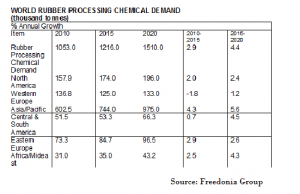

Cleveland, Ohio – World rubber processing chemical demand is expected to grow 4.4-percent a year to 1.5 million tonnes by 2020, according to market researchers at Freedonia.

In a new report, Freedonia linked the forecast growth to rises both in rubber consumption and in the loadings of processing chemicals needed to manufacture premium tires and automotive and industrial goods.

Advances will be strongest in the developing countries of the Asia/Pacific region, but improving conditions in the mature markets of the US, Western Europe and Japan will also contribute significantly to growth.

The Cleveland-based group noted that demand for rubber processing chemicals remains “tightly correlated” to rubber consumption within individual countries.

More generally, it said, trends that influence demand for rubber used in tires and industrial products are expected to have a strong impact on rubber processing chemicals.

“Rising motor vehicle ownership rates in developing nations will support local tire production, necessitating additional consumption of processing chemicals,” said analyst Jason Carnovale.

Similarly for non-tire rubber chemicals, demand is predicted to benefit from a hike in motor vehicle production, as well as industrialisation in the developing world.

On the other hand, the possibility of further economic slowdown in China remains a significant concern for the industry.

“Rubber demand growth in China has already decelerated in recent years as the country faces challenges related to its real estate and financial markets,” said Freedonia.

“However, the Chinese market is expected to remain healthy through 2020 as motor vehicle production remains strong, and the country is forecast to contribute nearly half of incremental global demand growth,” the report added.

Japan and western Europe are expected to see a reversal from declines in rubber processing chemical demand experienced between 2010 and 2015, while the US demand is set to accelerate due to improving market conditions.

Freedonia, though, said advances in these industrialised areas are projected to remain well below the world average through 2020, reflecting market maturity and limited opportunities for additional rubber consumption or increases in processing chemical loadings.