NDX

-1.53%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

US500

-0.65%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DJI

-0.18%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ORCL

-1.82%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ADBE

-0.78%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

NVDA

-5.55%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DLTR

-1.41%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

IXIC

-1.16%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

DG

-0.95%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ULTA

-1.48%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

XLK

-1.51%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

S

+1.16%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

CPI inflation, retail sales, producer prices, and more earnings will be in focus this week.

Oracle is a buy with strong earnings and guidance on deck.

Dollar Generalis a sell with disappointing results, outlook expected.

Looking for more actionable trade ideas? Join InvestingPro for under $9 a month for a limited time only and never miss another bull market by not knowing which stocks to buy!

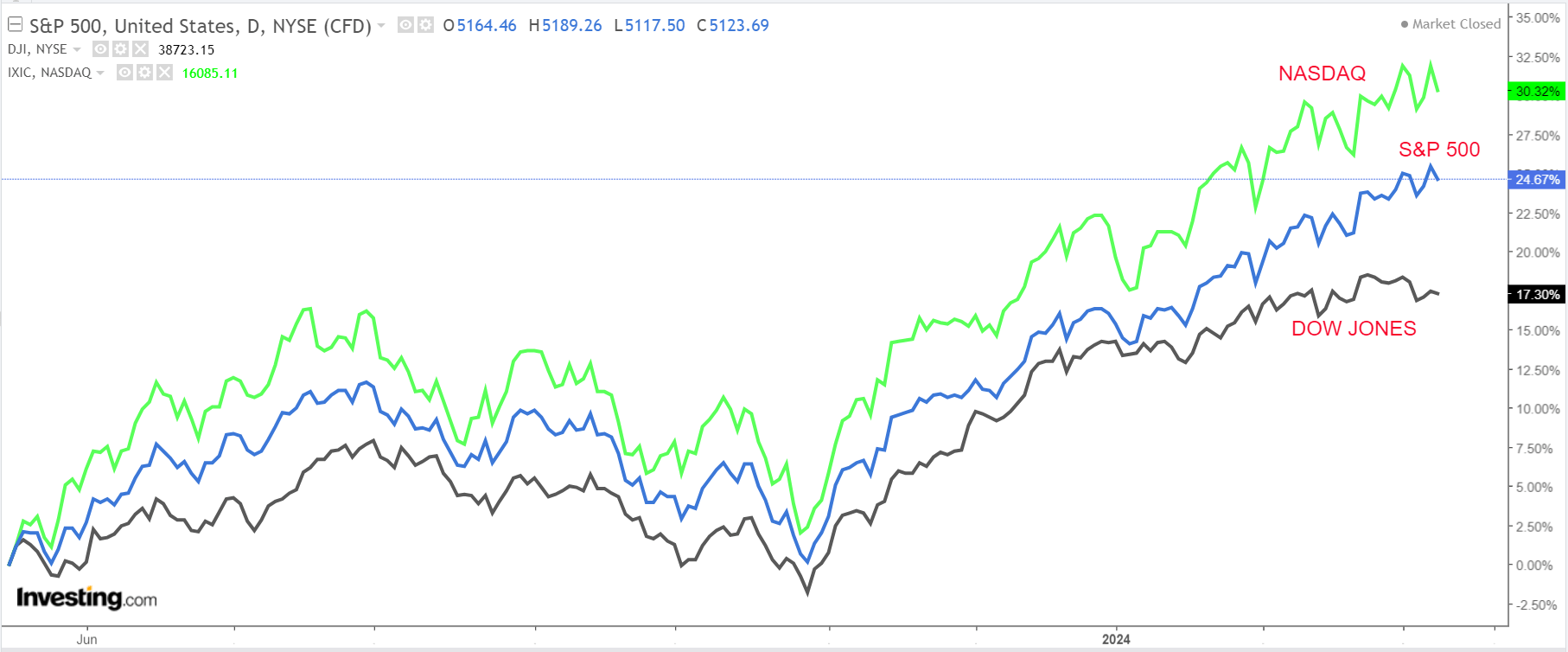

U.S. stocks finished lower on Friday to close out a turbulent week as Nvidia’s monster rally took a breather, weighing on other AI-linked chip companies.

The S&P 500 and Nasdaq Composite both hit fresh record highs earlier in the session after the latest labor market data showed the U.S. economy added more jobs than expected in February, while the unemployment rate rose for the first time in four months.

For the week, the benchmark S&P 500 declined 0.3%, the tech-heavy Nasdaq dropped 1.2%, and the blue-chip Dow Jones Industrial Average shed 0.9%.

