Seeking a haven from plunging commodity prices? Look no further than the humble tiremaker, whose profit-making prowess appears anything but dull.

Germany’s Continental on Thursday reported a 20.4 percent full-year adjusted operating margin at its tire division, far higher than the company’s average of 11.8 percent. To put it in context, luxury carmaker Mercedes-Benz achieved only a 10 percent auto division operating margin last year.

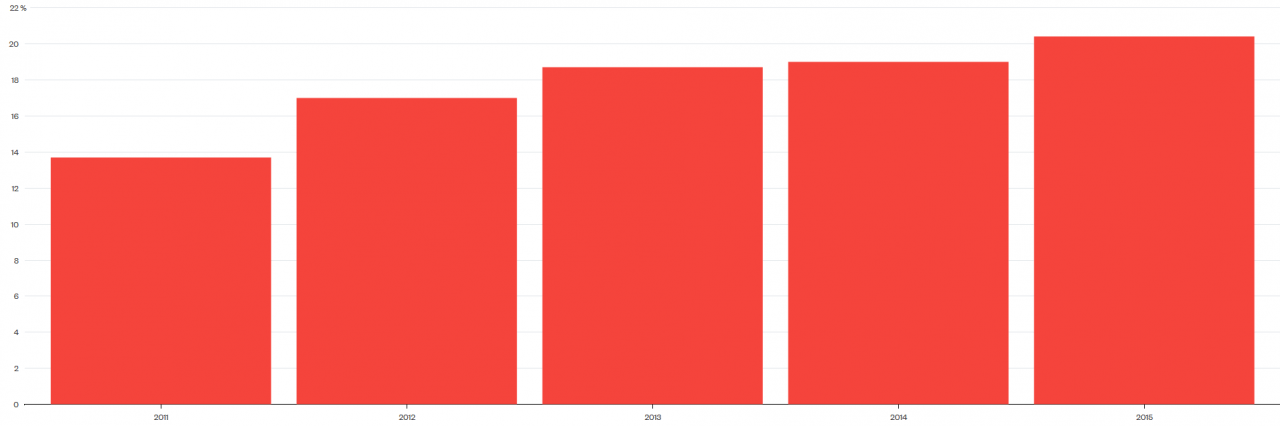

Margins Are Motoring

Continental’s tire unit profit margin is benefiting from falling raw material costs.

Source: Continental

What’s going on? Natural and synthetic rubber typically account for about half a tire company’s raw materials bill. So plunging prices for natural rubber and crude oil (the building block of synthetic rubber inputs such as butadiene) cut that bill substantially and help boost gross margin.

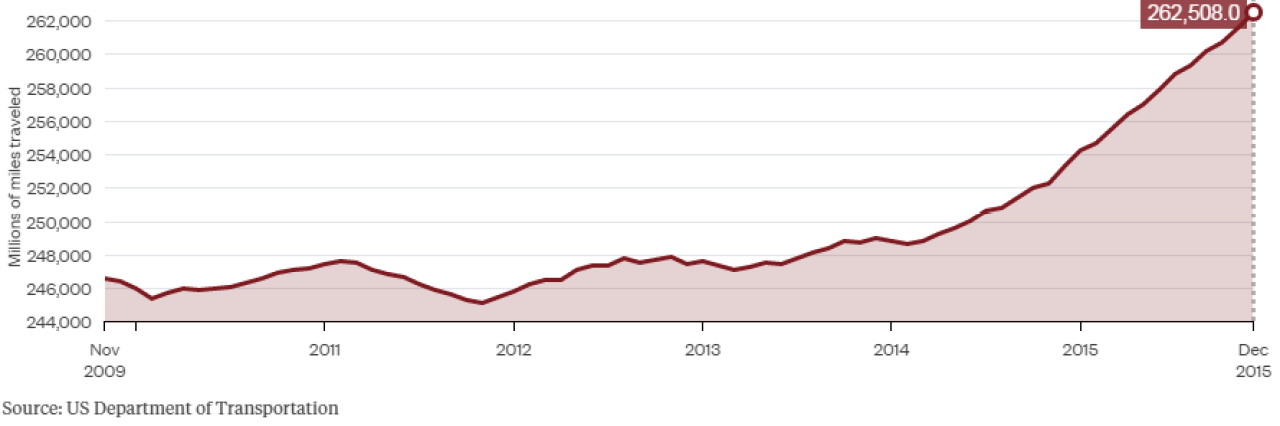

Cheap fuel also helps. Gas-guzzling trucks and sports utility vehicles are popular again with consumers, as Gadfly has examined, and their tires are usually more expensive. Plus lower pump prices encourage drivers to increase their mileage, meaning they’ll have to change tires more often as Bloomberg News’s Javier Blas has reported.

Rubber Hits the Road

US car drivers are covering greater distances, which should boost replacement tire demand

And it’s not just Conti profiting. Europe’s biggest tiremaker Michelin reported a 13 percent rise in full-year net income last month and forecast a 400 million-euro ($438 million) tailwind from raw materials in 21016. The French company also raised its passenger car tire margin target for the period until 2020 to as much as 15 percent, compared to 11.5 percent last year. Japan’s Bridgestone is also doing well:

And it’s not just Conti profiting. Europe’s biggest tiremaker Michelin reported a 13 percent rise in full-year net income last month and forecast a 400 million-euro ($438 million) tailwind from raw materials in 21016. The French company also raised its passenger car tire margin target for the period until 2020 to as much as 15 percent, compared to 11.5 percent last year. Japan’s Bridgestone is also doing well:

