June 24, 2016

Email Print

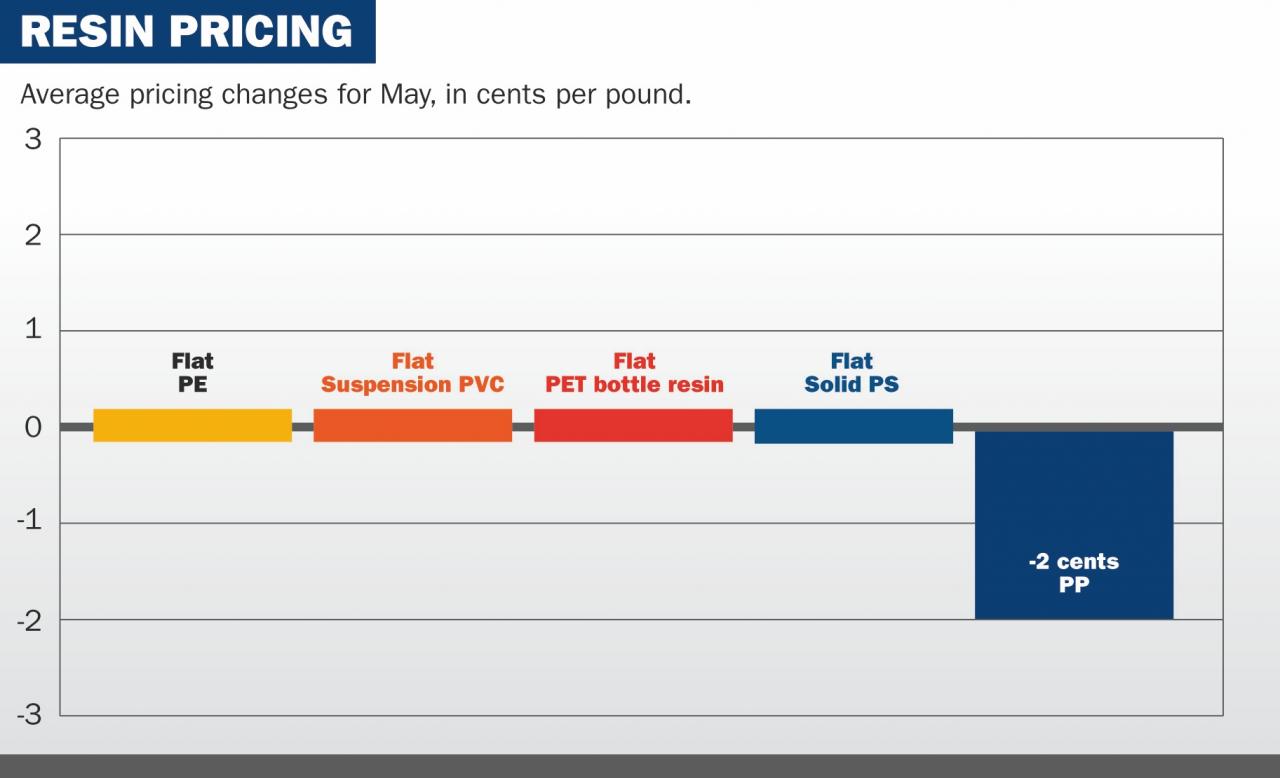

The North American commodity resin market gave peace a chance in May, with all prices flat except for polypropylene.

Plastics News in May reported an additional 2-cent decrease on North American PP resin prices to reflect price erosion that took place between March and May. The PN resin pricing chart previously showed a 3-cent PP price drop for April.

Conversations with resin buyers and other market watchers indicated that the total price drop for the March-April-May time period was 5 cents, with buyers seeing the decreases in varying amounts at various times over that period. The 5-cent decline has canceled out price gains from earlier in the year, leaving regional PP prices down a net of 1 cent per pound since Jan. 1, according to the PN chart.

PP makers ExxonMobil Chemical Co. of Houston and Formosa Plastics Corp. USA of Livingston, N.J., already have announced price decreases for June. The ExxonMobil decrease ranges from 3 to 5 cents per pound, while the Formosa downward move is 5 cents.

Domestic PP suppliers are facing competition from material imported from several regions. Import material has found a home in North America as the region’s PP production has struggled to keep up with demand. Operating rates for PP plants in North America are in the high 90s.

Through April, North American PP sales were up almost 1 percent vs. the year-ago period, according to the American Chemistry Council in Washington. Domestic growth of 2.3 percent was curbed by a 44 percent drop in export sales.

Regional polyethylene prices were flat in May after rising an average of 4 cents per pound in April. PE prices stayed the same even though crude oil prices moved up from $ 45 per barrel to $ 49 during the month. Oil is a global price setter for PE, although natural gas is the most common PE feedstock in North America.

The April PE increase was the second consecutive monthly hike for the material. Prices had dropped in the first two months of 2016. A 5-cent January/February drop had been canceled out by a 5-cent gain in March.

U.S./Canadian PE sales fared well in the first four months of 2016. Sales of high density PE surged almost 6 percent, with flat domestic sales magnified by gains of 30 percent in export sales. Linear low density PE sales were up just over 4 percent for the quarter with domestic sales gains of more than 3 percent boosted by 7 percent growth for exports. Low density PE managed first-quarter growth of just over 2 percent, as a domestic sales gain of more than 3 percent was softened by a 1.5 percent drop in export sales.

PVC suspension resin prices were flat in May, even amid increased construction activity. Prices for the material had bumped up a combined 6 cents per pound in March and April. U.S./Canadian PVC sales were off to a strong start in the first four months of 2016, growing almost 9 percent. Domestic sales growth of almost 4 percent was bolstered by a surge of more than 21 percent in the export market.

North American PET bottle resin prices also were flat in May, after ticking up 2 cents per pound in April, with warmer weather improving seasonal demand for bottled water and carbonated soft drinks. The April move was the second straight monthly price hike for that material, following a similar 2-cent move in March. Prior to those back-to-back increases, regional PET prices had fallen for six consecutive months.

In the solid polystyrene market, May prices were flat after jumping an average of 5 cents per pound in April. A 4 percent price drop for benzene feedstock wasn’t enough to move the needle for PS prices.

Benzene prices for June are expected to be down another 4 percent, which could put downward pressure on polystyrene. Solid PS prices had been flat in March after declining by an average of 2 cents per pound in February.

North American PS sales fell 1.3 percent in the first four months of 2016, even as sales of the material into the food service/food packaging end market grew almost 2 percent and sales into electrical/electronic uses grew almost 3 percent.