Source: Investing.com

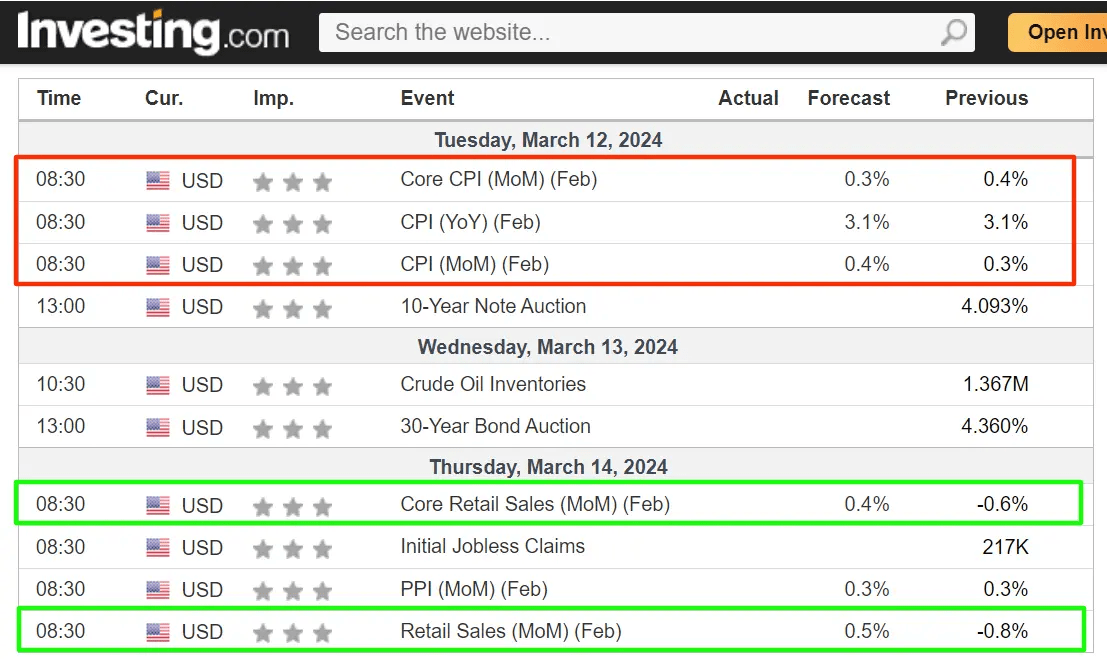

The week ahead is expected to be another eventful one as investors continue to look for more cues on the prospects for potential rate cuts.

On the economic calendar, most important will be Tuesday’s U.S. consumer price inflation report for February, which is forecast to show headline annual CPI holding steady at 3.1%.

Weekly Events

Weekly Events

Source: Investing.com

The CPI data will be accompanied by the release of the latest retail sales figures as well as a report on producer prices, will help fill out the inflation picture.

As of Sunday morning, financial markets see a 75% chance of the Fed cutting rates in June, according to the Investing.com Fed Monitor Tool.

Elsewhere, some of the key earnings reports to watch include updates from Oracle, Adobe (NASDAQ:ADBE), SentinelOne (NYSE:S), and Jabil Circuit (NYSE:JBL). Several consumer-facing companies such as Ulta Beauty (NASDAQ:ULTA), Dollar General, Dollar Tree (NASDAQ:DLTR), Kohl’s (NYSE:KSS), and Dick’s Sporting Goods (NYSE:DKS) also head into the earnings confessional as Wall Street’s Q4 reporting season draws to a close.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, March 11 – Friday, March 15.

