April 24, 2016 Updated 4/24/2016

Email Print

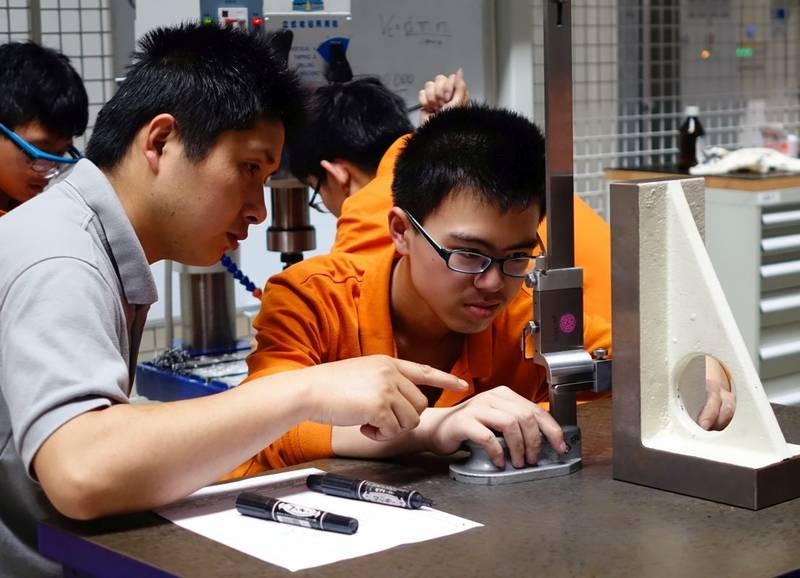

Engel Holding GmbH Engel trains apprentices at its Shanghai plant.

Shanghai — Injection machine maker Engel Holding GmbH is investing 60 million yuan ($ 9.2 million) to expand capacity at its Shanghai factory, saying it sees continued growth in the higher end of the market in China.

The Schwertberg, Austria-based company announced a doubling of capacity at the Shanghai plant in 2012, and said this latest investment will enlarge machining capacity and provide more office space and room for its training programs.

“We have expansion plans in China because we are reaching again our limits, we will add another building to add more space for manufacturing,” said Gero Willmeroth, sales and service president at Engel Machinery Shanghai. “In this one we will put another heavy duty machining center for platen manufacturing.”

Willmeroth made the announcement April 24 in a news conference ahead of the Chinaplas trade fair in Shanghai, which runs from April 25-28.

Construction has started and the new machining center is scheduled to be finished by April 2017, he said.

Asia accounts for almost 25 percent of Engel’s 1.23 billion euros ($ 1.38 billion) in total sales, or about 300 million euros ($ 336.5 million).

By comparison, the company said its Asia business in 2012 generated only 100 million euros in sales. China is Engel’s largest market in Asia.

The company has injection machine manufacturing plants in South Korea, which also doubled capacity in 2012, and at its new Wintec subsidiary in Changzhou, China, where it has started manufacturing less expensive, more standardized molding machines aimed at the middle of China’s market.

Engel’s expansion comes amid some signs of softening in China’s market for plastics equipment.

The German trade group VDMA said that Germany’s exports of all types of plastics and rubber machinery to China fell 19 percent in 2015. Chinese industry figures show that overall market for plastics machinery in the country fell 6 percent last year, to 53.3 billion yuan ($ 8.2 billion).

But Willmeroth told reporters that the upper end of the injection machine market fared better.

Engel Holding GmbH Engel’s Shanghai plant

China’s overall economic growth rate slowed to about 6 percent a year, but he called that a “healthy development” for Engel because injection molding companies are focused on smarter capital investment.

“This creates opportunities for companies like Engel, because when the development is slower, then people are more focused on productivity and efficiency and have to strengthen their competitive advantage,” he said.

“We see this in our sales figures,” Willmeroth said. “Not only the international investment, but also the local companies in China and in the region invest in better-grade equipment to improve their competitive advantage.”

He also told reporters that while the company currently does not manufacture any of its robots or automation equipment or Asia, it’s looking at that.

“For sure we are thinking about manufacturing robots in Asia, maybe in China, but this will not happen overnight,” Willmeroth said. “But I’m sure in the mid-term this will definitely happen.”

He said Engel last year established an automation technical center in Shanghai with engineers to provide more support to customers looking to beef up their use of robots.

At Chinaplas, Engel said it would exhibit several machines to showcase production control and efficiency, and the Wintec subsidiary unveiled a new line of budget all-electric machines, its e-win series.

Wintec President Peter Auinger said the unit, which opened its first, relatively small factory in Changzhou in 2014, is likely to double its manufacturing capacity in the next three to five years.

The company said 85 percent of its Asia production is sold within the region.