© Reuters

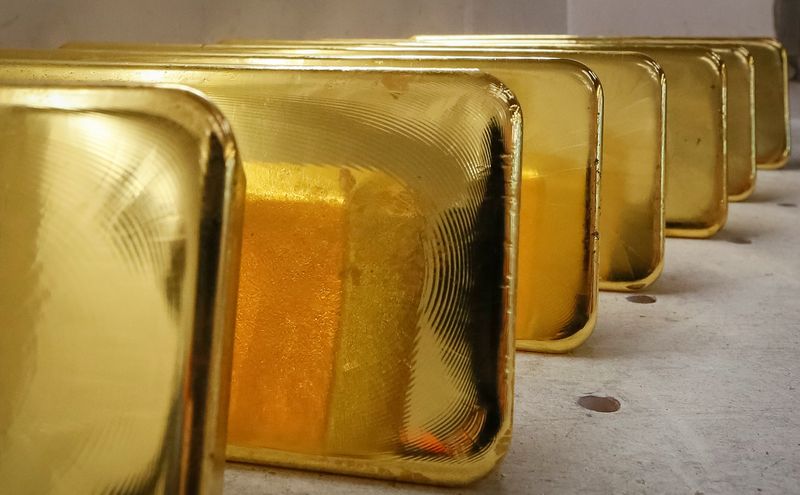

Gold

+0.97%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

Investing.com – Gold prices settled at a record high Friday after briefly topping $2,200 for the first ever as growing optimism on major central banks dropping the axe on interest rates in the coming months and ongoing geopolitical tensions in high demand.

Gold futures for April delivery on the Comex division of the New York Mercantile Exchange rose by 0.8% settle a record of $2178.6 a troy ounce after hitting an all-time high of $2,202.35.

The latest record milestone for the precious metal, which notched a 4% gain for the week, comes as investors digested a slew of remarks form central banks and economic data including the jobs report Friday that points to rate cuts in the coming months.

Data Friday showed the U.S. economy created 275,000 jobs last month from a downward revised 229,000, well above economists’ expectations for a 160,000 new jobs on a slowdown in wages and a moderate uptick in unemployment.

“The downgrades to the December and January figures and the rising unemployment revealed by the household survey nevertheless suggest the market is cooling,” Desjardins said in a note.

The 2-year Treasury yield, which is sensitive to Fed rate policy, fell 2 basis points, adding further fuel to record rally in gold. Treasury yields were also dented a day earlier after the European Central Bank cut its inflation forecast, prompting investor bets on a rate cut as soon as June.

As gold non-interest-bearing asset, the prospect of lower interest rates lowers the opportunity cost of owning gold relative to interest-bearing assets like bonds, boosting demand.

The record run in gold comes even as a certain cohort of investors in gold continue to head for the exit.

Global gold exchange traded funds “collectively saw another outflow in February, extending their losing streak to nine month,” The World Gold Council reported Thursday.

Total assets under management in global gold ETFs fell by 1.8% in February, to US$206 billion.

Yet, that did little to dent demand for the yellow metal as central banks continue to buy the yellow metal amid an ongoing effort to diversify their reservers, led by China.

Central banks bought 1,037 tonnes of gold last year, just shy of the all-time high of 2022, as shown by data from the World Gold Council.

Looking ahead to next, the yellow metal is likely to remain in focus as fresh consumer inflation day will likely offer fresh clues on the path of U.S. interest rates.

“U.S. inflation numbers will be in the spotlight on Tuesday as U.S. Federal Reserve officials consider when it might be appropriate to begin lowering interest rates,” RBC said in a note.

Source: Investing.com