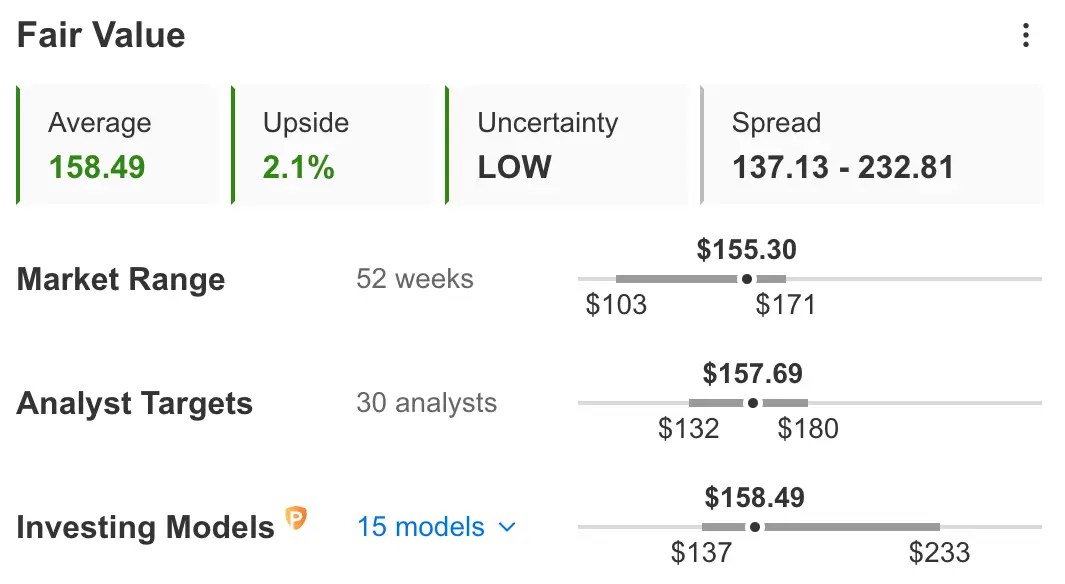

According to InvestingPro’s Fair Value assessment, Target’s stock appears to be priced appropriately, presenting a modest potential increase of 2.1% from its last closing price.

TGT

TGT

Foot Locker

Foot Locker (NYSE:FL) is scheduled to announce its Q4/24 earnings on March 6, before the market opens. Analyst consensus stands at $0.32 for EPS and $2.27B for revenues.

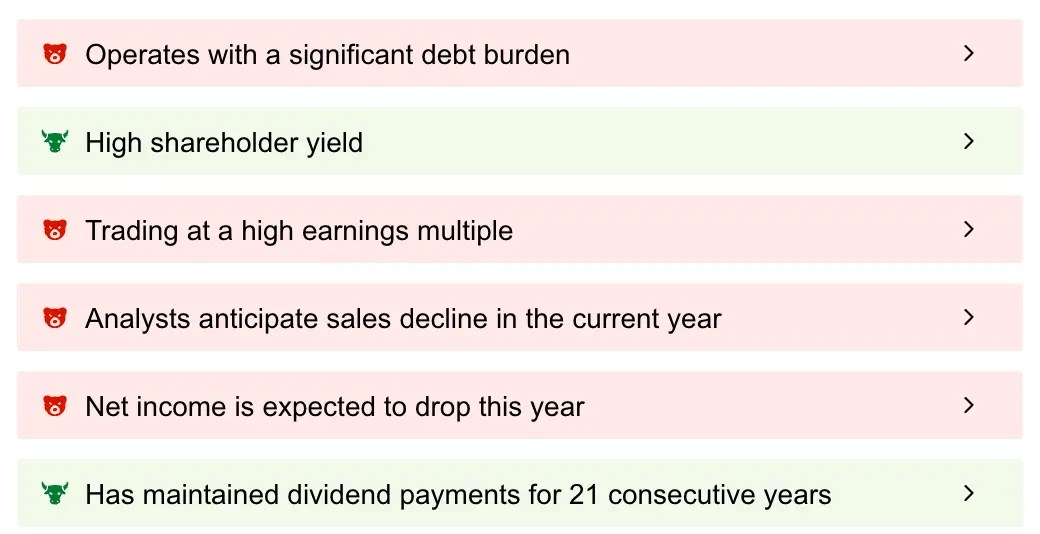

Our ProTips highlights predominantly negative points for Foot Locker, such as a significant debt burden, trading at an elevated earnings multiple, expectations of a sales downturn this year, and a forecasted decrease in net income.

FL

FL

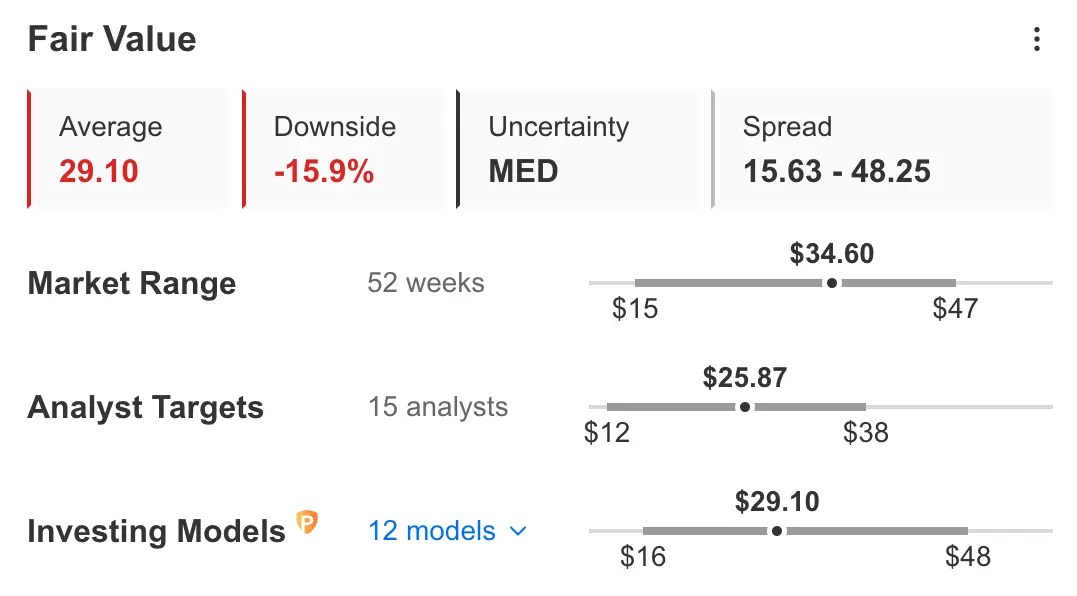

Moreover, according to our Investing Models, Foot Locker’s stock appears to be overvalued, with a fair value estimate of $29.10. This suggests a potential downside of 15.9% from its most recent closing price. Analysts also foresee a possible 25.2% reduction in its value.

FL

FL

This week, some Wall Street analysts adjusted their price targets for Foot Locker. Telsey Advisory Group increased its price target to $38.00 from $31.00, while maintaining an Outperform rating. Citi raised its price target to $22.00 from $20.00, albeit with a Sell rating, noting:

We expect 4Q inventory to be relatively clean but believe it will be challenging for FL to grow sales in F24 against heavy promotionally driven sales in F23.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Subscribe here and never miss a bull market again!

new year

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com