May 26, 2016 Updated 5/26/2016

Email Print

Bill Wood

Total retail sales, not including automobiles, expanded by 3 percent in April compared with the same month last year, according to the U.S. Census Bureau. Through the first four months of 2016, this series is up 3.3 percent over the same period in 2015.

My forecast calls for annual growth of 4 percent in total retail sales in 2016, which is a marked improvement over the modest annual gain of 1.2 percent last year.

The recently released figures for monthly retail sales in the United States indicate that consumer spending for most types of goods continues to gain momentum. This bodes well for both the U.S. economy and many sectors of the plastics industry for the rest of this year. When retail sales go up, demand for plastics products goes up.

The trends in the various retail sales data are also excellent indicators of demand for different types of plastics products. The Census Bureau reports this data broken down by the type of establishment (grocery store, auto dealer, gas station, online shopping, etc.), and these data series are very reliable planning tools for processors who are trying to forecast end market demand for their products or to identify emerging trends in consumer behavior.

The series that really stood out for me in the report for April was the data on sales at building material and garden equipment and supplies dealers. I typically think of Home Depot or Lowe’s when I analyze this category, but I’m sure there are a lot of smaller, locally owned establishments as well. There are two reasons why I think this series is particularly interesting.

First, these establishments are enjoying faster growth this year than any of the other categories in the report. Through the first four months of 2016, sales at these places are up by 10 percent when compared with last year. That’s a faster pace of growth than at restaurants, auto dealers and even online stores. For all of last year, sales at building materials and garden supplies dealers expanded by 4 percent. So it is clear that Americans are increasing the amount they spend on their homes and gardens this year, and they are accelerating the pace.

Now I have referenced the changes in this particular data series before in this column, but it was usually from the perspective of what the trend at that time meant to the outlook for the market for plastic building materials. And for the record, I will say that the current trend in sales at these establishments indicates that demand for plastic building materials should continue to improve in the coming months.

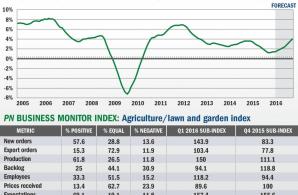

But the reason this outsized gain in sales at building materials and garden supplies dealers caught my eye this month is because of my newfound interest in the “garden supplies” part of the store. That’s because our most recent quarterly survey of plastics processors — conducted so that we can calculate our Plastics News Business Monitor Index — shows that the agriculture/lawn and garden end market generated the highest index value of all of the end markets we measure in our survey.

Green thumb

opportunities

Our agriculture/lawn and garden index for the first quarter of this year came in at record-high 116.5. This is significantly higher than the 105.6 this index registered in the first quarter of last year. It is also much stronger than the 106.5 value for our overall Business Monitor Index in the first quarter. Robust gains were reported by processors who supply this end market in new orders and production levels, and there was even a small increase in export orders. All of these readings indicate that the overall demand for plastics products is gradually rising at the present time, but the demand for plastics products that are used to grow things is escalating rapidly.

I am not an avid gardener, but I dabble a bit in the lawn. And I am no stranger to the lawn and garden aisles in the local big box stores. I can safely report that in the past few years the number of lawn and garden products for sale, and the amount of shelf space they take up, is expanding at a noticeable pace.

The same can be said for the number of these products made of plastic and also the number of products packaged in plastic. This seems especially true for shrink-wrapped pallets, which makes the products more efficient to ship and they also allow a store to expand their inventories without building any new warehouse space. Add a little spray paint, and the sides of these pallets also doubles as signage.

Another trend I have noticed locally is the rapidly increasing use of plastic sheet as a row covering for commercial farms. The farm-to-table movement is thriving in my county, and this seems to be one of the drivers of the increase in demand for plastic row covering. I have also noticed a jump in the number of shrink-wrapped bales of hay in the nearby fields. So in both the Home Depot parking lots and the local hay fields, polyethylene sheet is being used as a low-cost, efficient substitute for barns and sheds.

And there is one more reason why I expect this trend toward more plastic in agriculture will continue. It just works better. In a recent tweet sent out by the Society of the Plastics Industry Inc., there is a link to an article in The Economic Times reporting that a wider use of plastics in agriculture in India reduces input costs and harvesting waste while at the same time increases yield. They get more food with higher quality at a lower price. So it works in the United States, it works in India, and plastics are making it happen.

You may want to add a discussion about these trends to the agenda the next time you find yourself in a meeting where somebody is trying to de-select plastic for use as a shopping bag or water bottle.