November 25, 2015 Updated 11/25/2015

Email Print

Bill Wood

“You have to keep your head on swivel.” Whether you played a full-contact sport like football or hockey or an intricate team sport like basketball or soccer, you probably heard that piece of advice many times as a youth (typically, your coach screamed it immediately after you made a painful mistake).

To be successful in fast-paced, competitive sports, you have to know the exact location of the ball (puck), your teammates and your opponents at all times. Lose track, and the results can be embarrassing, painful or both.

Running a company is usually not a full-contact activity, but it’s definitely fast-paced and competitive. At all times you must have intimate knowledge of the team, your products, your processes, the owners/board of directors, your competitors and your customers. And in case that’s not enough, your business can suffer setbacks caused by unexpected changes in the economy (either local or global), regulations, politicians and even the weather.

Your head is on a swivel all right, and most of the time it’s spinning.

That’s why I was excited to analyze the results of the recent survey conducted by Plastics News Research of the owners/CEOs/presidents of companies in the North American plastics industry. Based on what I have observed over the years, it is clear to me that many of these leaders not only survive in these challenging conditions, they thrive. So if they take the time to complete and submit a survey about the state of their respective businesses, then they have my full attention.

They did not disappoint.

Let me start by saying that those who participated in this year’s survey are seasoned campaigners. The average amount of time our respondents have been in the plastics industry is 29 years, and they have been running their companies for more than 13 years on average. They are survivors, and they are innovators. They do not just manage, they lead. And many of them have strong opinions about what it takes to succeed.

This is a conversation I am always eager to have, but it is especially timely as we head into a new year. So as we all make plans for 2016, here are a few things that I take away from the survey results:

• A strong majority of the owners/CEOs/presidents of plastics companies are optimistic about the U.S. economy and the prospects for the North American plastics industry in the coming year. Just about two-thirds of the respondents have a very favorable or somewhat favorable outlook about the prevailing business conditions and prospects for our industry while less than 10 percent have any kind of unfavorable opinion about the immediate future of the economy and the industry.

• This optimistic outlook is accompanied by confidence in their business prospects. About two-thirds of the respondents expect their revenues to increase in the coming year, and over half expect to be more profitable. The strong correlation between the responses to the questions about the domestic economy and the plastics industry are a good indication that these industry leaders understand the drivers of the demand for plastics products.

• These are also the conditions that drive investment in new equipment and new employees, and over 60 percent of the respondents intend to pursue either a very aggressive or a moderately aggressive growth strategy in the next twelve months.

But if this growth strategy is going to extend well into the future, then it has to come from organic market growth and not just because of mergers and acquisitions in the industry. The North American plastics industry has to innovate and it has to become even more productive. These are the ingredients for long-term growth.

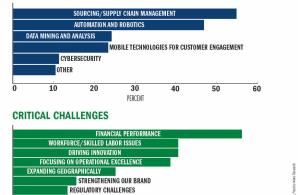

• This is why the two-thirds majority believe that investing in operational improvements delivers the biggest financial returns for their companies. But while most of these leaders know that investment in the future is crucial to the success of their businesses, it is never easy to identify the best investment. More than 60 percent of respondents identify the rapid pace of technological innovation as a major challenge for the plastics industry.

• While the outlook for the United States is mostly favorable, the expectations for the global economy are less optimistic. Two-thirds of the respondents are either neutral or unsure about the global economy and the remaining one-third is pretty evenly split between favorable and unfavorable.

The plastics industry is somewhat less susceptible to negative business conditions caused by a slower global economy and a stronger dollar than are some of the other segments of the U.S. manufacturing sector. This is one of the primary reasons why the plastics industry has grown at a faster rate than the overall manufacturing sector during the past few years.

• Finally, the main theme that I take away from this survey of successful plastics industry owners, CEOs and presidents is that they have to be masters of both internal processes and external forces in order to compete. Like the head coach or manager of a winning sports team, they have to train, equip and inspire their teams. They have to drive innovation and hone the skills of their employees. This describes some of the internal processes, and they are ongoing.

Mastery of the internal is crucial, but it is not enough. Business leaders also have to understand the needs of their customers and the strategies of their competitors. They have to market their products once they get them produced, and they have to procure a price that ensures a profit. These are a few of the never-ending external pressures that were referenced in the survey.

And there is one more thing that I learned from this survey. The leaders of the plastics industry need constant communication, both internally and externally. That is what they said. They need news, data and statistics about business and technology. They need eyes in the sky, advanced scouting and any kind of information that has predictive power. This survey is good effort in that direction. With some more honing and innovating it will get even better.