December 11, 2015 Updated 12/11/2015

Email Print

Dow’s chief executive Andrew Liveris speaking at the company’s annual meeting this year

Can Dow Chemical’s diamond logo fit inside the oval logo of DuPont Co.? The plastics market soon will find out.

Midland, Mich.-based Dow and DuPont of Wilmington, Del., two global chemical companies with major plastics businesses, announced on Dec. 11 that they will be combining in a merger of equals. A combined DowDuPont — as the firm will be known — will have annual sales of around $ 83 billion, with a little more than $ 54 billion coming from Dow and just over $ 28 billion from DuPont.

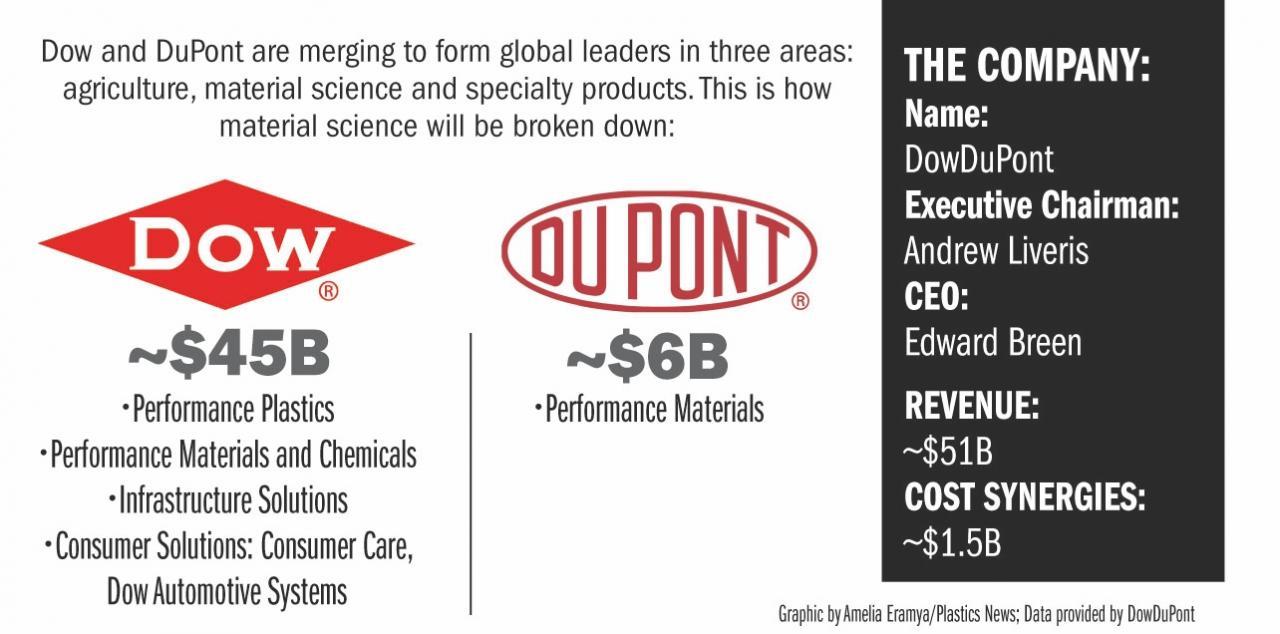

Dow President, Chairman and CEO Andrew Liveris will serve as executive chairman of the new firm. DuPont CEO and Chairman Edward Breen — who joined the firm’s board earlier this year and became CEO in October — will be CEO of DowDuPont.

“This will create tremendous value for our shareholders and employees,” Liveris said on a Dec. 11 conference call. “It’s a tectonic shift in an industry that’s been evolving for many years.”

“When I look at Dow and DuPont, I see businesses that fit together like hand and glove,” Breen added on the call. “This is the strongest possible foundation for where the industry and markets are heading.”

DowDuPont then in the next 18-24 months will be split into three separate public companies in order to better capitalize on growth opportunities. Plastics units will be contained in a material science company that by far will be the largest of the three with annual sales of $ 51 billion.

Liveris will lead the material science firm in addition to his role of executive chairman. He said that about 70 percent of the materials company’s sales will come from three key end markets — packaging, transportation and construction.

The material science firm will improve the combined firm’s cost position by leveraging Dow’s platform in low cost feedstocks, officials said. It also will enhance opportunities to cross-sell in a number of key markets, including packaging, transportation and infrastructure solutions.

An agricultural company will have annual sales of $ 19 billion and a specialty products company will have annual sales of $ 13 billion. Dow shareholders will receive one share in DuPontDow for each Dow share they own. DuPont shareholders will get 1.282 shares in the new firm for each DuPont share.

The combination is expected to create annual cost savings of $ 3 billion. The combined firm also will continue to maintain headquarters in both Midland and Wilmington.

Both companies have been under pressure from activist investors who have argued that the companies’ stocks were underperforming.

“Only time will tell whether merging two companies that have individually been pursued by activist investors will discourage further demands from impatient investors — or simply give them one bigger company to chase,” said Phil Karig, an industry veteran who’s with the Mathelin Bay Associates LLC consulting firm in St. Louis.

DuPont Co. Breen

Changes at DuPont

DuPont had been dealing with the fallout of a lengthy proxy war with activist investor Trian Fund Management LP and its founder Nelson Peltz. DuPont won that fight in May — retaining control of its board — but it still played a role in the Oct. 16 resignation of CEO Ellen Kullman.

DuPont has struggled with lower growth and reduced profitability in recent years. When it announced Kullman’s resignation, the firm also lowered earnings expectations for 2015 to $ 2.75 per share, down from prior guidance of $ 3.10. It blamed the strengthening of the U.S. dollar vs. currencies in emerging markets, particularly the Brazilian real.

