December 8, 2015 Updated 12/8/2015

Email Print

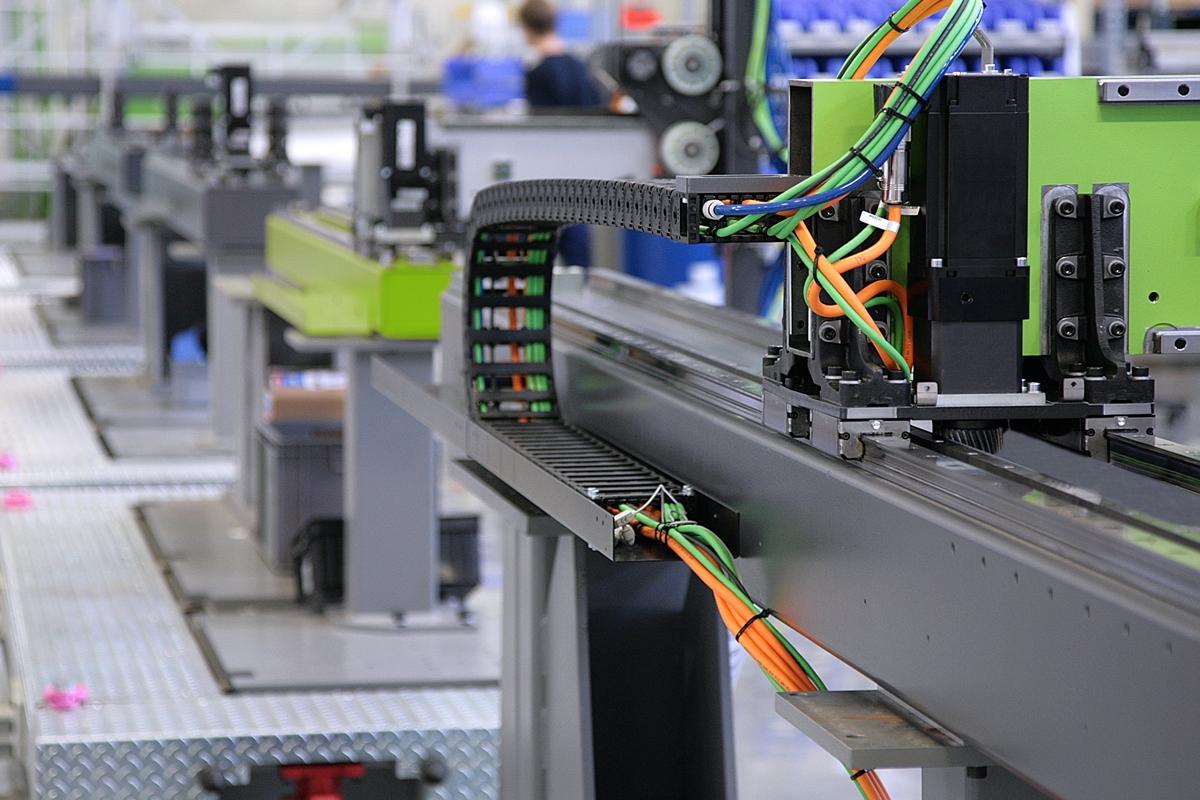

Engel Holding GmbH Assembly of injection molding machines at Engel Holding GmbH’s facility in Schwertberg, Austria.

The U.S. injection press market should top the landmark 4,000 unit level in 2015, say officials of press suppliers.

Some big reasons: greenfield plants, many for the robust automotive sector. Also, an ongoing move by processors to regularly trade out older machines for new ones.

So what now? Most machinery executives said the growth rate has slowed to a more moderate 5 to 10 percent this year, making 2015 the second year of conventional improvement after the big-growth rebound years post Great Recession.

Even if 2016 is flat or up a few percentage points, the U.S. press market is strong.

“We’ve been on a pretty good roll. I think we’ve just hit a plateau at a pretty good level,” said plastics economist Bill Wood, who runs Mountaintop Economics & Research Inc. in Greenfield, Mass., and also is Plastics News’ economics editor.

Machinery executives contacted for this story said a “normal” year moving forward could be 3,500 units. But for 2016, 4,000 seems sustainable, they said.

Automotive is a big reason — the industry’s solid U.S. sales of 16 million to 18 million vehicles in recent years has powered the broad injection molding machinery business.

The appliance market has growth, too, thanks to reshoring.

David Bernardi of Ube Machinery Inc. said newly built plants are gobbling up new injection molding machines, as well as auxiliary and material handling equipment.