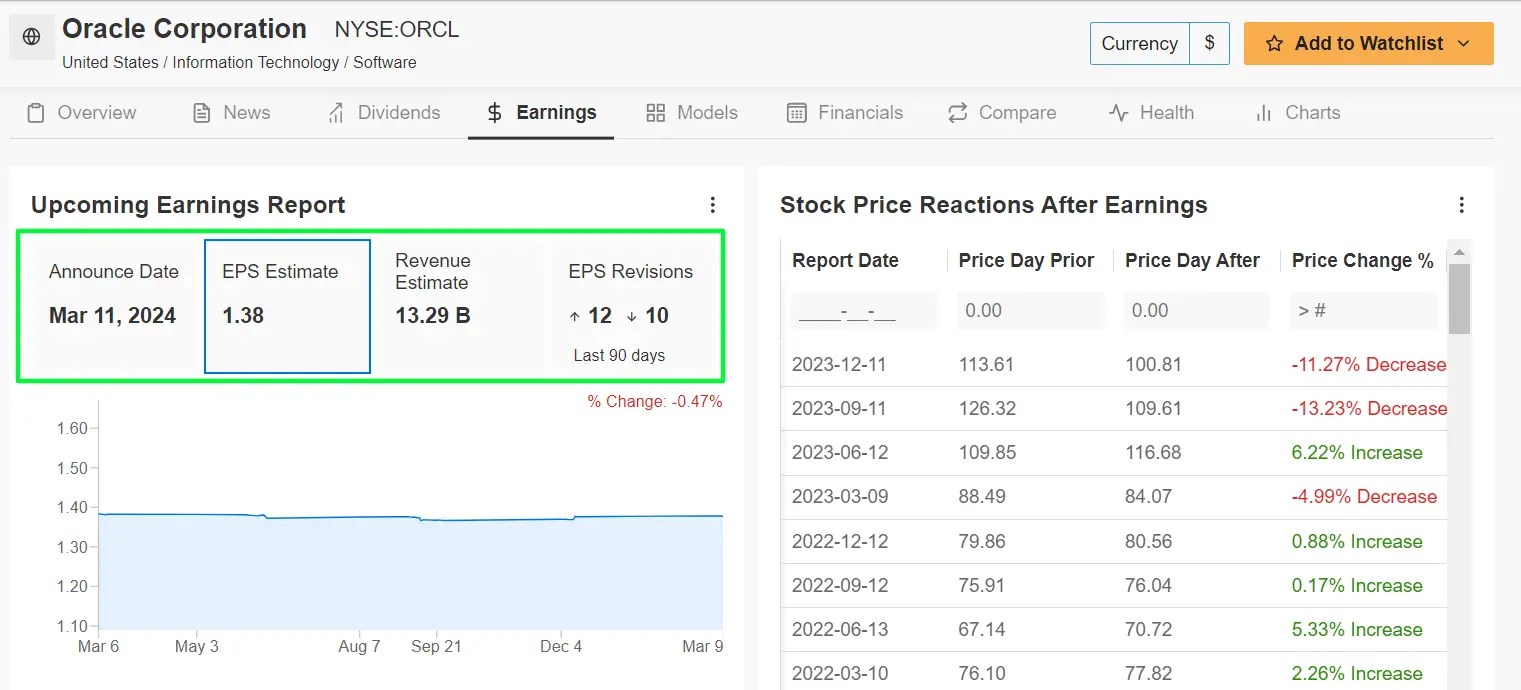

Stock to Buy: Oracle

I expect Oracle (NYSE:ORCL) stock to outperform this week, as the cloud and software company will likely deliver another quarter of strong top-and bottom-line growth and provide an upbeat outlook thanks to broad strength in its cloud business.

Oracle is scheduled to release its fiscal third quarter earnings report after the U.S. market closes on Monday at 4:05PM ET.

Market participants expect a sizable swing in ORCL shares after the update drops, according to the options market, with a possible implied move of roughly 7% in either direction. Shares fell around 11% after its last earnings report in mid-December.

Oracle Earnings Page

Oracle Earnings Page

Source: InvestingPro

Wall Street sees the Austin, Texas-based tech titan earning $1.38 per share for its fiscal Q3, improving 13.1% from the year-ago period due to the positive impact of ongoing cost-cutting measures.

Analysts have raised their EPS estimates 12 times in the past 90 days, according to an InvestingPro survey, while 10 of the analysts surveyed downwardly revised their ORCL earnings forecast.

Meanwhile, Oracle’s revenue is forecast to increase 7.2% year-over-year to $13.29 billion, reflecting strong growth in its cloud services and infrastructure business, which is getting a boost in demand from generative AI companies.

In my opinion, Oracle’s update regarding the performance of its license-support segment will surprise to the upside to reflect growing demand from both large enterprises and government agencies.

As such, I believe Oracle CEO Safra Catz will provide an upbeat outlook as the tech company’s cloud business is well positioned to benefit from the growing AI trend and its tight partnership with Nvidia (NASDAQ:NVDA).

Oracle Chart

Oracle Chart

Source: Investing.com

ORCL stock – which hit an all-time high of $127.54 in June 2023 – closed at $112.45 on Friday. With a market cap of $309 billion, Oracle is one of the most valuable database software and cloud computing companies in the world.

Year-to-date, shares are up 6.6%, much better than the 2.1% increase recorded by the SPDR® S&P Software & Services ETF (NYSE:XSW), which tracks an equal-weighted index of software and services companies in the S&P 500.

As ProTips points out, Oracle is in ’Good’ financial health condition, thanks to solid earnings prospects, and a robust profitability outlook. Additionally, it should be noted that the company has raised its dividend payout for 10 years running.

