CL

+0.36%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

WMT

+1.73%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

V

-0.56%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

In this piece, we will evaluate stocks using the Piotroski Index, which utilizes nine key measures.

This index scores companies from 0 to 9, helping determine their financial standing.

We will take a look at the stocks of three established brands with high Piotroski scores.

In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The Piotroski Index evaluates a company’s attractiveness based on nine key measures:

The company’s return on assets must be positive in the past year.

The return on assets from the last year should show improvement compared to the previous year.

Cash flow from operating activities needs to exceed net income in the last year.

The liquidity ratio for the last year should be higher than in the previous year.

The number of shares outstanding should remain constant.

Gross profit for the last year should be greater than the previous year.

Cash flow from operating activities should surpass net profit for the last year.

The debt-to-equity ratio should decrease in the last year compared to the previous year.

Asset turnover in the current year should exceed the previous year.

The evaluation assigns a score of 0 to 9, indicating the company’s strength based on the points awarded.

Today’s analysis will highlight three companies scoring a minimum of 8 under the Piotroski index.

1. Colgate-Palmolive

Colgate-Palmolive (NYSE:CL), a leading global brand in household essentials, relies on robust marketing, sector leadership, and expansion into emerging markets.

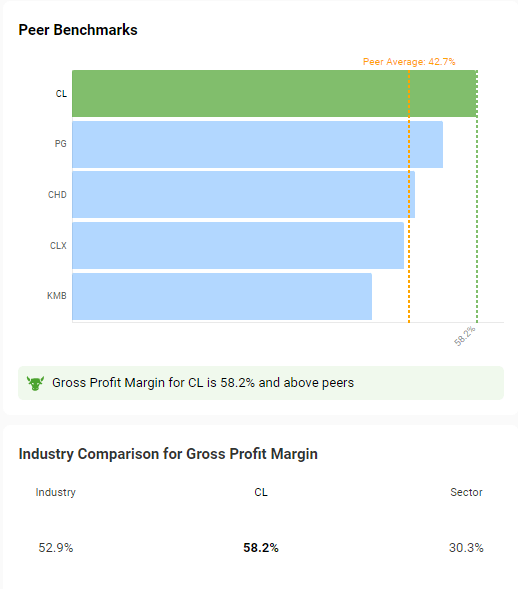

Riding the broader market uptrend, the company’s stock exhibits strong growth. Financially, it boasts a solid Piotroski score of 8, consistent quarterly net profit growth, and an impressive net margin surpassing sector averages at nearly 60%.

CL Peer Benchmarks

CL Peer Benchmarks

Source: InvestingPro

Currently, the stock has broken above historical highs and there’s a good chance of the rally continuing with a target near $90.

2. Visa

Visa (NYSE:V) scores a high Piotroski score as well. The ongoing upward trend isn’t just due to a general bull market but also stems from several positive fundamental indicators. A quick look shows a remarkable rise in net profit, a trend that has persisted for nearly the entire past decade.

Visa Net Income to Company

Visa Net Income to Company

Source: InvestingPro

The company consistently outperformed expectations in the last eight quarters, reporting higher net profit and revenue. The current quarter’s sales are projected to reach 8.6 billion, indicating a 7.7% increase compared to the previous year.

3. Walmart

The strong bull market has also boosted Walmart’s (NYSE:WMT) stock price. Following the positive quarterly results released on February 20, the stock experienced a 2% growth on the publication day, reaching new all-time highs just above $60 per share.

WMT Price Chart

WMT Price Chart

We are currently seeing a local consolidation, and if the price breaks upward, the bullish momentum will continue. However, a correction might find support near the $57 level.

If the overall economic conditions remain positive, with no significant recession and the Federal Reserve beginning a cycle of rate reductions, there is a strong chance that the upward trend will continue.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Subscribe Today!

Subscribe Today!

Now with CODE INWESTUJPRO1 you can get as much as a 10% discount on InvestingPro annual and two-year subscriptions.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Source: Investing.com