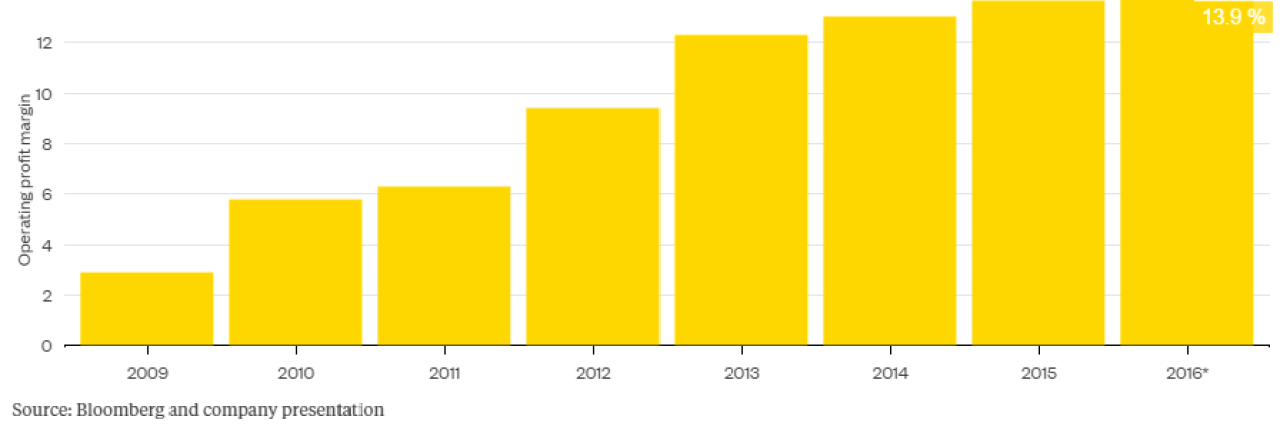

Moving Higher

Bridgestone’s return on sales has steadily improved since 2009.

That’s not to say the good times will last forever.

That’s not to say the good times will last forever.

Developed economy tiremakers have taken steps to structurally boost profits, including cutting manufacturing costs by closing plants and shifting production to cheaper locations. They’ve also invested heavily in premium tires that boast enhanced grip and shorter braking distance, meaning they can charge more for them.

New tire-labeling schemes in Europe help carmakers market those innovations to customers. In addition, regulations mandating the use of special winter tires oblige drivers to keep a costly spare set in the garage. High-performance and winter tires were 47 percent of total volumes sold last year at Conti, six percentage points higher than 2011.

But it would be naive to think tiremakers won’t have to pass some of the benefit of falling raw material costs to customers via lower prices, especially given the threat from cheap Asian imports. The restructuring of China’s tire industry has been painfully slow, and it still has huge overcapacity.

The U.S. has already imposed anti-dumping tariffs on Chinese tires but that just threatens to shift the problem to Europe. In February, Goodyear warned of a “continued influx of Asian imports in eastern Europe.”

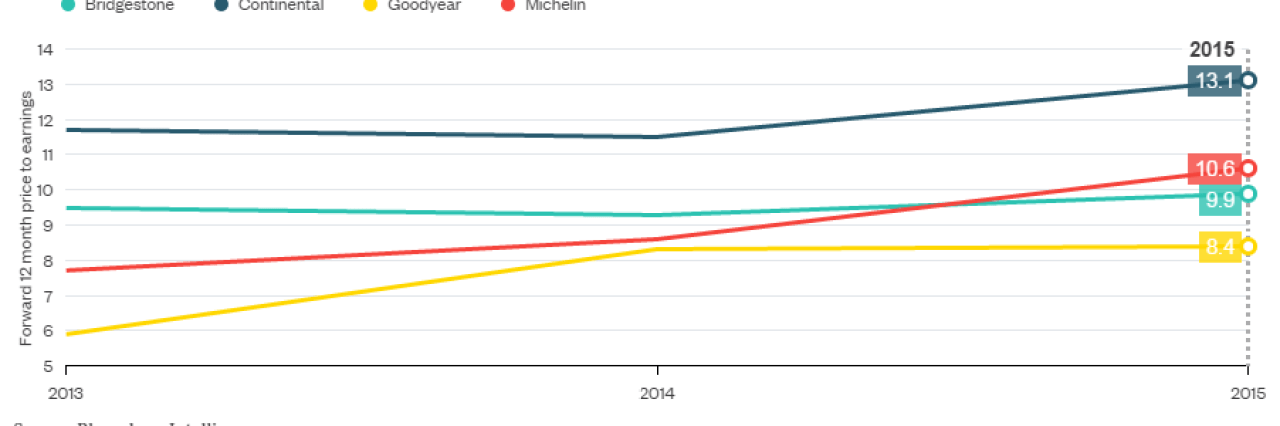

There are other reasons to think tire margins could peak soon and let some of the air out of rising valuations.

Pumped Up

Tiremakers’ forward p/e multiples have increased over past three years

Continental enjoyed a 250 million-euro boost from lower raw material costs in 2015 (more than 5 percent of adjusted group ebit). Yet it anticipates only a 100 million-euro benefit in 2016 because it expects raw materials prices, including crude oil, to climb again in the second half of the year.

German chemical company Lanxess and Saudi Aramco agreedlast year to form a 2.75 billion-euro venture, which could help drive consolidation in the synthetic rubber industry and further support prices. Meanwhile, natural rubber prices have rallied in recent weeks after Asian producers Indonesia, Malaysia and Thailand — together responsible for about 70 percent of global production — agreed to cut exports.

Tire valuations look slick right now, but the road to further profit growth could get a little more treacherous.