December 23, 2015 Updated 12/23/2015

Email Print

Esposito

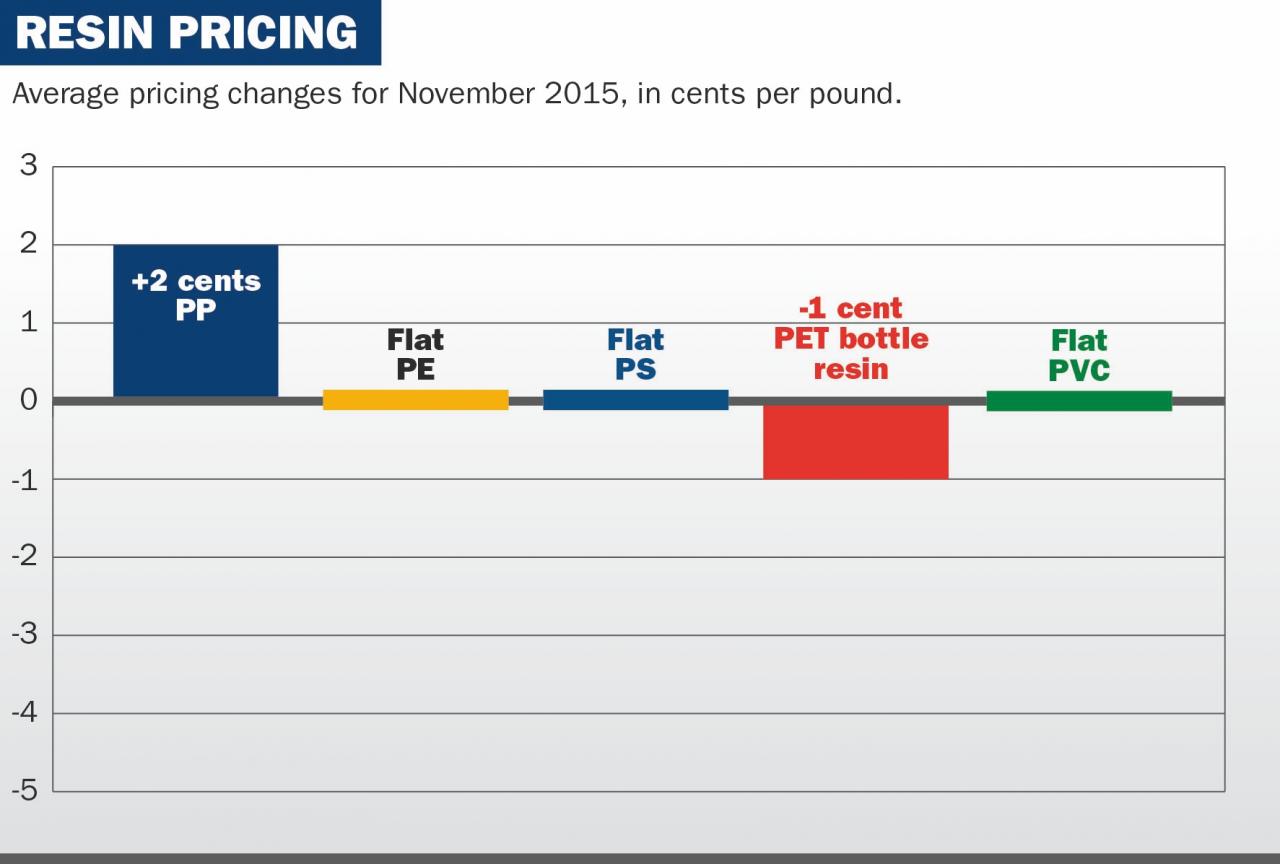

North American resin prices remained relatively calm in November, with only PET bottle resin and polypropylene showing any movement.

Regional selling prices for PET bottle resin ticked down a penny per pound for the month, due in part to lower seasonal demand. Prices for the material now have fallen for four consecutive months. The 1-cent November drop followed declines totaling 8 cents combined in August-October.

PET bottle resin prices now are down a net of 3 cents per pound so far in 2015. The market continues to struggle with resin overcapacity and with reduced demands for carbonated soft drinks, its largest end market. Demand for bottled water is up, but thinner bottles are using less PET per bottle than they did in previous years.

While PET prices declined, North American PP resin prices increased by an average of 2 cents per pound in November, as the market continued to struggle with tightness for the material.

The 2-cent hike is the second consecutive monthly price hike, following a 3-cent increase in October. These increases have reversed a trend that had seen regional PP prices fall for three straight months. Even with the November increase, regional PP prices are down a net of 13 cents per pound so far in 2015.

The PP demand picture has been more positive. Through October, North American PP sales were up 5.1 percent vs. the same period in 2014, according to the American Chemistry Council. Domestic sales were up almost 6 percent, but the overall growth rate was dampened by a 14 percent drop in export sales.

Among individual end markets, domestic sales of PP into injection molded housewares were up 15 percent through October, while sales of the material into sheet were up more than 8 percent and into film were up almost 5 percent.

Average North American selling prices for all grades of polyethylene — as well as for solid polystyrene and suspension PVC — were unchanged in November. For the year to date, prices for all grades of PE and of solid PS are down a net of 13 cents per pound, while suspension PVC prices have declined by a net of 3 cents per pound.

Through October, U.S./Canadian sales of high density PE were up 6.6 percent, according to ACC. Domestic sales were up only 1 percent for the period, but export sales rocketed up almost 42 percent. Sales of HDPE into household chemical bottles provided a domestic bright spot, growing 7 percent.

Regional sales of low density PE through October improved 3.3 percent, with domestic growth of almost 4 percent lessened somewhat by growth of only 1.2 percent in export markets. Sales of LDPE into non-food packaging film soared more than 11 percent in that 10-month period.

For linear low density PE, 10-month sales grew 6.3 percent. Domestic sales growth of almost 6 percent was amplified by a 9 percent rise in export sales. Sales of LLDPE into all types of film — packaging and non-packaging — climbed almost 8 percent in that period.

North American PS sales dipped 1.2 percent through October, even as sales in its leading food packaging/food service segment ticked up 0.3 percent. That category accounted for almost 62 percent of regional PS sales in the first 10 months of the year.

The North American PVC field had an odd year, as the construction market — PVC’s biggest consumption sector — didn’t rebound as expected. As a result, U.S./Canadian PVC sales are on track to be down almost 3 percent in 2015.

Sales of PVC into the domestic market fell 3 percent in the first 10 months of 2015, according to the American Chemistry Council, but export sales fell less than 2 percent, lowering the overall sales loss.

Ten-month sales into PVC’s dominant rigid pipe and tubing sector — which accounted for almost 45 percent of domestic sales — fell almost 2 percent in that period. Sales into siding and related uses provided a bright spot, growing almost 3 percent through October.