July 11, 2016 Updated 7/11/2016

Email Print

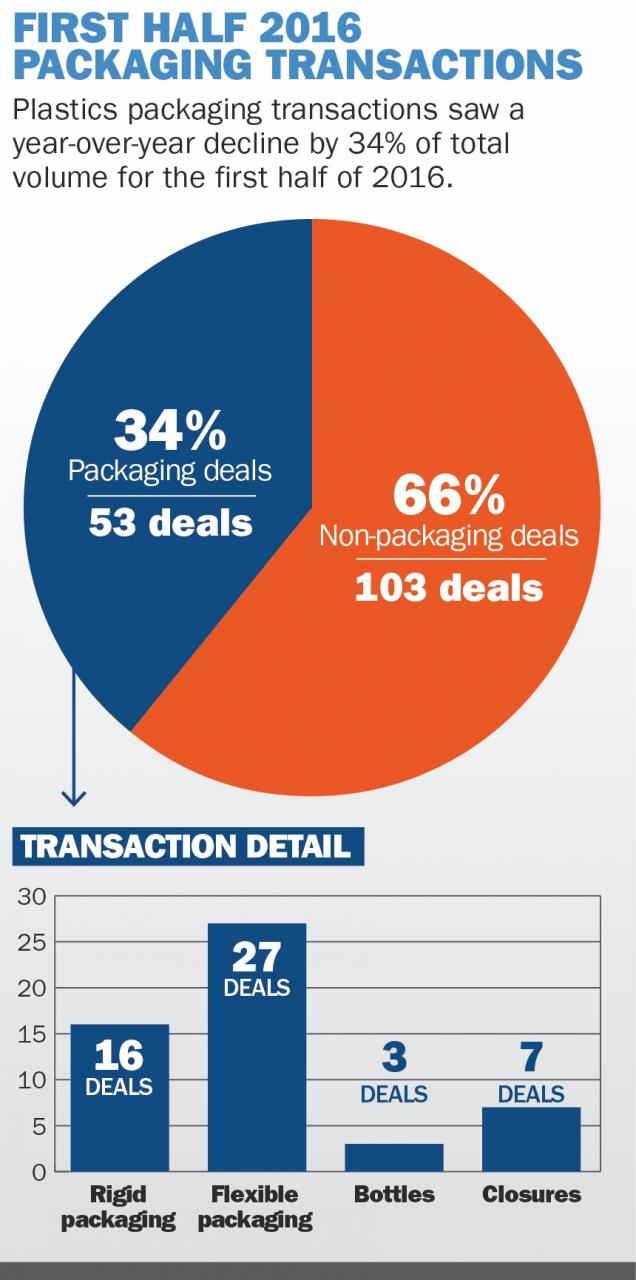

Jessica Jordan The number of packaging deals declined in the first half of 2016 vs. the same period in 2015.

Injection molder Quantum Plastics LLC and packaging giant Amcor Ltd. each made multiple acquisitions in the first half of 2016.

Elgin, Ill.-based Quantum made two deals in March alone, snagging Plasticos Promex USA Inc. of El Paso, Texas, and 3D Plastics Inc. of Gladewater, Texas. Plasticos and Gladewater both have molding operations in Mexico, allowing Quantum to operate there for the first time.

No purchase price was disclosed in either deal. Quantum spokeswoman Lisa Forret told Plastics News that Plasticos Promex complements Quantum. “They have different customers and products within the markets we serve,” she said. Plasticos Promex sells to appliance, consumer, electronics, industrial, and lawn and garden sectors.

Plasticos Promex President and co-founder Don Labbruzzo will continue with the business. The merger with Quantum will help the Mexico operation to strengthen its offerings in painting, decorating and assembly.

3D Plastics’ southern U.S. location was a key attraction for Quantum, Forret said. The firm’s ISO certification meshes well with Quantum’s quality programs, she added, and 3D Plastics brings value-added work involving heat staking and assembly.

Quantum now has made seven acquisitions since 2014. The firm is a unit of Quantum Ventures of Auburn Hills, Mich., an investment firm owned by the Skandalaris family.

Amcor of Hawthorn, Australia, paid $ 435 million to lasso Alusa, the largest flexible packaging business in South America. Alusa includes four plants in Chile, Peru, Argentina and Colombia and has been owned by Techpack SA and Nexus Private Equity. Its annual sales are $ 375 million.

Acquiring Alusa is part of a strategy by Amcor to be with its customers around the globe. “A large number of Amcor’s multinational customers operate in South America, and this acquisition significantly improves our ability to support their needs and grow with them in these markets,” CEO Ron Delia said in a statement.

Alusa has a broad range of capabilities including film extrusion, flexographic and gravure printing and lamination. Amcor’s latest move further bolsters the company’s push into flexible packaging in the Americas. The firm also in the first half apparently used its spare change to make three more acquisitions — Deluxe Packages of Yuba City, Calif. ($ 45 million), Chinese blown film maker and flexographic printer BPI China ($ 13 million) and plastic container and closures maker Plastic Moulders Ltd. of Toronto ($ 30 million).

Of the BPI move, CEO Delia said that China “continues to be an attractive market for flexible packaging globally.”

Amcor manufactures rigid and flexible plastic packaging products for the food, beverage, health care, home and personal care, and tobacco packaging industries. It has annual sales of $ 10 billion and employs 29,000 across more than 180 sites in 43 countries.

Amcor is one of the world’s largest PET bottle makers and generates about a third of its sales in rigid plastics. North America accounts for 29 percent of its overall sales.