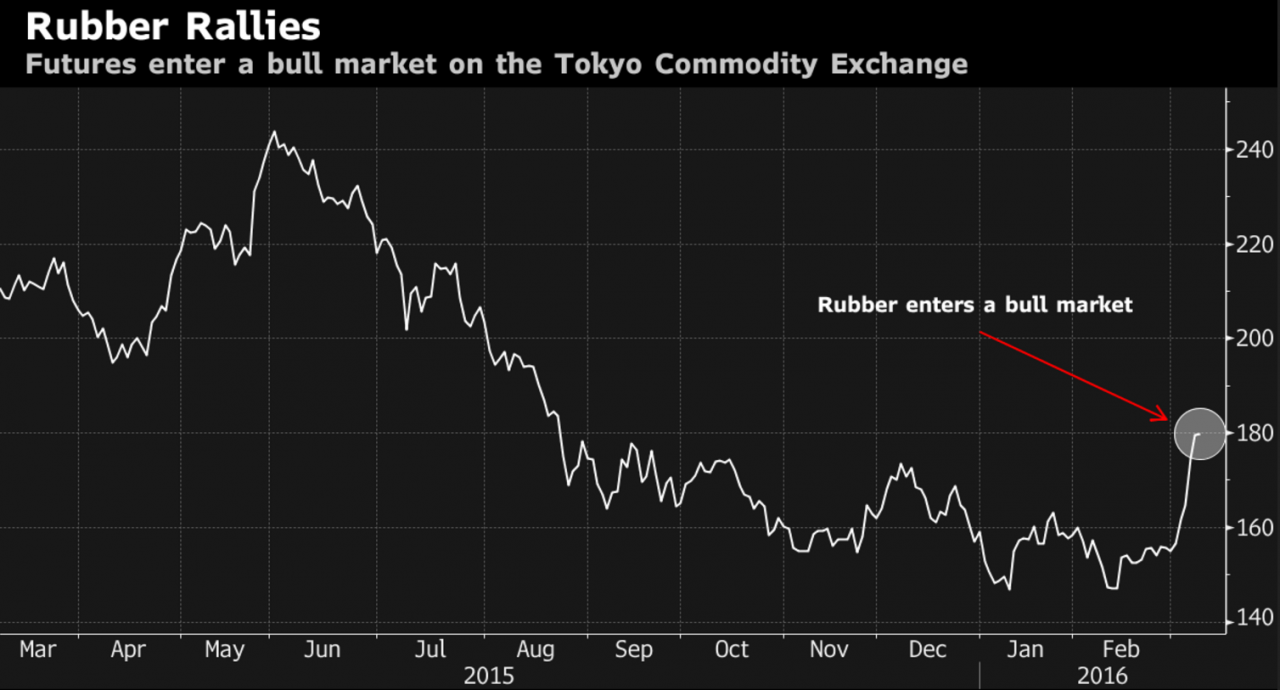

(March 7): Rubber entered a bull market in Tokyo and Shanghai after the world’s biggest exporters cut shipments to help boost prices.

Futures in Tokyo climbed 22% from the lowest in more than six years reached Jan 12, meeting the common definition of a bull market. The contract for August delivery on the Tokyo Commodity Exchange advanced 2.8% to settle at 179.50 yen (US$1.58) a kilogram. Rubber on the Shanghai Futures Exchange rose 21% from a seven year-low also reached Jan 12.

Thailand, Indonesia and Malaysia, which account for more than 60% of global output, cut exports starting this month. The countries are seeking to boost sales after prices tumbled as slowing economic growth in China weakened demand from the biggest consumer. Thailand, the top shipper, has also agreed to buy rubber from growers at above-market prices.

“The move to restrict shipments by Thailand and other major producers starting this month has increased concern that supply will decrease,” said Kazuhiko Saito, an analyst at Fujitomi Co, a broker in Tokyo. That’s “spurring investors to buy back futures,” he said.

The three producers will reduce shipments by 615,000 metric tons in the six months to Aug 31, the International Tripartite Rubber Council said last month. Thailand will account for more than half the reduction.