May 13, 2016 Updated 5/13/2016

Email Print

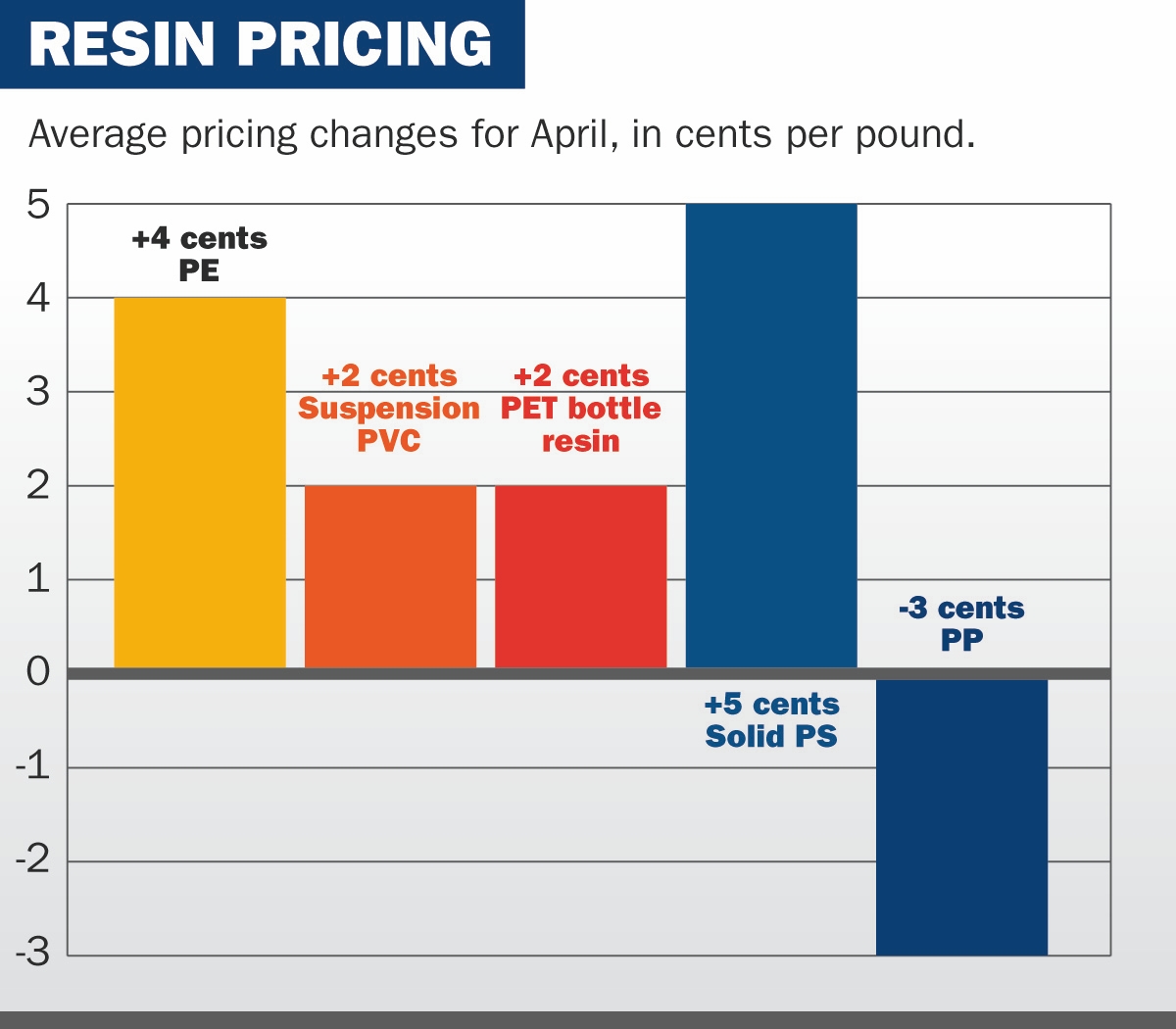

Four of five major commodity resins tracked by Plastics News saw North America price increases take hold in April — with only polypropylene prices bucking the trend by declining.

Polyethylene prices for April rose by an average of 4 cents per pound as oil prices recovered from less than $ 38 per barrel early in the month to around $ 45 when the month ended. Oil is a global price setter for PE, although natural gas is the most common PE feedstock in North America.

