February 24, 2016 Updated 2/24/2016

Email Print

Bill Wood

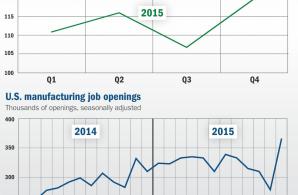

The total number of job openings that U.S. employers were actively trying to fill as of the last business day of December 2015 tallied 5.6 million on a seasonally-adjusted basis. Let me say that again — there were 5.6 million jobs that were unfilled at the start of this year.

A portion of these jobs are part-time or seasonal, but they are all offering wages or salaries. This total represented a gain of 15 percent when compared with December 2014, and it was a gain of 4.9 percent from the total in November. When you divide the number of job openings by the total number of jobs in America, the rate you get at this time represents the strongest level this data has registered in several years. This data is compiled by the Bureau of Labor Statistics and reported in their monthly Job Openings and Labor Turnover Survey (JOLTS) report.

A strong rise in the number job openings in itself is reason for optimism amongst plastics processors. The trend in the openings data is a reliable leading indicator of the near-term trend in the total employment figures. If this relationship continues to hold, then the strong rise in the number of job openings should eventually lead to more people actually getting a job. This will in turn lead to higher wages and household income levels, and ultimately to increased consumer spending. All of these projections bode well for future demand of plastics products. Like most sectors of the consumer-driven U.S. economy, our industry does best when incomes are growing and Americans’ propensity to consume is increasing.

But what really caught my attention in the latest JOLTS report was the source of the job openings as the year ended. The construction sector added 69,000 job openings, nondurable goods manufacturing gained 60,000 new openings, and durable goods manufacturing added 26,000 new job openings.

Do the math and you get that the U.S. manufacturing sector added a whopping 86,000 new job postings in the month of December. And just to be clear, this number does not include internal transfers, promotions, demotions or people called back from layoffs. These are specific new positions that employers are actively trying to fill.

Now we have all heard the reports in the media recently about the headwinds for U.S. manufacturers. These reports are based on three real trends: the collapse in demand from the energy sector; the rise in the value of the dollar that is hurting export demand and increasing the competitive pressures from imported products; and the slowdown in the economies of our global trading partners. I will not deny that these conditions have hurt some segments of the U.S. manufacturing sector, and maybe your company is one that has felt some of this pain.

But these headwinds are affecting the various sectors of the economy in different ways. And there are some sectors in which the current state of affairs is actually an advantage. Some manufacturers — especially plastics processors — are actually thriving in these conditions. One significant reason for this is that the strong value of the dollar has had the beneficial effect of pushing energy and materials prices down while at the same time improving the purchasing power of the U.S. consumer.

For an analyst that focuses on the plastics industry, the data are starting to exhibit a gratifying pattern. The sharp rise in the December data from the JOLTS report corroborates the trend in our own Business Monitor Index that emerged at the end of last year. According to our survey, the number of new employees added by North American plastics processors jumped significantly during the last three months of last year when compared with the previous quarter.

These developments in the labor market data are healthy, and they are indicative of strength in the underlying market fundamentals for many segments of the manufacturing sector, especially the plastics industry. They also point to further improvements in the labor market data as the U.S. economy continues to expand.

But how do all of these strengthening labor market indicators square with the aforementioned headwinds for manufacturers and all of the other negative news in recent months about the U.S. manufacturing sector?

Some economists working for the Bank of America Merrill Lynch have an answer. They broke the data from the U.S. manufacturing sector into three groups depending on how much each sector depends on foreign trade. The growth rate in the jobs data for manufacturers in the high-trade sectors declined from a gain of 1.4 percent in the fourth quarter of 2014 to a decline of 1.1 percent in the fourth quarter of 2015. For manufacturers in the medium-trade group, the growth in the number of jobs decelerated from 2.1 percent growth in fourth quarter of 2014 to 1 percent growth in the fourth quarter of 2015.

For manufacturers that comprise the low-trade segment, the growth in the jobs data actually accelerated to a rate of 1.8 percent at the end of last year compared with a gain of 1.2 percent at the end of 2014. Things like plastic construction materials, packaging products, and many types of automotive parts — the sectors of the industry that remain in the U.S. after all of the off-shoring that occurred 10 years ago — would likely fall into the low-trade category.

A similar pattern for these three groups of industries can be seen in the industrial production data that is compiled and reported by the Federal Reserve Board every month. These data show that the plastics industry was one of the top two or three fastest growing domestic industries in 2015. In fact, the annual output of plastics products escalated by 4.4 percent in 2015, but total industrial production in the U.S. grew by a modest 1.3 percent. And primarily because of the low price for natural gas in the U.S., I expect the plastics industry to stay in the top three industries in terms of overall growth for at least the next five years.