Friday, 13 November 2015 18:49

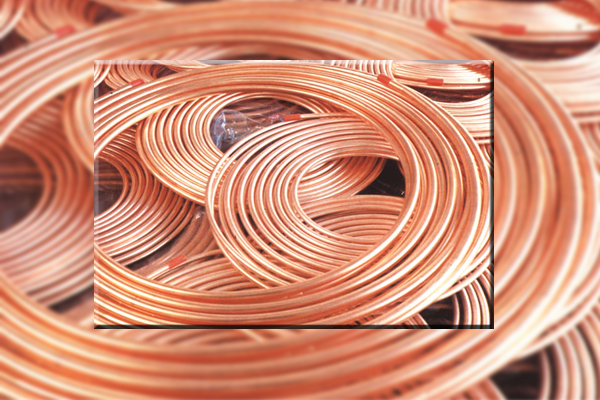

LONDON: Copper prices slid to a six-year low on Friday as worries about economic and demand growth in top consumer China escalated and abundant supplies reinforced expectations of surpluses. Benchmark copper on the London Metal Exchange earlier hit $ 4,787.50 a tonne.

LONDON: Copper prices slid to a six-year low on Friday as worries about economic and demand growth in top consumer China escalated and abundant supplies reinforced expectations of surpluses. Benchmark copper on the London Metal Exchange earlier hit $ 4,787.50 a tonne.

The metal used in power and construction traded down 0.3 percent at $ 4,810 in official rings.

It is down nearly four percent so far this week and heading for its largest loss since September.

Data this week showed China’s industrial output was at a seven-month low in October and investment expanded at its weakest pace since 2000.

“We’re seeing short-selling largely on the back of negative news flow out of China, where the economy is still not showing signs of stabilising,” Societe Generale analyst Robin Bhar said. “We’ve not had enough production cutbacks to rebalance the market, so a further fall in the price should act as a necessary incentive in an oversupplied market to force more output cuts.”

Some producers have cut output and others are planning to cut, but analysts say more will be needed before participants start to believe that a more balanced market is in sight.

The consensus for the copper market surplus this year is 349,000 tonnes and 177,000 tonnes for 2016, recent Reuters survey showed. “We could see even lower levels if momentum picks up again, maybe $ 4,710 (July 2009 low)” one trader said.

“The catalyst could come from the dollar later today.” A higher US currency makes dollar-denominated commodities more expensive for holders of other currencies.

The dollar could rise if US data later on Friday bolsters expectations that the Federal Reserve will raise interest rates in December.

Three-month aluminium was down 0.2 percent at $ 1,489.

Zinc, holding near six-year lows, was down 0.5 percent at $ 1,607 a tonne. Bearish sentiment can be seen in an LME report showing funds holding the largest short position since the exchange started compiling the report.

“We estimate global discretionary zinc concentrate and metal inventories at over 3 million tonnes, or about 80 days of consumption,” Citi said in a note.

“This is a worryingly high level, which the market would need to work through to cause tightness in the refined zinc market.”

Lead lost 0.7 percent to $ 1,605 a tonne, tin gained 0.6 percent to $ 14,700 and nickel was steady at $ 9,410.