What do hose pipes, wetsuits, chewing gum, golf balls, car tyres and adhesives have in common? They all contain rubber.

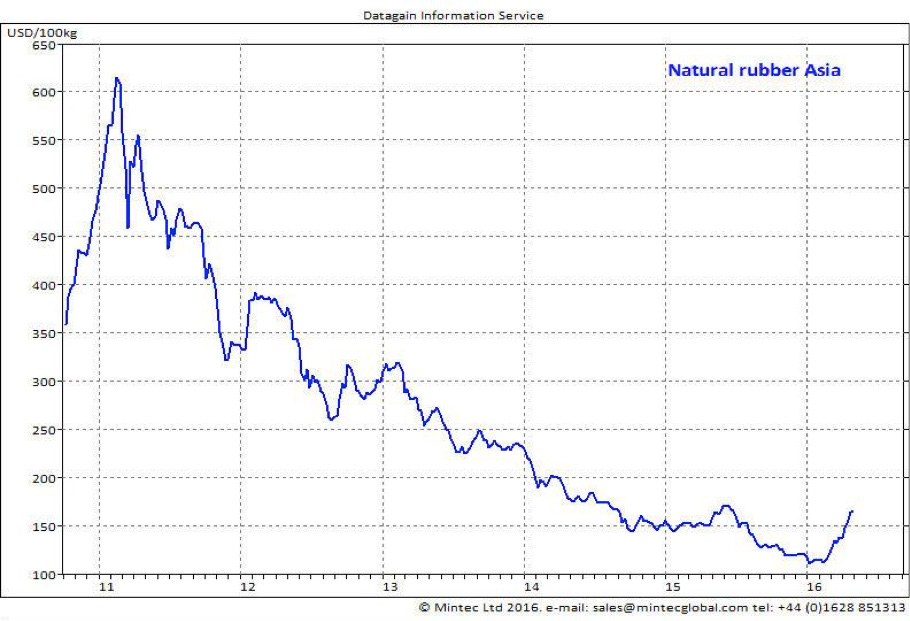

Prices for rubber were falling for five straight years up to the end of last year, but they are now bouncing back. Natural rubber in Asia rose 20% month-over-month in April and 49% since the beginning of the year. To put this into perspective, this is the largest m-o-m increase since mid-April 2011.

Natural rubber can be produced naturally or synthetically, with around 27 million tonnes produced annually. It accounts for around 40%–45% of total production, whereas synthetic rubber (SR) accounts for 55%–60%. The biggest producing country is Thailand (30% of global production), followed by Indonesia (27%) and Malaysia (10%).

Natural rubber can be produced naturally or synthetically, with around 27 million tonnes produced annually. It accounts for around 40%–45% of total production, whereas synthetic rubber (SR) accounts for 55%–60%. The biggest producing country is Thailand (30% of global production), followed by Indonesia (27%) and Malaysia (10%).

Natural rubber is made from the latex found in more than 200 species of plants; however, over 99% of it is produced from the latex of the Hevea tree. Although native to South America, the Hevea tree was introduced to Asia in the 19th century, which has become the top producing region in the world (over 90% of global output).

During 2011–2015, natural rubber prices fell due to reduced demand from China and the U.S. (the second and fourth largest importing countries, respectively) as car sales growth slowed in both China and the US. Automotive demand is important, because tyre manufacturing accounts for around 60% of natural rubber consumption.

The recent upturn in the market has also been driven by lower production levels in Thailand, caused by fire and drought. As a result, Thai latex production fell 60% since the beginning of the year. Stronger car sales, economic growth and low fuel prices boosted natural rubber demand in the U.S. In addition, rubber is increasingly used in a wider range of applications, such as road construction.

Reduced production, increased demand from the automotive industry and diversification of demand seem to have pushed natural rubber prices to bottom out, although there is still a long way to go before prices reach their 2011 highs. Let’s see how high the market can bounce.