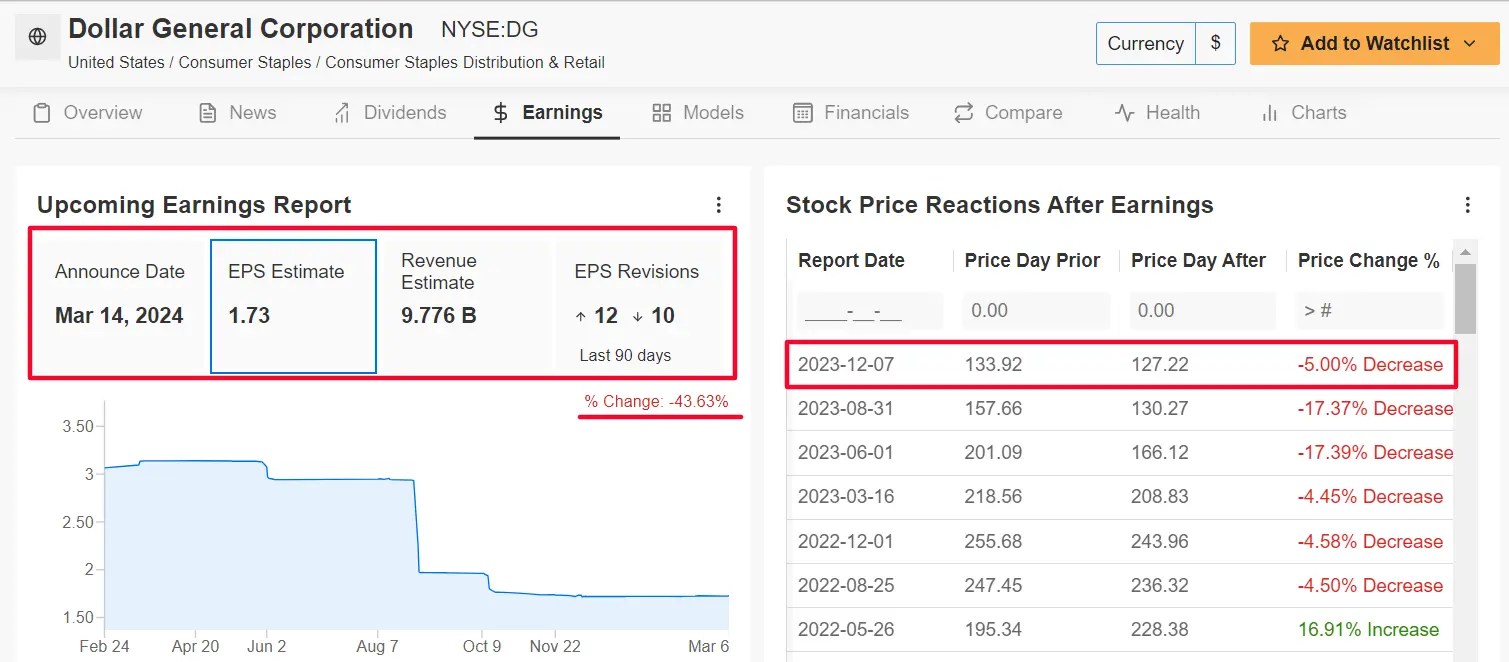

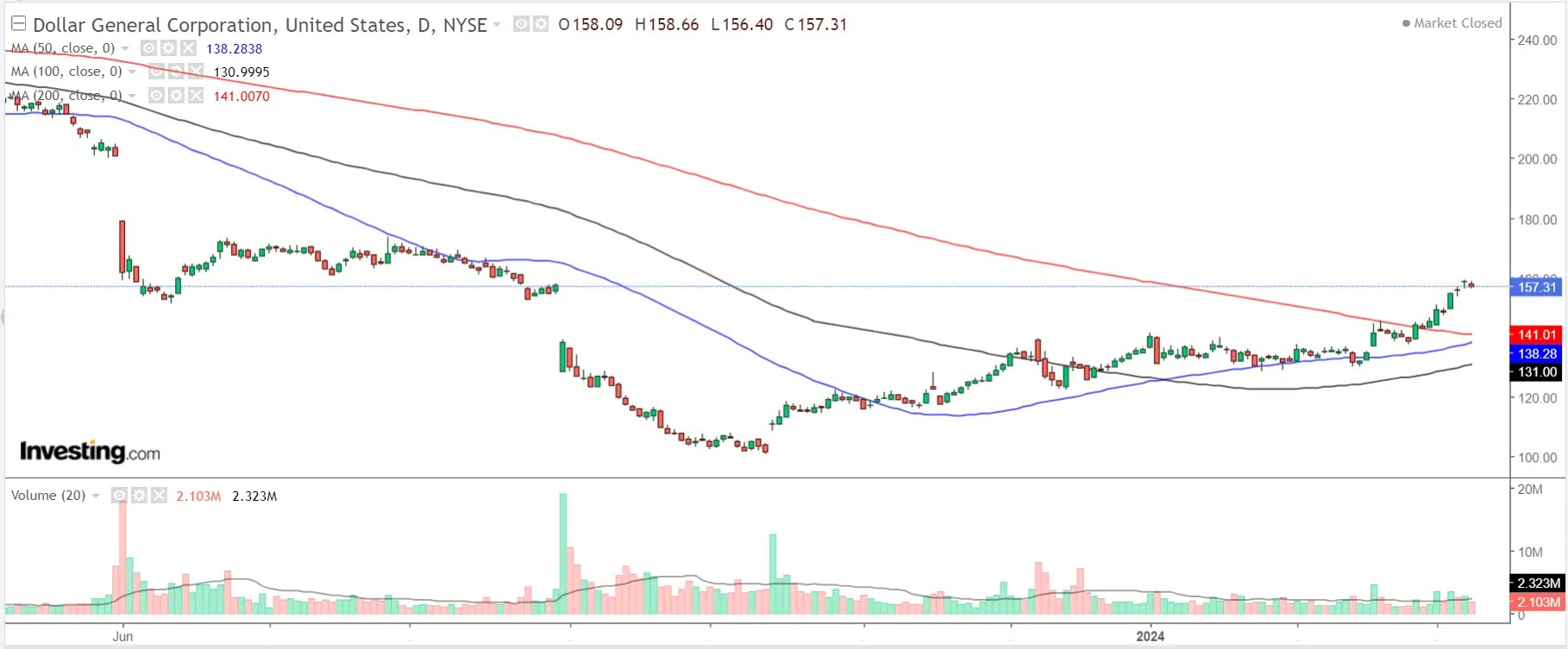

Stock to Sell: Dollar General

I believe Dollar General (NYSE:DG) will suffer a disappointing week ahead as the discount retailer’s latest earnings report and forward guidance will likely underwhelm investors due to the negative impact of several headwinds on its business.

Dollar General’s update for the fourth quarter, which covers the holiday shopping period, is scheduled to come out before the U.S. market opens on Thursday at 6:55AM ET, and results are expected to take a hit from a decline in customer traffic at its stores as well as higher cost pressures and decreasing operating margins.

Underscoring several near-term challenges facing Dollar General amid the current climate, 10 out of the 22 analysts surveyed by InvestingPro lowered their earnings estimates in the three months leading up to the print to reflect a drop of 43.6% from their initial profit forecasts.

As per the options market, traders are pricing in a swing of about 8% in either direction for DG stock following the release. Notably, shares fell 5% to suffer their sixth straight negative earnings-day reaction after the company’s Q3 report in December.

Dollar General Earnings Page

Dollar General Earnings Page

Source: InvestingPro

Dollar General – which operates 20,000 stores across the U.S. – is expected to post Q4 earnings per share of $1.73, tumbling 41.5% from EPS of $2.96 in the year-ago period amid rising operating costs.

