As rubber prices slumped toward a six-year low, 20 of 30 workers who drained the sticky latex from trees on Winai Chaikunanant’s plantation in Thailand quit. Even with income sharing, they earned less than the minimum wage.

Winai isn’t faring much better. The 70-year-old loses money on every kilogram produced on the farm he’s tended for five decades because government subsidies aren’t big enough to make up the difference. Half his trees were left untapped this season, and he plans to raze about 100 rai (40 acres) to grow cassava or pineapple instead. And the market may only get worse for rubber growers.

Farmer Winai Chaikunanant stands next to rubber sheets in a drying room – Photographer: Dario Pignatelli/Bloomberg

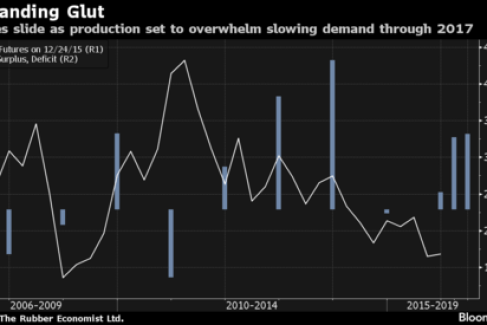

Global demand for natural rubber, used mostly in tires, is slowing as the economy cools in China, the world’s largest buyer of new cars. Supplies are expanding after a decade-long rally in prices to a record in 2011 encouraged top producers like Thailand, Indonesia and Vietnam to plant more trees. Output will exceed use for two more years, with the surplus quadrupling in 2016, according to The Rubber Economist Ltd., a London-based industry researcher.

“We face so many challenges from all sides,” Winai said on his 600-rai plantation in Rayong, about 180 kilometers (110 miles) southeast of Bangkok.

Rubber traded in Tokyo, a global benchmark, has tumbled 70 percent from a record in 2011, touching a six-year low of 153 yen ($1.26) a kilogram on Nov. 6. Futures in Shanghai have slumped 22 percent in 2015. The export price from Thailand, the top producer, is down 23 percent.

Global production is set to exceed demand by 411,000 metric tons next year and by 430,000 tons in 2017, compared with a surplus of 98,000 tons in 2015, The Rubber Economist predicted on Dec. 9. Output will increase 3.8 percent next year to 13 million tons and will keep expanding through 2018, the researcher said. Consumption won’t grow nearly as fast, which will leave stockpiles by the end of 2017 at a record 3.7 million tons, said Prachaya Jumpasut, managing director of The Rubber Economist.

Slowing Demand

China, which buys more than third of world output, forecast imports of natural rubber will plunge 10 percent this year to 3.7 million tons as consumption growth slows to 2.9 percent from 13 percent in 2014, the Association of Natural Rubber Producing Countries said in a report dated Dec. 7. Stockpiles on the Shanghai Futures Exchange this month were the biggest since at least January 2003, and tire production probably will be down 5 percent this year, China Rubber Industry Association Secretary-General Mary Xu said in October.

“We’re quite bearish on rubber,” said Daryna Kovalska, an analyst at Macquarie Group Ltd. in London.

Price Outlook

Excess supplies may keep prices subdued for a decade, said Hidde Smit, an industry adviser who has studied the market for more than 30 years and is the former secretary-general of the International Rubber Study Group. Even with some smaller farms cutting back now, the planted area across 11 Asian countries that are the primary growers has surged 45 percent since 2004, he said.

“I try to cut costs, save power, and reduce household spending,” said Winai, the Thai farmer who lost two-thirds of his workers because they were making less than Thailand’s minimum wage of 300 baht ($8.30) a day. “I’ve been living in a simple way on the money I made when the price was at peak.”

In Thailand, the local price of rubber sheet has plunged to about 37 baht a kilogram from an average of 56 baht last year and 76 baht in 2013, according to the Rubber Authority of Thailand. The average cost of production is around 65 baht, the farm ministry estimates.

Farmer Subsidies

The government on Nov. 3 approved 13 billion baht to support farmers. Land owners and their workers will get a combined 1,500 baht a rai for plantations up to 15 rai. About 80 percent of growers own as much as 25 rai. An additional 5 billion baht was approved in December for producers who pursue alternative employment.

“The subsidy amount is so small that it barely offsets rising production costs and the high cost of living,” said Fong Wongchana, a 73-year-old farmer in the southern province of Songkhla. “It’s very difficult to find labor as low prices reduce income sharing.”

The stress of money-losing crops could limit supplies more than forecast. Output from growers accounting more than 90 percent of world supply may decline 0.3 percent to 10.92 million tons this year, the lowest since 2012, according to the ANRPC. Thailand, Indonesia and Malaysia, which account for 80 percent of world shipments, have said they would consider limiting exports and would seek to increase domestic uses of natural rubber.

Vietnamese farmers are cutting down trees, and the government is urging them to switch to other crops. Rubber producers in Indonesia say output this year may drop 10 percent as dry weather and haze from forest fires disrupts tapping. Drought-like conditions are also hurting production in some areas. Zaman Abdul Somad, a 61-year-old rubber farmer in Indonesia’s South Sumatra, said his yields are down 50 percent this year, forcing him to collect sand at a river or do other random jobs to earn more income.

“For price recovery, we need to see a significant reduction in supply or a strong growth in demand,” said Macquarie’s Kovalska. “We’re unlikely to see any of that anytime soon.”