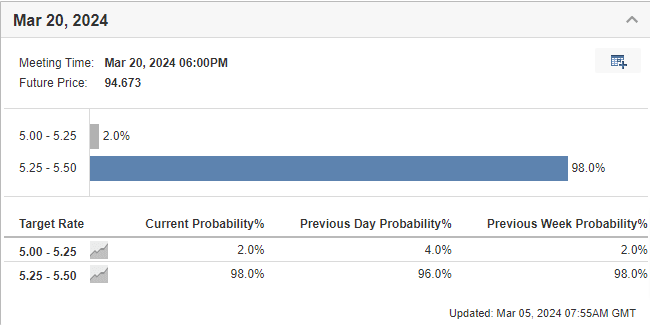

Despite a slight slowdown, the economy continues to thrive and the chances of a rate cut at the March 20 meeting stand at a minuscule 2%.

In this piece, we will consider the recent statements from Fed members that have indicated varying degrees of support for rate cuts.

Meanwhile, Powell’s stance leans towards evidence of sustained inflation decline before considering rate cuts.

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The economy and the job market remain strong, despite a slight slowdown recently.

As of today, the chances of a rate cut at the next meeting on March 20 is minuscule, with current probabilities standing at 98%.

With that in mind, let’s examine the statements made by Fed members regarding potential rate cuts this year.

This will enable us to determine when the first rate cut might occur and how many cuts are likely this year.

Fed Rate Cut Probabilities

Fed Rate Cut Probabilities

What Have the Fed Members Said Recently?

If Powell has appeared tougher than expected in his latest media appearances, it’s crucial to consider the perspectives of other members.

Let’s briefly summarize the recent statements made public:

Daly (San Francisco Fed): Supports cutting rates before inflation hits the 2 percent target. Advocates for not waiting to avoid the risk of a recession.

Williams (New York Fed): Favors rate cuts but emphasizes a measured approach based on periodic economic data.

Mester (Fed Cleveland): Inclined towards cuts and suggests the possibility of up to 3 interest rate cuts, depending on the continued decline in inflation and a labor market that might keep fluctuating.

Goolsbee (Chicago Fed): Backs a rate cut, expressing concern about potential negative impacts on the labor market if rates remain at current levels. Believes the economy could still maintain a robust pace.

Bostic (Atlanta Fed): Supports rate cuts and specifies a potential timeline, pointing to the summer as a plausible period for rate adjustments.

Collins (Boston Fed): Advocates for a rate cut, focusing on the Shelter component of inflation. Suggests cuts would be appropriate if there are further declines in this component, which holds significant weight in the CPI.

What About Powell?

Ahead of Senate testimony, Powell wants to see evidence of a sustained decline in inflation towards the Fed’s 2 percent target. He’s unlikely to cut the key interest rate in March, possibly considering June as a more suitable month.

In general, the sentiment appears favorable for an initial cut in the summer.

How Should We Position Our Portfolios?

However, it’s essential to remember that portfolio decisions should focus on factors within our control, such as asset allocation, rebalancing, risk management, and setting goals and time horizons, considering the inherent uncertainty in predicting future events.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Subscribe Today!

Subscribe Today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com