SINGAPORE (ICIS)–Falling butadiene (BD) prices in Asia have shut the arbitrage window for European cargoes, with the downtrend expected to continue because of weak downstream synthetic rubber market, industry sources said on Wednesday.

But prices in this region may be nearing bottom as crude values have firmed, they said.

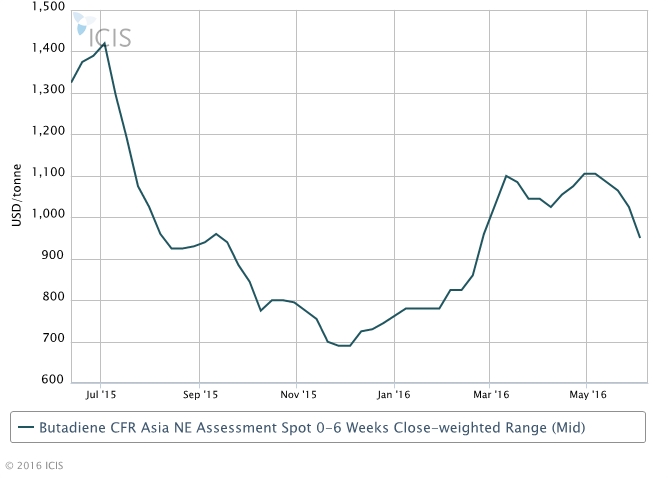

On 3 June, spot BD prices fell to an average of $950/tonne CFR (cost and freight) northeast (NE) Asia, down by about 15% since early May, ICIS data showed.

“There seems to be more downside potential as the BD end-users seem to be really determined to push BD price down lower,” a trader said.

The BD price gap between this region and Europe has recently narrowed, dampening the appetite among European producers to sell to Asia, market sources said.

More than 80,000 tonnes of BD from Europe had been shipped to Asia since early this year, following Shell’s declaration in early December 2015 of force majeure at its 960,000 tonne/year cracker and 155,000 tonne/year BD extraction unit in Bukom, Singapore.

The influx of deep-cargoes has aggravated the pressure on Asian BD prices, which have continuously fallen since early May amid poor demand.

“BD buyers have retreated and no buyers are willing to pay higher than $900/tonne CFR NE Asia due to the weak downstream synthetic rubber market,” another trader said.

A downstream synthetic rubber producer said: “We think a reasonable BD price should be below $900/tonne CFR NE Asia as the synthetic rubber price has dropped a lot.”

In the key China market, BD supply remained ample, prompting Chinese buyers to hold back on their imports purchases.

Domestic BD prices in east China have tumbled by about yuan (CNY) 2,000/tonne since early May to below CNY8,000/tonne DEL (delivered).

Asia’s BD spot prices have been weighed down in the past month by weak downstream styrenebutadiene rubber (SBR) prices, which tracked the slump in natural rubber (NR) prices.

NR and SBR are interdependent substitute raw materials in the production of tyres for the automotive industry and their prices tend to move in tandem with each other.

Despite recent rebound, the SMR 20 tyre grade NR prices have shed about $300/tonne since late April to $1,290/tonne FOB (free on board) Malaysia at the Malaysian Rubber Exchange on 7 June.

SBR prices fell by about $100/tonne from early May to $1,350/tonne CIF (cost, insurance and freight) China on 1 June, according to ICIS data.

Focus article by Helen Yan