Friday, 13 November 2015 01:12

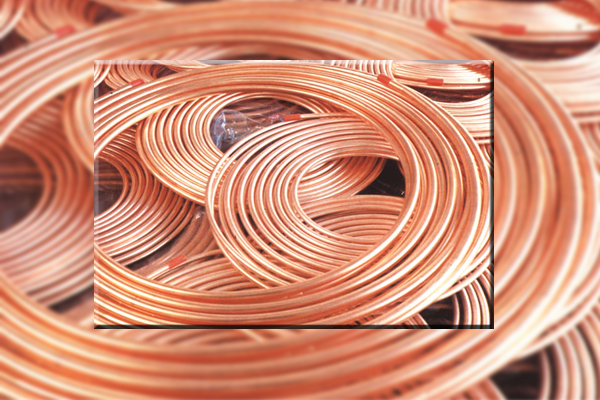

LONDON: Copper prices tumbled to their weakest in more than six years on Thursday, weighed down by a strong dollar, weak Chinese credit data and concern about oversupply after inventories rose.

LONDON: Copper prices tumbled to their weakest in more than six years on Thursday, weighed down by a strong dollar, weak Chinese credit data and concern about oversupply after inventories rose.

As copper fell for a fifth session in six, other metals on the London Metal Exchange also declined after heavy selling from Chinese funds and analysts said more losses are on the cards.

Metals were hurt by a rise in the dollar index after the head of the European Central Bank underscored the bank’s readiness to extend money printing.

A firmer dollar dampens demand for metals priced in the U.S. currency, making them more expensive for buyers outside of the United States.

Three-month copper on the London Metal Exchange lurched to a low of $ 4,800 a tonne, the weakest since July 2009, but recovered slightly to close down 2.4 percent at $ 4,823.50.

Copper is likely to extend losses in coming weeks to $ 4,397, the June 2009 low, said London-based Commerzbank technical analyst Axel Rudolph, who examines chart patterns to predict future moves.

“That’s a level that I think we could reach pretty quickly, in the next two or three weeks,” he said. “If you look at the decline in the last two weeks, from $ 5,200 to $ 4,800, we’re talking just less than another $ 200.”

The most-traded January copper contract on the Shanghai Futures Exchange slid to a low of 36,310 yuan, also the weakest since July 2009.

“Macro sentiment is the main overlay at the moment … that dollar strength and weaker Chinese data is hitting the market,” London-based Citi analyst David Wilson said.

Data showed that credit activity in China’s financial system dropped to its lowest level in 15 months in October, highlighting the challenges the country faces as it seeks investment to reinvigorate growth.

China is the largest metals consumer, accounting for nearly half of global copper demand.

The main feature of the market this week has been heavy selling by Chinese funds on the ShFE, Wilson added.

“We’ve seen some funds long on the LME having to close out those long positions on the back of those Chinese moves.”

Also pressuring copper was LME data showing that copper inventories climbed by 4,750 tonnes, highlighting worries about surplus metal.

LME aluminium ended down 1.7 percent at $ 1,492 a tonne, zinc fell 0.5 percent to finish at $ 1,615 and lead declined 0.2 percent to $ 1,617.

Tin closed 1.4 percent lower at $ 14,620 and nickel slid 2.7 percent to end at a 2-1/2 month low of $ 9,410.