Monday, 16 November 2015 18:11

LONDON: Copper prices fell to six-year lows on Monday in a sell-off triggered by the attacks in Paris, a stronger dollar and poor demand prospects in top consumer China.

LONDON: Copper prices fell to six-year lows on Monday in a sell-off triggered by the attacks in Paris, a stronger dollar and poor demand prospects in top consumer China.

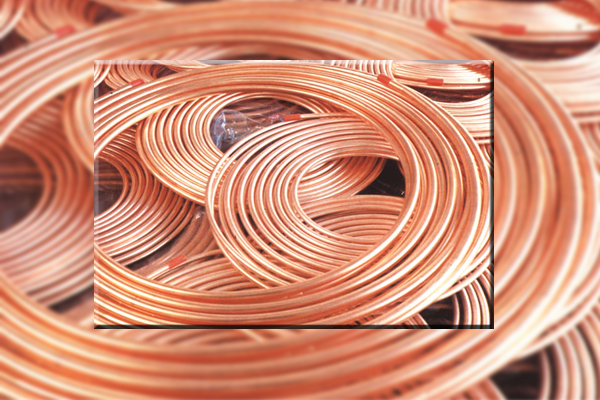

Benchmark copper on the London Metal Exchange hit $ 4,747.50 a tonne earlier, although by 1029 GMT the metal used in power and construction was down 1.3 percent at $ 4,762.

Risky assets, such as commodities and equities, came under pressure as investors turned to safer assets, such as the dollar, after suspected Islamist militants launched coordinated attacks across Paris.

“We’re struggling to see light at the end of the tunnel, things aren’t getting any better in China, we can’t see what is going to turn thing around for industrial metals,” said Asa Bridle, analyst at Cantor Fitzgerald.

A higher US currency makes dollar-denominated commodities more expensive for non-US firms.

Slowing demand growth in China has been a major reason for copper’s losses of about 25 percent since the 2015 peak at $ 6,481 a tonne in May.

The latest signs of weaker Chinese demand come from Chile’s Codelco, the world’s top copper producer, which has slashed its 2016 premium to China for refined metal by more than a quarter to a three-year low of $ 98 a tonne.

Lower prices have persuaded some major mining firms such as Freeport McMoRan and Glencore to cut output.

But the cuts are sufficient, some analysts say.

“Ongoing price weakness, in spite of price-related output cuts, is consistent with our view that producers do not move markets into deficit by cutting supply … rather they move markets closer to balance (than they otherwise would be),” Goldman Sachs said in a note.

“A demand recovery along with further supply discipline is required to see markets such as copper move into deficit.”

A recent Reuters survey showed analysts expect the global copper market to see a surplus of 349,000 tonnes this year and 177,000 tonnes in 2016.

The global aluminium market is also forecast to see a surplus of 815,000 tonnes this year and 719,000 tonnes in 2016. The problem is oversupply, particularly from top producer China.

Three-month aluminium fell to $ 1,466.50 a tonne, its lowest since Oct 29. The metal used in transport and packaging was last down 1.3 percent at $ 1,471 a tonne.

Zinc was down 1.2 percent at $ 1,603, lead slid 1 percent to $ 1,594, tin lost 0.4 percent to $ 14,655 and nickel rose 0.2 percent to $ 9,445 a tonne.