Rubber gloves sector

Maintain market weight: Share prices of glove companies have plunged by 20% to 34% since the beginning of the year, spooked by the steep 8.9% year-to-date (YTD) appreciation of the ringgit to below the RM4 per US dollar threshold (RM3.91 per US dollar currently). Top Glove Corp Bhd, which posted the largest share price gain last year (+200%), saw its share price shed 23% YTD, while the decline in Hartalega Holdings Bhd’s share price was more modest at 20%. Kossan Rubber Industries Bhd posted the most significant share price decline (-34% YTD) within the sector.

Barring any adjustment to average selling prices, we conducted sensitivity tests on glove makers’ earnings (based on an average financial year 2016 [FY16] to FY18 foreign exchange rate of RM3.80 per US dollar scenario) and found a possible sector-wide aggregate reduction in industry earnings of up to 25% to 26%, with Top Glove being the most impacted glove stock under our coverage due to its lower degree of natural hedge amid its proportionately smaller nitrile glove production mix of 32% (as compared with 75% to 80% and above 90% for Kossan and Hartalega respectively).

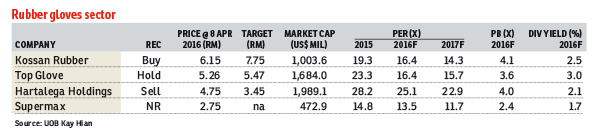

We reiterate “market weight” on the sector as we believe the valuations of most glove companies have fully priced in cost savings from softening raw material prices and future capacity expansion plans. We retain Kossan as our sector pick. Kossan’s share price has shed the most among glove companies since Jan 16, and also saw valuation retrace back to its historical mean valuation. The stock has the lowest price-earnings ratio (PER) multiple (14 times 2017 forecast PER) within our glove sector coverage (as compared with 16 times and 23 times for Top Glove and Hartalega respectively).

We maintain “buy” on Kossan with an unchanged target price of RM7.75. We believe its value has re-emerged following the steep 34% YTD pullback in its share price. Furthermore, we expect Kossan to deliver gradual margin expansion in 2017, underpinned by productivity gains (arising from its push for a degree of automation) and the sustained weakness in raw material input prices, while its four-year strategic expansion plan should offer investors a good long-term earnings visibility.

We recommend “sell” on Hartalega as most of the positive near-term catalysts have been largely reflected in its current rich valuation of 23 times 2017 forecast PER. We deem Hartalega’s valuation as pricey on expectations of earnings growth normalising to 10% to 12% post 2016. As such, we believe Hartalega’s lofty valuation ignores the risk of long-term margin erosion arising from intensifying pricing pressure. Furthermore, its near-term earnings growth could be crimped by the recent strengthening of the ringgit against the US dollar, while over the longer term, the nitrile glove segment is set for more challenging times when the industry’s capacity expansion eventually outstrips demand. — UOB Kay Hian, April 8