Rubber products sector

Maintain neutral: Higher hygiene standards, progressive healthcare reforms and demand growth in emerging markets are expected to be key growth drivers of global rubber glove consumption, which we estimate to grow between 8% and 10% annually.

This loosely translates into an additional 55 billion gloves for the next five years, keeping utilisation levels high and the volume growth outlook intact. Glove consumption per capita is still low in Asia at approximately 11 pieces of gloves per person per annum, compared to developed nations which consume approximately 100 pieces of gloves per person per annum, indicating a further upside to demand growth. Malaysian rubber glove manufacturers supplied approximately 63% of the world’s total gloves in 2015 and are prime beneficiaries of growing global glove demand.

Latex prices have declined for a fourth consecutive year due to depressed demand and pent-up supply. Global demand for latex, 60% of which is used in tyre manufacturing, is slowing as the world’s top buyer, China, rebalances its economy. Global rubber stockpiles are likely to reach a record 3.7 million tonnes in 2017. The current rally in rubber prices is seasonally driven due to the winter season. Without any corresponding increase in demand, we believe latex prices will remain benign.

The “big four” glove makers’ total effective capacity is set to expand by 13% in compound annual growth rate in calendar year 2016 estimate (CY16E) to CY19E. Assuming global glove demand were to grow at an annual 9%, overcapacity risk could escalate in CY18E and CY19E, with supply outstripping demand at a net surplus of 2.4 billion or 1% of total global demand.

However, we believe that the risk is manageable and can be mitigated by delaying or slowing down some of the expansion plans, given the small surplus quantum. To put it into perspective, 2.4 billion gloves are equivalent to roughly a single plant’s annual production capacity.

Declining average selling prices should continue to be an ongoing theme, given the capacity influx, heightened competition and the ringgit’s strength. Margin compression is likely in the coming quarters, but we understand that rubber glove manufacturers are taking measures to ease margin pressure, which include entering into hedging contracts and implementing operational improvement initiatives. Our current forecasts assume an exchange rate of RM3.95/US$1 for FY16 to FY18 for all rubber glove makers under our coverage. Our sensitivity analysis shows that every five-cent change in the RM/US$ could shave off net earnings by 5% to 9%.

We remain “neutral” on the sector. We peg our valuations to +1 standard deviation over their respective past three-year mean price-earning ratio on: i) sustained global glove demand; ii) preference shift to nitrile gloves with higher profitability; iii) aggressive market share gains over Thailand and Indonesia; and iv) ongoing innovation and automation leading to productivity gains.

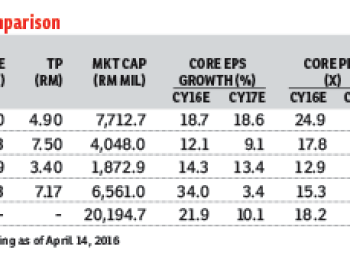

We like Top Glove Corp Bhd for its undemanding valuation and improving efficiencies. We reiterate our “buy” rating on Top Glove and target price (TP) of RM7.17. We maintain “hold” on Hartalega Holdings Bhd and cut our TP to RM4.90 (from RM5.16) as we think current valuations have priced in most of the positives. — Affin Hwang Capital, April 15