April 5, 2016 Updated 4/5/2016

Email Print

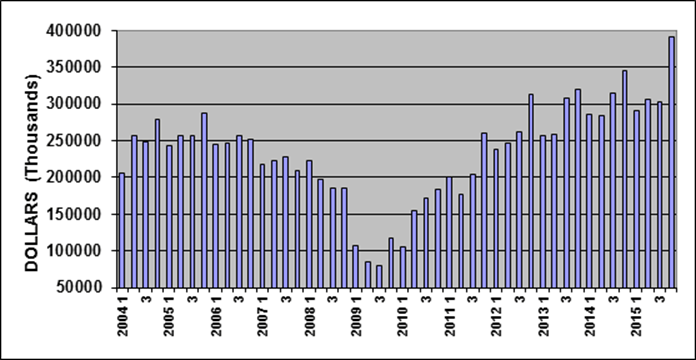

Society of the Plastics Industry Inc. Machinery sales continued to grow in 2015, with a growth spurt in the final quarter.

North American shipments of primary plastics machinery increased to a value $ 1.29 billion in 2015, 4.8 percent over the 2014 level, according to the Society of the Plastics Industry Inc.

For 2015, the annual shipments of plastics machinery increased for the sixth straight year, according to SPI’s Committee on Equipment Statistics. But economist Bill Wood said the strong sales rebound after the Great Recession is slowing down. The fourth quarter was strong for injection molding machines and single-screw and twin-screw extruders — a spike that helped the machinery industry enjoy a year of growth, SPI said.

“Market conditions should remain strong in 2016, but the pace of growth in the shipments data is expected to decelerate after six years of strong expansion,” Wood said.

Machinery executives say North American injection press shipments topped 4,000 machines in 2015. Washington-based SPI does not release unit data, only including dollar-value numbers in its public year-end report issued April 5.

Wood said some big-picture economic forces hit the U.S. plastics machinery sector.

“The U.S. machinery data were strongly affected by the drop in investment from the energy sector and the strong value of the dollar in 2015,” said Wood, who runs Mountaintop Economics & Research Inc. in Greenfield, Mass. “These headwinds will persist in 2016, but they will not affect the plastics machinery sector as strongly as some other sectors of the machinery industry.”

Wood said the U.S. economy will continue to recover through 2016.

“Consumer demand for plastics products will steadily rise,” Wood said. “The three main factors that will continue to drive the economy over the coming months are: Low interest rates, low energy prices and rising wages and household incomes resulting from stronger employment levels.”

SPI reports that the shipment value of injection molding presses jumped 18.2 percent in the fourth quarter of 2015, compared to the year-ago final period. For all of 2015, shipments of injection presses were up 6.4 percent, over the 2014 total.

Single-screw extruders increased 16.9 percent in the fourth quarter vs. the year-ago fourth quarter. For all of 2015, single-screw extruders were up 10.1 percent from the 2014 level.

Shipments of twin-screw extruders — including both co-rotating and counter-rotating machines — gained 13.2 percent in the fourth quarter over the fourth quarter of 2014. But for the year as a whole, shipments of twin-screw machines fell by 5.3 percent.

SPI reports shipments of blow molding machines fell by double-digits for both the full year and fourth-quarter measurements. Fourth quarter vs. fourth quarter, the decline was 52.9 percent. Year to year, blow molding machinery fell 27.5 percent, measured in shipment value.

Auxiliary equipment from manufacturers that reported totaled $ 126.7 million in the fourth quarter of 2015 — a jump of 22.4 percent from the total in the 2014 fourth quarter. For all of 2015, auxiliary equipment bookings increased 13.2 percent over 2014.

The Committee on Equipment Statistics also conducts a quarterly survey of plastics machinery suppliers that asks about present market conditions and expectations for the future. The survey indicates that expectations have slipped for 2016 but suppliers remain mostly optimistic about machinery demand in the coming months.

The fourth-quarter survey said that “83 percent of respondents expect market conditions to hold steady or get better during the next 12 months,” SPI said.

The United States and Mexico are the regions that machinery executives believe will be “most promising market conditions” for equipment sales in the coming year. And what are the strongest end markets? Appliance and medical, the survey said. All other end markets should see steady-to-better demand in 2016.

For 2015, total industrial machinery orders — every type of equipment — declined by 5 percent, according to the Census Bureau.