HONG KONG—Ministers from the world’s top three rubber producers could set up a new trading platform for the commodity by the end of the first quarter of 2016, as they try to turn around five years of falling prices.

But analysts and traders remain skeptical that any new method for trading natural rubber will gain the support of major buyers in a market valued at around $25 billion a year.

Representatives from Indonesia, Malaysia and Thailand—which together produce around 70% of the world’s rubber—said after a meeting of the International Tripartite Rubber Council late Thursday they would look to establish the new platform to help provide “better price discovery and effective hedging functions” for rubber market participants.

Details of the new trading system remain sketchy but the broad aim is to set up an open forum through which producers can sell their output, which in turn could provide greater transparency over prices.

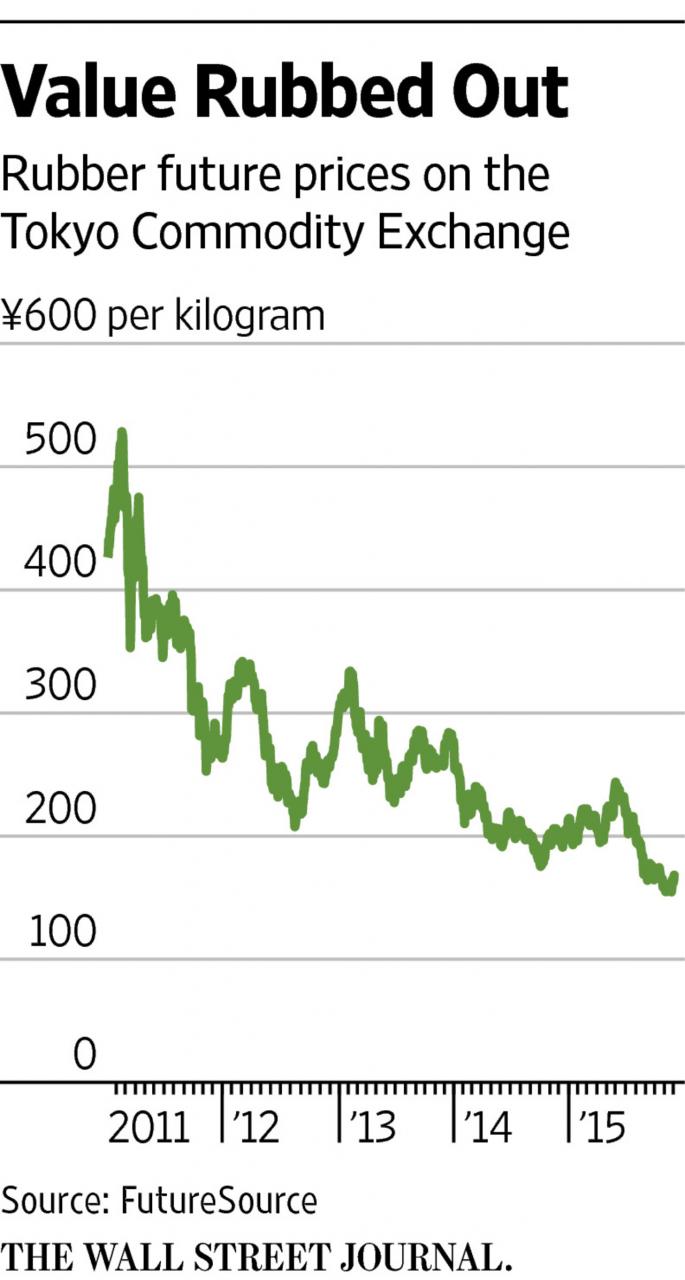

Rubber producers from the three nations—mostly smallholders farming a few acres of rubber trees—are under heavy financial strain following rubber’s 60% fall since the start of 2011.

They say weak prices are partly down to the current method of pricing most rubber sales.

A higher proportion of natural rubber is sold through bilateral agreements than in many other commodity markets. Spot and futures markets such as Tokyo and Singapore are often used as a reference point for such contracts.

Because those markets are relatively illiquid they can, producers argue, be easily manipulated by big buyers of rubber and speculators who use their financial clout to drive down prices. Small producers, by contrast, don’t have the financial resources to step in and prop up the market.

“There is a suspicion that prices are manipulated by traders because they form the bulk of the liquidity,” said Xavier Veillard, Asia Pacific director at Accenture Trading, Investment and Optimization Strategy.

The idea of a new method for connecting buyers and sellers of natural rubber was first mooted in 2011. At the ITRC meeting Thursday, ministers said the regional market would be established by June 2016 but that they would like the process to be expedited “if possible” so the exchange could be up and running within 3 months.

“The futures markets are just too volatile,” said Salmiah Ahmad, head of the International Rubber Consortium, following her appointment as chief executive in October. The consortium was set up by the ITRC to develop the new platform.

Natural rubber is produced by tapping into rubber trees and collecting and processing the liquid, known as latex, which drips out. It is primarily used in the manufacture of tires but is also in latex gloves and condoms.

Rubber can be a thorny political issue in Southeast Asian producing nations, where parties often rely on the rural vote to remain in power. In 2013, low rubber prices led Thai farmers to stage protests to demand government action.

However, the new platform is unlikely to prove a panacea for falling rubber prices, analysts say. Supplies of natural rubber remain plentiful, demand from China has waned and crude oil prices—the main feedstock for synthetic rubber—is below $50 a barrel.

Six month benchmark futures for ribbed smoked sheets traded in Tokyo have sunk 29% to ¥171.6 ($1.40) a kilogram since the start of summer, while three-month technically-specified rubber on the Singapore Exchange is down 29% to $117.20 a kilogram.

Meanwhile rubber traders and buyers fear any market structure set up by producing nations will be inherently unfair.

“I think a mechanism like this is biased in favor of the producer and I think the end user will be reluctant to buy based on this,” said Casey Oh, head of global trading at R1 International, a Singapore-based rubber trading company.

For any new platform to become an efficient pricing mechanism it must offer a contract that reflects cash market realities, have sound infrastructure and be attractive to those in the market, according to Craig Pirrong, a finance professor at the University of Houston.

“The process of becoming a benchmark is an organic, dynamic one,” said Mr. Pirrong.