The ASEAN-India Free Trade Agreement (AIFTA) has negatively affected India’s balance of trade in rubber and rubber products, impacting the strategic commercial importance of the inter-linkages among the constituent segments of the domestic rubber sector.

The surge in raw materials imports, especially natural rubber, has nullified the country’s historically inherited advantages in the external trade in finished rubber products, leading to a negative balance of trade to the tune of $866.9 million in the post-AIFTA phase.

The surge in raw materials imports, especially natural rubber, has nullified the country’s historically inherited advantages in the external trade in finished rubber products, leading to a negative balance of trade to the tune of $866.9 million in the post-AIFTA phase.

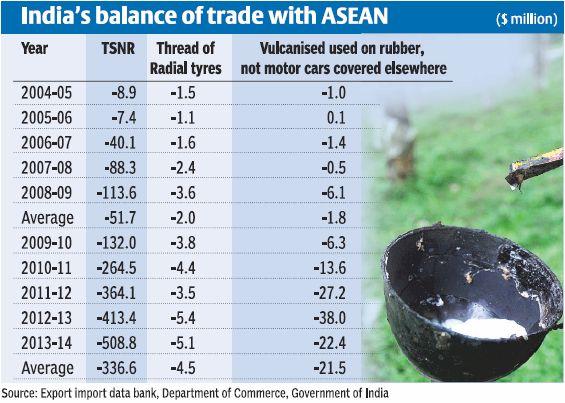

The trade deficit in rubber and rubber products with ASEAN has registered a quantum jump from $98.8 million (2004-05 to 2008-09) to $611.6 million (2009-10 to 2013-14), according to a study titled ‘ASEAN-India FTA and India’s balance of trade in rubber and rubber products: A preliminary assessment’, carried out by the Rubber Research Institute of India (RRII).

Raw material to blame

Joby Joseph and K Tharian Goerge, who carried out the study, said the import intensity of raw materials in the external trade with ASEAN has been the major contributory factor for the deteriorating balance of trade.

The sector-wise decomposition of the trade performance shows an 89.5 per cent increase in India’s favourable balance of trade in finished rubber products against 415 per cent growth in the negative balance of trade, especially for raw materials, including natural rubber, synthetic rubber and reclaimed rubber.

The RRII analysed three products representing raw materials, intermediate products and finished products based on their shares in the total value of imports from ASEAN.

Technically Specified Natural Rubber (TSNR), thread of vulcanised rubber, intermediate products, and radial tyres used in motor cars (including station wagons and racing cars) represented the three product groups.

The average negative balance of trade in the selected products with ASEAN increased from $51.7, $2.0, $1.8 million during the pre-AIFTA phase to $336.6, $4.5, $21.5 million, respectively, during the post-AIFTA phase.

Among the three products, thread of vulcanised rubber, and radial tyres used in motor cars are categorised under the ‘sensitive track’, with tariff reduction commitments, whereas TSNR is in the exclusion list.

Despite that, TSNR accounted for the highest negative balance of trade, which underlines the raw material intensity of India’s imports under the AIFTA.

Indonesia stands to gain

Indonesia retained its status as the major source of imports of TSNR during both phases; it improved its share (57.9 per cent) during the post-AIFTA phase.

The emergence of Vietnam as a major source of import of TSNR is another significant development.

The early indications on the impact of AIFTA on rubber and rubber products highlight the need for identifying the structural weaknesses in various segments in the context of the growing market integration process.

The need of the hour is to implement interlinked policy measures for raw material, intermediate and finished products segments to ensure the historically inherited resilience of the Indian rubber sector.