Earlier this year, DuPont attempted to improve its results by spinning off its struggling titanium dioxide unit — as well as Teflon-brand fluoropolymers — into a separate public company, Chemours.

On Nov. 2, the company announced another major change that involved plastics: a plan to consolidate two of its plastics-related units into a single business. As of Jan. 1, DuPont’s Performance Polymers unit will merge with Packaging & Industrial Polymers. DuPont also is merging its Protection and Building Innovations units.

“By bringing these business units together under common management structures, we are creating business of more significant scale to better serve our customers,” Breen said at the time.

DuPont Performance Polymers includes nylon, acetal and polybutylene terephthalate resins, as well as thermoplastic elastomers and biopolymers. Packaging & Industrial Polymers includes polymer modifiers and additives and specialty resins used in adhesives, barriers, sealants and peelable lidding; as well as the DuPont Teijin Films business.

DuPont Teijin is North America’s fifth-largest film and sheet business, according to a recent Plastics News ranking, with estimated sales of almost $ 1.4 billion in 2014.

In the first nine months of 2015, DuPont’s sales fell 12 percent to $ 19.8 billion, with operating profit down 13 percent to $ 3.7 billion. Performance Materials sales fell 13 percent to just over $ 4 billion, with operating profit down 1 percent to $ 935 million. Based on sales, Performance Materials ranked second among DuPont’s six operating units in the nine-month period.

In 2014, the firm’s full-year sales fell 3 percent to $ 34.7 billion, while annual profit tumbled 25 percent to just over $ 3.6 billion.

Activist investors and Dow Chemical

Meanwhile, Dow Chemical has been jousting with activist investors, too.

Third Point LLC, led by activist veteran Daniel Loeb, bought a stake in Dow in 2013 and called on the company to spin off its petrochemicals business — including plastics — in January 2014.

Like DuPont, Dow made some concessions. First, it added new members to its board of directors. Then, in March this year, Dow announced that it would combine a large part of its chlorine value chain with specialty chemicals and ammunition maker Olin Corp. to create a global materials firm with annual sales of almost $ 7 billion. The combination includes Dow’s global epoxy business and units that make feedstocks used in PVC production.

The firm’s nine-month results were mixed, with sales down almost 15 percent to $ 37.3 billion — due in part to lower selling prices for many of its products — while EBITDA jumped 21 percent to almost $ 8.4 billion. Dow’s Performance Plastics unit — including its massive PE business — saw nine-month sales fall almost 19 percent to $ 13.7 billion as EBITDA improved almost 19 percent to more than $ 3.8 billion.

Based on sales, Performance Plastics was the largest Dow business unit in the first nine months of 2015, generating almost 37 percent of total sales. In addition to resins, Dow operates a plastics films business that has annual sales of around $ 125 million.

Dow’s 2014 full-year results showed sales up almost 2 percent to $ 58.2 billion as profit slid 20 percent to just over $ 1.4 billion.

At Mathelin Bay, Karig said that “almost any large public company with diversified operations that is not consistently delivering superior returns is at risk of facing calls to spin off operations … or to package them into separate public companies that are easier for investors to understand, and presumably so the individual pieces are valued more highly in total than the former, larger company.”

And even if such a move is successful, Karig added, that might not be the end of the story.

“The challenge with a Dow-DuPont merger,” he said, “is that no matter how much internal reorganization is done post-merger to cut costs and to provide investors with a clearer picture of individual operating segments, the first time earnings disappoint the market it would not be surprising at all if there are renewed demands from activist investors to do to the larger company what had previously been demanded of the two smaller companies.

Liveris meets goal

On the conference call, Liveris said he had been interested in DuPont for several years. Media reports said that he contacted Breen about a deal in October. The two are an interesting contrast in that Liveris, age 61, has been with Dow for 37 years, while Breen, age 59, has been with DuPont for less than a year. Breen is best known for his restructuring efforts at industrial conglomerate Tyco International, where he served as chairman and CEO from 2002-12.

Combining DuPont and Dow would be an interesting merger of different corporate cultures. Both companies have long histories as specialty chemical companies.

Both are major players in commodity resins, to be sure, although DuPont’s plastics portfolio is heavy on engineering materials like nylon and specialty polyesters, while Dow is better known for commodity resins including polyethylene.

Both companies are global giants, but they have roots in small-town America. Dow is the largest employer in Midland, a Midwestern enclave with a population of about 42,000, while DuPont is entrenched in the East Coast city of Wilmington, with a population of about 70,000.

The companies have crossed paths before, notably in 1996, when they combined their specialty rubber businesses into a 50:50 joint venture, DuPont Dow Elastomers. But that venture lasted less than a decade.

At the time of the breakup of the joint venture, Balaji Singh of Chemical Market Resources Inc. wrote that: “DuPont Dow as an organization could not survive the general organizational issues that are independent of its overall goals and objectives.”

Singh wrote that the joint venture failed to integrate DuPont and Dow cultures to develop a new start-up with its own identity and culture.

Early Wall Street reaction to the rumored deal was positive, sending per-share prices of both Dow and DuPont up almost 12 percent on Dec. 9. That movement put Dow’s per-share price just under $ 57 and DuPont’s at $ 74.50. DuPont’s price stayed near that level on Dec. 10, but Dow’s fell almost four percent to just under $ 55.

In spite of mixed financial results, both Dow and DuPont have outperformed the overall stock market so far in 2015. Through Dec. 10, Dow’s per-share stock price was up more than 20 percent for the year, while DuPont’s had risen more than 6 percent. By comparison, the Dow Jones Industrial Average was down more than one percent and the broader S&P 500 was down 0.3 percent.