Regional PE prices now have risen in back-to-back months after dropping in the first two months of 2016. The 5-cent January/February drop had been canceled out by a 5-cent gain in March.

“Just about everyone in the PE market sees the massive wave of capacity starting to come online soon, and PE processors are anxious to start enjoying a multi-year buyers’ market,” said Phil Karig, managing director with Mathelin Bay Associates LLC consulting firm in St. Louis.

The 4-cent April hike was the result of “pure determination” on the part of North American PE makers, according to Mike Burns, a PE market analyst with Resin Technology Inc. in Fort Worth, Texas. “Without oil getting to $ 50, the increase should have been hard to get, but [PE makers] got it,” he said.

North American PE markets also could be tightened by the April 20 explosion at a plant in Mexico that made ethylene feedstock and other petrochemical products. The incident has resulted in at least 32 deaths and caused force majeure to be declared on products made there.

Esposito

Through March, U.S./Canadian high density PE sales soared 9 percent vs. the same period in 2016, with linear low density PE sales up 7 percent, according to the American Chemistry Council in Washington. Regional LDPE sales were up just over 2 percent in the same comparison.

For HDPE, first-quarter domestic sales growth of almost 3 percent was amplified by a 34.5 percent jump in export sales. Regional LLDPE saw domestic sales growth of more than 6 percent for the quarter boosted by export sales gains of 10 percent. LDPE sales did not fare as well in that three-month period, with domestic growth of almost 4 percent softened by a 3 percent dip in export sales.

PVC suspension resin prices bumped up an average of 2 cents per pound in April, as warmer weather increased demand for construction-related products. Prices for the material had climbed 4 cents in March after being flat in February.

The Mexican outage also should have an impact on the regional PVC market, since the plant was a major supplier of vinyl chloride monomer feedstock. One industry source said that regional operating rates for suspension PVC resin already were above 90 percent before the accident.

U.S./Canadian PVC sales were off to a strong start in the first quarter of 2016, growing 8.3 percent. Domestic sales growth of 2.5 percent was bolstered by a surge of almost 23 percent in the export market.

North American PET bottle resin prices also ticked up 2 cents per pound in April, as warmer weather improved seasonal demand for bottled water and carbonated soft drinks. It’s the second straight monthly price hike for that material, following a similar 2-cent move in March.

Prior to these back-to-back increases, regional PET prices had fallen for six consecutive months.

In the solid polystyrene market, a surge in benzene feedstock prices sent North American selling prices for solid polystyrene resin up an average of 5 cents per pound in April.

Benzene settled at $ 2.16 per gallon for April, a 22 percent jump from March prices. The bounce was anticipated because of recent higher oil prices, according to Mark Kallman, a market analyst with RTI.

Solid PS prices had been flat in March after declining by an average of 2 cents per pound in February. Prior to the February drop, regional PS prices had been flat for four consecutive months. Looking ahead, regional benzene prices are expected to settle near $ 2.07 per gallon for May, down 4 percent vs. April.

North American PS sales grew just under 1 percent in the first quarter of 2016, according to ACC. Sales of the material into the food service/food packaging end market grew 2.2 percent in that period. Food service/food packaging accounted for almost 65 percent of regional sales of solid PS for the quarter.

Polypropylene goes down

Like an unruly child, PP prices just had to be different in April, falling while other commodity resin prices rose. The regional market for that material surprised some by posting a 3-cent price drop. Prices had climbed in five of the previous six months, raising prices a total of 11 cents per pound.

Market watchers said the April drop was the result of increased competition coming from PP imported into North America from other parts of the world. Growing PP demand and limited supplies have created the opportunity for foreign suppliers to enter the region, sources said.

The decrease occurred even though prices for propylene monomer feedstock increased slightly in April, according to Scott Newell, a PP market analyst with RTI. “It’s a very competitive [PP] marketplace all of a sudden,” he said. “The domestic guys have to compete with material from [South] Korea, Brazil and other places.

In addition to South Korea and Brazil, sources told Plastics News that Saudi Arabia, Colombia, Thailand and Singapore also have been active in importing PP into North America. A PP buyer in the Midwest U.S. said that he expects more price drops as increased summer gasoline production lifts supplies of propylene monomer feedstock.

Through March, North American PP sales were up almost 2 percent, with a 3 percent domestic sales gain softened by a 44 percent drop in export sales.