China has put the world’s traditional financial centers on notice that it wants to develop its raw material markets as hubs for setting prices, seeking to marry the country’s commercial heft with a much greater say in determining how much commodities cost.

“We’re facing a chance of a lifetime to become a global pricing center for commodities,” Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said at the Shanghai Futures Exchange’s annual conference in the city on Wednesday. “On the way to realize this goal, we’ll see very intense competition. We have the advantage of trading size and economic growth, but our legislation is still not sound and we lack enough talent.”

Fang Xinghai – Photographer: Nelson Ching/Bloomberg

China is the world’s largest user of metals and energy, but its traders and companies rely on financial centers outside the country — typically London and New York — to set benchmark prices for most of the commodities they handle and consume. While raw materials trading in the nation remains largely off-limits to overseas investors — who also face currency restrictions — China has long pledged to open up. Fang vowed to press on with that process, while also seeing tough challenges from rival centers as it does so.

‘Starting Point’

“We plan to use crude oil, iron ore and natural rubber futures as the starting point in our efforts to open the domestic market to more foreign investors,” Fang told the audience. China shouldn’t underestimate “the determination of current pricing centers to maintain their status,” he said.

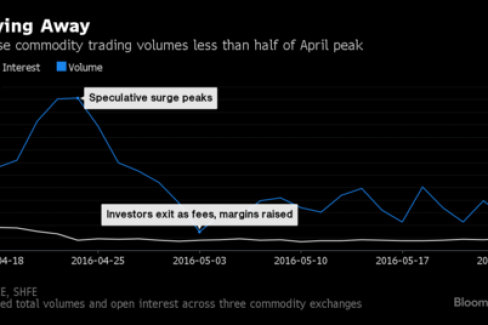

Raw-material futures markets in Asia’s top economy became a focal point earlier this year after being engulfed in a speculative frenzy, with a rapid run-up in prices and unprecedented volumes in March and April. The outburst prompted a crackdown from the CSRC and exchanges, which tightened rules and raised fees. The intervention was successful, and for China to now expand its role as a global center, effective supervision is critical, according to Fang.

“Recently, we experienced huge volatility and trading volumes in some commodity futures,” said Fang. “We supervised the exchanges to take measures, which have seen a notable effect.”

Data from the three biggest commodity exchanges in China show that aggregate volumes are less than half of what they were at the peak of the fever. Still, Chinese speculators will probably continue to seek very short-term commodity exposure thanks to easy credit access and the poor performance of alternative investments, according to Morgan Stanley.