US500

-0.11%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

KO

+1.19%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

PG

+0.74%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

ABBV

+0.44%

Add to/Remove from Watchlist

Add to Watchlist

Add Position

Position added successfully to:

Please name your holdings portfolio

Type:

BUY

SELL

Date:

Amount:

Price

Point Value:

Leverage:

1:1

1:10

1:25

1:50

1:100

1:200

1:400

1:500

1:1000

Commission:

Create New Watchlist

Create

Create a new holdings portfolio

Add

Create

+ Add another position

Close

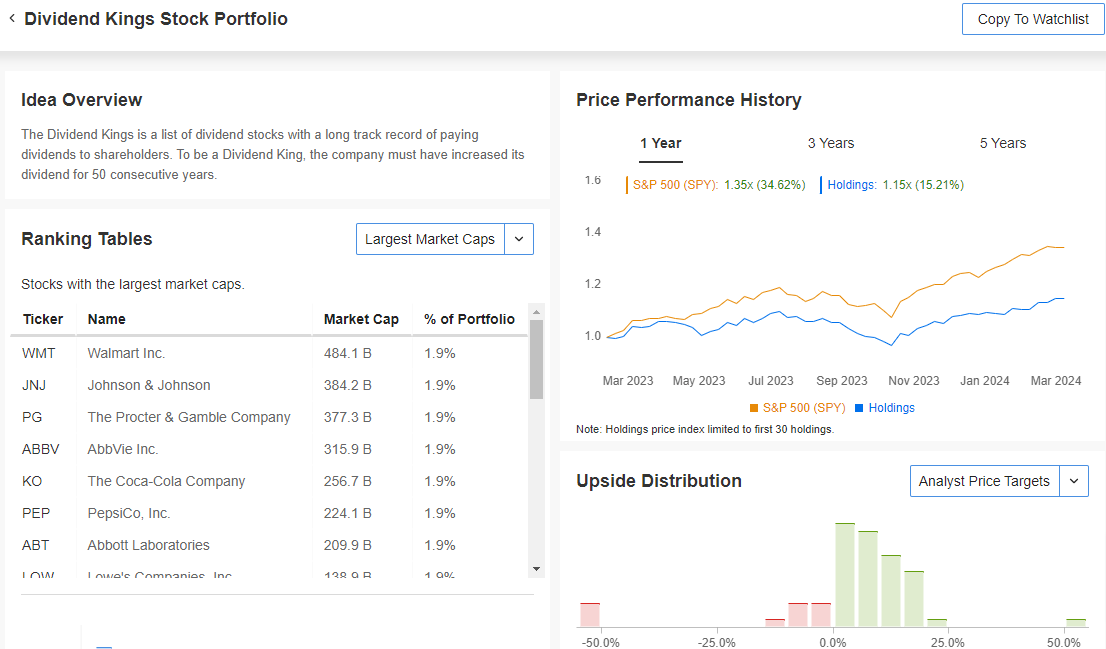

Amidst the allure of technology and renewable energy, dividend kings quietly anchor portfolios with their steadfast reliability, offering stability in uncertain markets.

Achieving dividend king status requires a rare feat: increasing dividends for over 50 consecutive years, a testament to financial resilience in today’s volatile economy.

In this piece, we will take a look at three stocks for not just stability but also potential for growth and income, making them essential components for long-term investors seeking resilience in their portfolios.

Invest like the big funds for less than $9 a month with our AI-powered ProPicks stock selection tool. Learn more here>>

In a world of fast-changing technology and shifts in renewable energies, dividend kings might not grab the spotlight, but their consistency makes them valuable assets for many investors. As the market faces uncertainty, investors seek stability, and dividend kings provide a reliable foundation.

Earning the title of a dividend king is no small achievement. Companies must increase dividends for at least 50 consecutive years, showcasing rare financial strength and continuity in today’s dynamic economic landscape. It’s this reliability that sets dividend kings apart.

While they may not shine like the tech stars on the Magnificent 7 or make headlines with AI breakthroughs, dividend kings excel in providing a dependable income stream, especially beneficial for retirees.

Being in a mature business phase, these companies not only maintain a stable and growing dividend but also outperform the market, making them attractive for long-term value investors who understand the power of compounding.

Despite market volatility affecting even dividend kings, those aiming for long-term growth and a steady income find them an excellent choice to diversify portfolios and achieve financial goals.

InvestingPro, Investing.com’s premium platform, offers a valuable resource for identifying dividend kings.

By filtering for dividend kings in the “Ideas” section, investors gain access to a comprehensive list of companies with a remarkable dividend history:

Dividend Kings – InvestingPro

Dividend Kings – InvestingPro

Source: InvestingPro

So, What are you waiting for? Get InvestingPro now at a discounted price today!