“This year we’re seeing a lot of that, in automotive and contract molding and housewares. People are building buildings and filling them up again,” he said. “They’re in expansion mode. They’ve got confidence in bricks and mortar.”

Many of the new car factories, and suppliers of their plastic parts, have set up shop in the Southeastern United States and Mexico.

As 2015 winds down, Bernardi, senior sales and marketing manager at Ube in Ann Arbor, Mich., said the machinery business is shrugging off what he called “depressing” headlines, of the terrorist attack in Paris and China’s economic slowdown. “There’s not a lot of great joyous news out there. But despite that, business keeps plodding forward and planning for the future,” he said.

Nearly every injection press executive interviewed for this story said automotive is the powerhouse for investment in not just machines, but complete systems for molding specific high-volume parts for vehicles.

More room for turnkey systems was one reason Arburg GmbH + Co. KG built its new 27,000-square-foot U.S. headquarters building in Rocky Hill, Conn., this year. The United States is the largest export market for the injection press manufacturer based in Lossburg, Germany. This year marked the 25th anniversary of Arburg’s direct U.S. sales, through Arburg Inc.

Friedrich Kanz, president of the U.S. operation, said the company is strong here in automotive, medical and electronics. Arburg also is getting stronger in the packaging market, he said.

Of the potential for 4,000 presses this year, Kanz said: “It’s another step forward after a strong year of 2014. So this is all good. And I think the mood in the market is still positive.” He thinks 2016 should be at a similar level.

The new normal?

What will be considered an average year now? Kanz is one of many machinery people who put it at 3,500. “As long as we achieve around 3,500 machines, it’s a healthy market in the United States,” he said.

As for automotive, at 18 million units this year, even a flat 2016 would still look very good, machinery officials said. Regardless of the number of cars and light trucks sold, processors are buying new technology like multi-component molding, coinjection, and all-electric and hybrid machines. Robot sales remain brisk: Yushin America Inc. and Wittmann Battenfeld Inc. are both making major additions to assemble more robots.

KraussMaffei Corp. President Paul Caprio said a more moderate pace of growth now is welcome. “It really was overheated in 2014,” he said.

KM, in Florence, Ky., is having a record year — as is its German parent, Caprio said. He cited automotive, packaging and large containers as strong markets. Reshoring is “a very positive trend,” he said. “We’re definitely very optimistic.”

Husky Injection Molding Systems Ltd. of Bolton, Ontario, now focuses on injection molding presses for the packaging and medical sector. That business “remains very healthy,” said Ron Burnside, vice president, Americas for beverage packaging.

Husky also gives customers overall value, he said, through global support, an integrated service organization and value-added programs like factory planning, systems integration and process optimization, said Henry Zhang, director of business development for medical and specialty packaging.

Bill Duff, national sales manager of Negri Bossi USA Inc. in New Castle, Del., thinks strong machinery sales could last for a few years. Greenfield plants, capacity expansions and replacement machines all are holding up. Like Caprio, Duff can appreciate a modest rate of growth.

“We’re not lighting the world on fire, but certainly it’s at a good pace for healthy growth,” he said.

Duff said that, of course, Negri Bossi is selling presses for automotive molding. But he pointed to one new trend this year: proprietary molders, who mold parts for in-house use, are replacing their older machines.

“It looks like we’re going to see a banner year for machinery sales across the board for North America,” he said.

Niigata’s unit sales in North America increased more than 20 percent, according to Peter Gardner, vice president of sales and general manager of Niigata at DJK Global Group in Wood Dale, Ill. That growth is coming from larger-tonnage machines such as the all-electric with 600 tons of clamping force, announced at NPE, which filled a gap between the company’s 500 ton, 720-ton and 950 ton all-electric offerings. Those machines are in “very high demand, particularly by Japanese automotive molders,” he said.

One automotive area that is hot is the headlight market, which requires thick-walled lenses, usually of polycarbonate, for LED lights, Gardner said.

Gardner said he thinks sales in the 4,000-unit range is sustainable, at least until the next economic downturn.

So does Sonny Morneault, national sales manager of Torrington, Conn.-based Wittmann Battenfeld Inc. He attended the Fakuma 2015 trade fair in Friedrichshafen, Germany, this fall. Not too many Americans visit Fakuma, right? Well, at the German show, Wittmann Battenfeld’s U.S. officials were talking about new investment there — by European molders.

