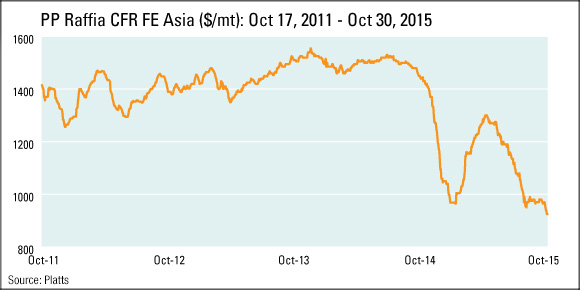

The CFR Far East Asia polypropylene raffia marker fell $40/mt week on week to $925/mt Friday, the lowest since the assessment began in October 2011, due to an oversupply in China.

Industry sources said ample supply and lower prices in the domestic China market have curbed interest in imported cargoes.

“Everyone including Sinopec is facing pressure to sell,” said a China-based polymer trader. “Coal-to-olefin material is coming from North China to East China and South China, creating a supply glut.”

The trader said producers are still expected to be profitable when domestic polypropylene prices are around Yuan 6,900/mt, given low feedstock costs.

The East China domestic price for PP raffia was heard at Yuan 6,850/mt Friday, equivalent to $870/mt on an import-parity basis, well below the CFR price.

Using the discontinued PP homo CFR Far East Asia weekly assessment, domestic China polypropylene prices were last lower March 25, 2009, at $915/mt.

The marker was replaced in October 2011 by the daily PP raffia CFR FE Asia assessment.