You’ll not only gain access to portfolios of well-known investors and a professional screener but also to our 6 AI-driven strategies that have consistently outperformed the S&P 500 over the last 10 years.

Click here to get started!

Here are three dividend kings that have proven to be robust investments and can offer investors significant overall returns.

1. AbbVie: Dividend King With Bullish Potential

AbbVie (NYSE:ABBV) shines as a beacon of stability. As a dividend king, the company has not only demonstrated impressive growth but also successfully addressed investor concerns about the patent protection of its key drug, Humira.

In the past five years, AbbVie’s stock has experienced a spectacular 180% increase. Much of this growth was recorded in the first three years. Since then, the stock has largely moved within a trading range, prompting some investors to express concerns about the company’s future.

AbbVie Returns

AbbVie Returns

Source: InvestingPro

The main source of these concerns was the expiration of the patent protection for Humira. However, the company’s recent financial reports have shown that these fears may have been somewhat exaggerated.

Despite losing patent protection for certain indications, AbbVie maintains a strong market position. The company has successfully relied on the introduction of replacement products like Rinvoq and Skyrizi, whose revenues steadily grew and now constitute more than a quarter of the total revenue.

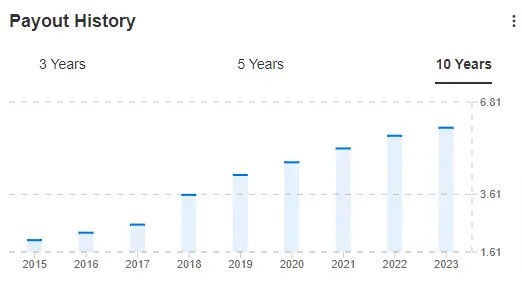

Analysts have praised AbbVie’s stock considering these developments, and investors are now increasingly focusing on the attractive dividend yield of 3.47% that the company offers. With an annual payout of $6.20 per share, AbbVie is not only a reliable investment for long-term investors but also an attractive target for dividend hunters.

Dividend History

Dividend History

Source: InvestingPro

The financial stability of AbbVie underscores its attractiveness as a long-term investment. According to InvestingPro’s quality score, which considers more than 100 individual indicators, the company scores 4 out of 5 possible points. This is also reflected in the moderate payout ratio of around 46% on a free cash flow basis, indicating that the company still has room for future dividend increases.

src=

src=

Source: InvestingPro

In a time of market uncertainty, AbbVie proves to be a rock in the storm. With a solid dividend policy, strong replacement products for Humira, and a robust financial position, the company offers investors not only stability but also significant potential for future growth.

2. P&G: A Stable Stock in Turbulent Times

Procter & Gamble (NYSE:PG) is also considered a solid anchor among investors in stormy waters. As a major player in the consumer goods sector, the company boasts an impressive portfolio of brands that continue to enjoy popularity in both good and bad times.

Last year, P&G once again demonstrated its pricing power and increased revenue and profit despite challenging conditions. This illustrates the company’s strength and its ability to thrive even in difficult market conditions.

With the expected improvement in the economic situation in the second half of 2024, P&G could enter a new phase where higher prices become the norm due to increased wages and potentially lower interest rates. This could provide the company with further opportunities to boost its margin.

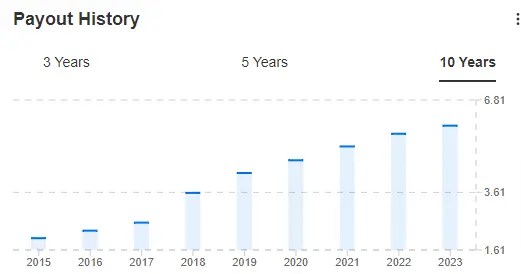

For long-term investors, P&G’s stock also offers an attractive dividend. The company has been paying dividends to its shareholders for an incredible 68 years, continuously increasing them.

Currently, the dividend yield is 2.35%, and with moderate payout ratios based on earnings per share and free cash flow (61.6% and 56.8%, respectively), there is still considerable potential for future increases.

Dividend History

Dividend History

Source: InvestingPro

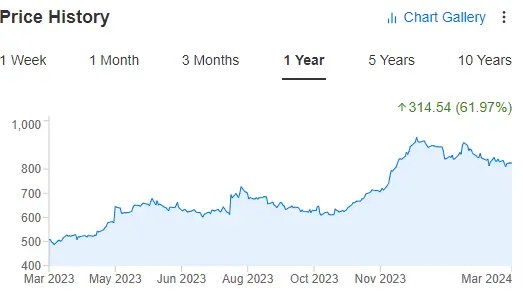

In the last five years, P&G’s stock has achieved a remarkable increase in value of over 77%.