Meanwhile, revenue is seen falling 4.2% annually to $9.77 billion, reflecting weakening demand for general merchandise and higher-margin items amid the current macro backdrop.

The retailer is also seen vulnerable to the negative impact of the ongoing industry-wide trend of retail theft, or ‘shrink’.

As such, it is my belief that Dollar General’s management will disappoint investors in their forward guidance for fiscal 2024 and strike a cautious tone amid soft consumer spending and declining operating margins.

Dollar General Chart

Dollar General Chart

Source: Investing.com

DG stock ended Friday’s session at $157.42, just below the previous session’s six-month peak of $159.20. At current valuations, Dollar General has a market cap of $34.5 billion, making it the largest U.S. dollar store and one of the biggest discount retailers in the country.

Shares of the Goodlettsville, Tennessee-based discount retail chain are off to an upbeat start in 2024, rising 15.7% year-to-date. That compares to a 4.3% gain recorded by the Consumer Staples Select Sector SPDR® Fund (NYSE:XLP) over the same period.

With that being noted, DG stock appears to be significantly overvalued heading into its Q4 earnings report, according to the quantitative models in InvestingPro.

Its ‘Fair Value’ price target stands at $134.03, which points to a potential downside of -14.9% from the current market value.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

InvestingPro Offer

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (NYSE:SPY), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Source: Investing.com