US500

+0.80%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US2000

+1.05%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IWM

+1.06%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

+1.14%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Last week finished on a high with breakouts in the Russell 2000 IWM, S&P 500 and Nasdaq.

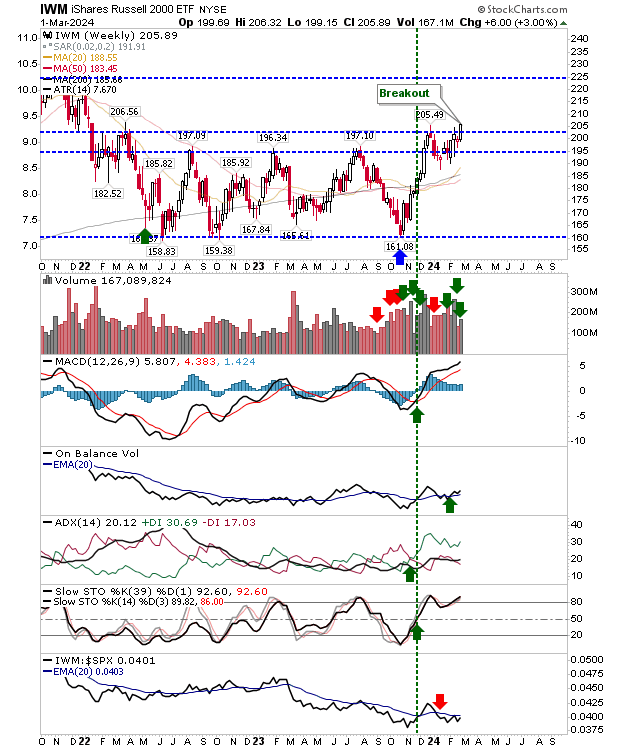

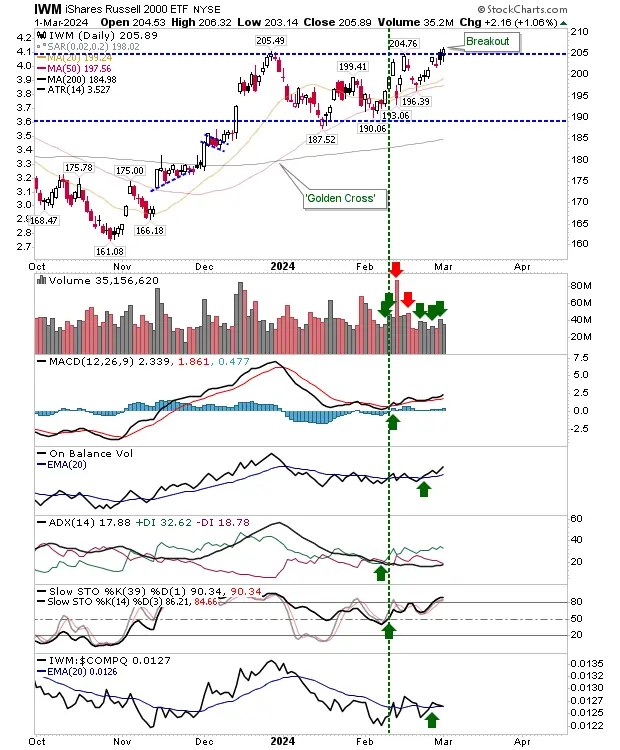

The Russell 2000 went a step further with a breakout on the weekly time frame too. The break on the weekly time frame for the Russell 2000 is critical as it marks the start of a right-hand-side base after repeated attempts to clear $195 ($IWM) had failed.

If there is a concern (across the board) it’s that breakout volume was modest.

IWM-Weekly Chart

IWM-Weekly Chart

IWM-Daily Chart

IWM-Daily Chart

The Nasdaq kept up with its step-by-step rally, delivering a breakout with new ‘buy’ triggers in the MACD and On-Balance-Volume, although the former indicator had flatlined so it’s not the most effusive ‘buy’ trigger.

COMPQ-Daily Chart

COMPQ-Daily Chart

The S&P 500 gained just under 1%, a little less than the Nasdaq, but the breakout was just as valid.

The index has a much stronger accumulation trend than the Nasdaq, and with all indexes in alignment on breakouts with small-cap leadership, all indexes should continue to perform well.

SPX-Daily Chart

SPX-Daily Chart

Heading into this week, we may see some early weakness, and if we do, it will be important we don’t see a close below Friday’s open.

If this was to happen, we would be at risk of a ‘bull trap’. Intraday losses, even losses that undercut the breakout are okay, it’s how markets finish that’s important.

Source: Investing.com