“The U.S. economy’s going great. Just in our time here [at Fakuma], we’ve met with four customers that are building brand new plants in the States, all to support the automotive industry,” Morneault said in an interview at the show.

Wittmann Battenfeld offers one-stop shopping, since the company makes injection presses, robots and a range of auxiliary equipment. On big greenfield plants, Morneault said, the company can start quoting just the molding machines, then end up quoting the entire project, and act as the “general contractor” for all plastics processing equipment.

Medical, packaging and appliances also represent solid markets, he said.

And Morneault said 2015 looks like it will be a record year for both injection presses and robots Wittmann Battenfeld makes in Connecticut. The backlog is strong going into 2016, and quoting activity is up, he said.

Bob Columbus said JSW Machinery Inc. has had a “very good” year. Automotive accounted for about half of the sales at the company in Lake Zurich, Ill.

And Columbus said the overall injection press industry “had three strong years” but said next year might level off. “We think that it’s still going to be good,” he said. “We’re looking to be aggressive in the marketplace and looking at gaining market share. We’re hiring more sales people, and we think for good reason.”

Mark Sankovich, president of Engel Machinery Inc. in York, Pa., said it makes sense for capital equipment to even out after the steep growth to rebuild after an economic recession. Another reason: the requirement for large-tonnage presses has been largely satisfied. So the overall industry is coming out of 2015 as an OK year for unit growth, but dollar volume is going to be flat, he said.

Large-tonnage press sales may slow

Even so, as molders win new large-part business in automotive and other markets, they will still need new big machines, he said. And Sankovich said about 70 percent of injection press sales is going into new production capacity, with the rest as replacement machines.

Engel, “is having a very good year,” he said. “Growth year-over-year has been right to plan. And we had a very aggressive plan, so we’re very happy with this year, and we’re projecting growth for next year.” Medical and packaging have remained strong.

Russ LaBelle, president of Wilmington Machinery Inc., said international customers account for about half of the company’s business of machinery designed to make plastic pallets, collapsible boxes and other big products. Entrepreneurial startups tend to buy the company’s equipment, but that segment was not expanding that much in 2015, he said.

LaBelle is fairly optimistic about 2016 for his company in Wilmington, N.C. “Do I think it will be a banner year? No, but I think we’ll do better than we did this year,” he said.

Reshoring “will continue to add a little wind at our sails,” said Shawn Reilley, Milacron Holdings Corp.’s vice president and general manager of injection presses. “Reshoring is real, and it’s happening with many of our customers, both in the U.S. and in Mexico,” he said.

With what Reilley said is an average age of injection press of about 15 years in the United States, the machinery sector has a good story to tell about how new machines take cost and energy consumption out of molding.

For Milacron, 2015 marked a huge business news year, Milacron made an initial public offering in the New York Stock Exchange, got a big tax credit from Ohio, moved its headquarters to the Cincinnati suburb of Blue Ash, Ohio, and bought screw and barrel firm Canterbury Engineering and Genca, the maker of crosshead dies, beefing up the company’s extrusion component and tooling areas.

John Martich said Sumitomo (SHI) Demag Plastics Machinery is targeting automotive and packaging in North America. He is vice president and chief operating officer of the company’s U.S. operations, with facilities in Strongsville, Ohio, and Norcross, Ga.

Martich said even if U.S. car and light truck sales do level off next year, automotive will continue adding more plastics to reduce weight, and that means investing in new molding technology and part design that integrates parts, molds in two colors or components and invests in higher-level family molds.

Reshoring in unexpected markets

Engel Holding GmbH Auxiliary equipment production by Engel.

And reshoring can even come in packaging, normally seen as import-resistant. Martich said one customer, a packaging distributor, was manufacturing overseas, but wanted to bring the work back to the United States. Sumitomo Demag’s message to customers is their machines are not general purpose, but can be designed for their job.

“We’re selling technology to a customer that has a specific purpose and a target,” Martich said.

He said Sumitomo Demag’s business jumped 60 percent this year in North America. The company has hired 15 people in 2014 and another five or six this year — and still has some openings.

“We’re seeing a lot of investment by Chinese businesses opening U.S. facilities,” said Glenn Frohring, president of Absolute Haitian Corp. in Worcester, Mass., which sells Chinese–made Haitian machines. Those transplants have experience with Haitian presses, so that’s what they buy, he said.

U.S. business and jobs coming from China! The global economy is real.

Frohring said molders are replacing aging machines, which are less energy efficient. It can also be tough to find parts for older machines.