Price History

Price History

Source: InvestingPro

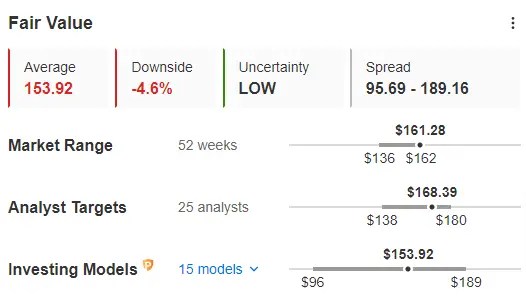

Analysts believe that this may not be the end of the road. According to estimates from 25 analysts captured on InvestingPro, the fair value of the stock is approximately $169, while it is currently trading at around $160.

Fair Value

Fair Value

Source: InvestingPro

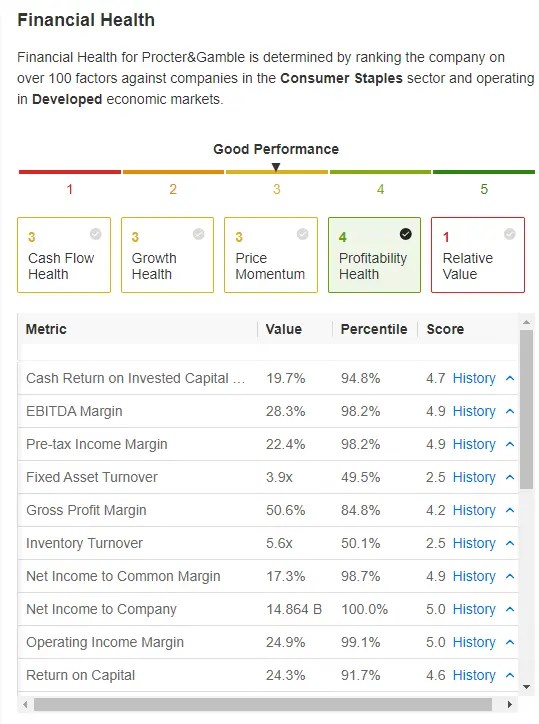

In terms of quality and financial position, the consumer goods giant also performs well. With a quality score of 3 out of 5 points on InvestingPro, P&G particularly does well in the profitability category, where the company receives 4 out of 5 points.

src=

src=

Source: InvestingPro

Overall, Procter & Gamble remains a reliable and attractive investment for investors, offering not only stability but also potential for growth and dividends.

3. Coca-Cola: A Stock for Dividend Lovers

When it comes to timeless investments, you can rely on the shortlist of Warren Buffett’s favorite stocks. And at the top of this list has long been the effervescent giant Coca-Cola Co (NYSE:KO). The Oracle of Omaha swears by the reliability that stems from the company’s impressive 63-year history of continuous dividend growth.

But what makes Coca-Cola so attractive to investors? A look at the company’s pricing power reveals a lot. Despite a long-term trend of declining soda consumption, Coca-Cola’s loyal customer base proves that it remains faithful to the brand even in times of high inflation. This factor protects the company’s margins and earnings, making future dividend increases almost inevitable, especially considering the still moderate payout ratios on an EPS and free cash flow basis.

In terms of financial position, Coca-Cola, like the other two dividend kings, performs solidly. With 3 out of 5 points, Coca-Cola proves to be stable and can easily navigate through economic turbulence.

src=

src=

Source: InvestingPro

But Coca-Cola is not resting on its laurels. The company has steadily diversified its product portfolio. While cola remains the heart of the company, Coca-Cola now also offers a wide range of teas, juices, and even energy drinks to expand its revenue streams and adapt to changing consumer trends.

In the last year, KO stock has gained 62%. While the dividend yield of 3.26% may not seem spectacular at first glance, for income-oriented investors, the stock provides a solid total return that effortlessly surpasses inflation.

Price History

Price History

Source: InvestingPro

For investors seeking long-term stability and consistent income, Coca-Cola undoubtedly remains a great choice.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it’s crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Subscribe Today!

Subscribe Today!

Enter the code “PROTRADER” when placing your order and secure an additional 10% discount on annual and two-year subscriptions of Pro and Pro+. Click here and don’t forget the discount code!

Disclaimer: Trading stocks and other financial instruments always involves a certain level of risk. Past performance is not a reliable indicator of future results. Investments in the stock market can lead to losses, and investors should be aware of the possibility of losing their invested capital. It is strongly recommended that investors conduct their own research and become familiar with specific risks before investing. This includes considering market risks, industry risks, company risks, as well as individual financial goals and risk tolerances. It is advised that investors, especially inexperienced ones, seek independent advice before making an investment decision. The use of tools and analyses provided by InvestingPro is for informational purposes only and should not be considered as investment advice. Any investment decision is solely the responsibility of the investor. Please note that trading stocks and other financial instruments involves significant risks and may not be suitable for all investors. It is recommended that investors only invest funds they can afford to lose.

Source: Investing.com