June 20, 2016 Updated 6/20/2016

Email Print

David Sedgwick

Automotive News

Mergers and acquisitions are heating up the global auto parts industry again, an echo of the consolidation craze that reshuffled the business in the 1990s.

But this time, the drive is different: Back then, suppliers urgently wanted to be able to control entire multipart modules and systems for their customers.

Today, parts makers appear to be sorting out which segment is profitable, which needs to be dumped and which business unit can be rendered profitable by combining it with the cast-off pieces of other suppliers.

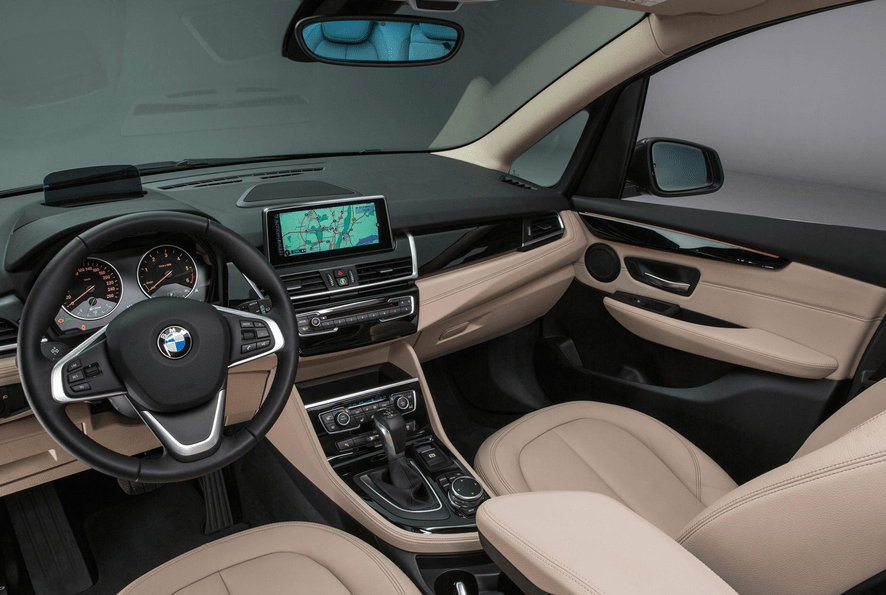

Case in point: vehicle cockpits.

If a tasteful, well-designed cockpit is the key to a vehicle’s appeal, why are cockpit component suppliers so unprofitable?

A consolidation of the interior trim segment is causing an upheaval among the top 100 global automotive suppliers, as listed by Automotive News in its annual ranking.

Industry youngsters such as Grupo Antolin of Spain and Yanfeng Automotive Trim Systems Co. of China are now breaking into the top ranks, while old timers such as Johnson Controls Inc., Magna International Inc. and Visteon Corp. have dumped their interior trim units.

“It’s an extremely profit-poor segment,” says Dietmar Ostermann, a PwC senior strategy consultant in Detroit. “Certainly, the megasuppliers are asking themselves: “Why should I do this if I can double my profit margins in another segment?'”

Both Yanfeng and Grupo Antolin are betting that economies of scale will help them make money in a difficult market segment.

Yanfeng, No. 18 on Automotive News’ global list, ranked by 2015 original-equipment parts sales, is a subsidiary of Shanghai Automotive Industry Corp., China’s largest state-owned automaker.

Last year, Yanfeng gained a 70 percent share of Johnson Controls’ interiors unit, which had been spun off into a joint venture called Yanfeng Automotive Interiors.

Johnson Controls’ former seat operation — now a stand-alone company dubbed Adient — holds a 30 percent stake in the venture.

Another company in growth mode is Grupo Antolin, No. 57 among the top global suppliers, which finalized its $ 525 million acquisition of Magna International’s interiors division last August.

The acquisition of Magna’s interiors business moved Grupo Antolin into the top spot in Plastics News North American injection molders ranking, with an estimated $ 2.6 billion in sales for 2015.

Those transactions were part of a lively year for deal-making. Last year, M&A activity among automotive suppliers generated an estimated $ 41 billion worth of deals — easily outstripping $ 14 billion worth of acquisitions in 2014, according to an annual survey by Strategy&, a unit of PwC.

While the total number of deals was about average, 20 of the acquisitions were worth more than $ 500 million. That is twice as many big deals as in prior years and a fair indicator of suppliers’ zeal to claim a larger piece of a robust market in North America and other regions.

Even though ZF Friedrichshafen AG’s blockbuster acquisition of TRW Automotive Holdings Corp. accounted for $ 12.4 billion of last year’s total, it was still an unusually busy time.

Ostermann says three trends are fueling the deal-making:

c Automakers are increasingly using a handful of platforms to underpin model lineups around the world. That trend favors big suppliers.

c To keep up with advances in self-driving cars, infotainment and powertrains, suppliers must support big r&d budgets. That is a challenge for modestly sized companies.

c Private equity investors are betting on the auto industry’s long-term growth, so financing is available to dealmakers.

“If you are a smaller supplier, you can’t survive anymore,” Ostermann says. A small supplier “can’t support global programs on five continents, so we are going through a consolidation that is pretty significant.”

Ostermann expects 2016 will be another robust year for deals, but Yanfeng and Grupo Antolin are likely to sit it out. Top executives of both companies say they are busy integrating their new units into their operations.

“We believe there is room [in the interiors industry] for some further consolidation, but it’s not in our plan,” says Pablo Baroja, president of Grupo Antolin’s North American unit.

The company expects to take two years to integrate Magna’s former division, a process that began nine months ago.

Grupo Antolin also is satisfied with its product lineup of floor consoles, headliners, door panels and instrument panels. “We are fully focused on the interior of the car,” Baroja says.

Likewise, Yanfeng will concentrate on organic growth rather than acquisitions, according to Johannes Roters, CEO of the company’s joint venture.

“For the interior business, size is important,” Roters told Automotive News in January. But, he said, “we don’t need further acquisitions because right now we have the right setup.”

Roters said he was happy with the joint venture’s product portfolio, which includes floor consoles, instrument panels, door panels, overhead consoles and some injection-molded parts. The joint venture’s portfolio will not include seats, Roters said. Instead, seats will remain within the product portfolio of Adient, Yanfeng’s partner.

Yanfeng is the biggest supplier in a segment that has spawned a clutch of global vendors.

Aside from Yanfeng and Grupo Antolin, the industry’s major players now include such powerhouses as Faurecia SA, No. 8 on the top global suppliers list; Toyota Boshoku Corp., 21; IAC Group, 43; and TS Tech Co., 54.

Roters, Ostermann and others believe the interiors segment could use additional consolidation to make it more profitable. But progress there may be fitful in the next few years. Forecasters are suggesting that North American vehicle production is close to a peak, and that is making some potential buyers skittish about a potential downturn.

Moreover, bargain hunters already have culled the most tempting acquisition targets.

“Coming out of 2009 and 2010, suppliers were very cheap,” Ostermann recalls. “That is no longer the case.”