HPM North America Corp. — which sells presses from China by parent Guangdong Yizumi Precision Machinery Co. Ltd. — is back in the game with large-tonnage HPMs. At NPE 2015, the company in Marion, Ohio, launched a new large tonnage, two-platen HSII line of machines. The hydromechanical presses run from 900 tons to 3,500 tons.

John Beary, general manager of sales and marketing at HPM North America, said HPM “still has a pretty significant footprint in automotive, with legacy machines.” That helps when pitching the HSII line.

HPM North America has sold some machines to the appliance sector. Also to custom molders, as Beary said, “These folks seem to be back and they seem to be back with a pretty good appetite for new machines.”

And Beary revealed that HPM and Yizumi are “taking a hard look” at packaging machines for the North American market. Yizumi has done well in Asia with its high-speed machines, he said.

New vs. replacement

Plastics News each year asks injection machinery executives about the mix of investment on presses for new capacity vs. replacing old machines. This year it was evenly mixed, but tilted toward new capacity.

“I think that new production capacity will definitely go over replacement of old machines from now on,” said Hitoshi “Jin” Yoda, president of Nissei America Inc. “The main reason is automotive. The key industry keeps growing even more and it will always require new production capacity. I expect about 70 percent of the shipments will be for new production.”

Nissei America also saw gains in medical molding and in residential/architectural, especially irrigation, Yoda said.

Maruka USA in Pine Brook, N.J., sells Toyo presses. “This year has been the best since the 2008-09 crash. We were able to make our target numbers,” said Dale Bartholomew, Maruka product manager. “Business is great right now if you’re an injection molding machine supplier,” he said.

Bartholomew said processors used to keep running machines that were 15-20 years old. He said now that the technology advances so fast that doesn’t make as much sense. “It’s just like a computer — if you’re computer’s two or three years old, it’s obsolete.”

For the record, he was making a rhetorical point, not suggesting a few-year lifespan of an injection molding machine. … But hey, if anyone wants to replace their presses every three years, there are plenty of sales men and women eager to oblige!

Tom Geddes, national sales manager of MHI Injection Molding Machinery Inc., which sells Mitsubishi presses in Bensenville, Ill., thinks that new production capacity accounts for around 60 percent of total sales. “Most of our growth is still in automotive,” he said.

“I’m still getting calls and quoting on companies opening new facilities, so it’s still a growing market. I’m in the middle of quoting two or three new greenfield plants right now,” Geddes said, in both the United States and Mexico.

Dane Bales is sales engineer at Cincinnati Process Technologies in Cincinnati, which sells Asian Plastic Machinery Co. Ltd. injection presses and does controls and other retrofits on existing machines. The new press business “has been fairly consistent for us the last few years,” he said.

Len Hampton, U.S. national sales manager for Sodick Plustech Co. Ltd., echoed some other machinery leaders by saying that smaller custom molders are investing in new equipment. For Sodick, a lot of action has been in medical as well.

“People are confident to invest money in the business,” Hampton said. Sodick’s U.S. unit is based in Schaumburg, Ill.

Marko Korneef, president of small-press specialist Boy Machines Inc. in Exton, Pa., said business in 2015 has been “a little sluggish.” Some economic uncertainty in the second half of the year has caused some delays, although plastics companies are ready to spend their capital investment budgets as the year closes out, he said.

“We’ve always been strong in startup companies, and this year, new startup has dropped by 50 percent,” Korneef said.

Are plastic injection molding companies delaying some investment, cautious of world and national events? Several injection press executives said they are seeing that, as 2015 comes to a close.

Bartholomew, of Maruka Toyo, said the U.S. presidential election, a weakening economy in China, the strong dollar and prospects of rising interest rates, are some of the factors. “What we’re seeing is customers waiting until the last minute. Everyone is getting cautious about spending their funds,” he said.

Bales said capital spending seemed to slow in the summer, but has picked up again.

Absolute Haitian’s Frohring said one difference is that, in 2014, it seemed like anytime a press went down at a molding factory, it was a severe blow as people were running at close to full capacity. Now not so much.

“There’s reason to be nervous about some things,” Frohring said.

Economist Bill Wood said rising employment and income levels, cheap energy prices and low interest rates are all positive signs for the economy in 2016.

And Kanz, of Arburg, said whoever becomes the next U.S. president doesn’t matter that much … well, maybe not Donald Trump. Who does he think has the most impact on the economy? Federal Reserve Chair Janet Yellen.