SINGAPORE (ICIS)–Spot butadiene (BD) prices in Asia may continue to head south because of waning demand while supply will be augmented by an expected influx of deep-sea cargoes in the next two months, market sources said on Thursday.

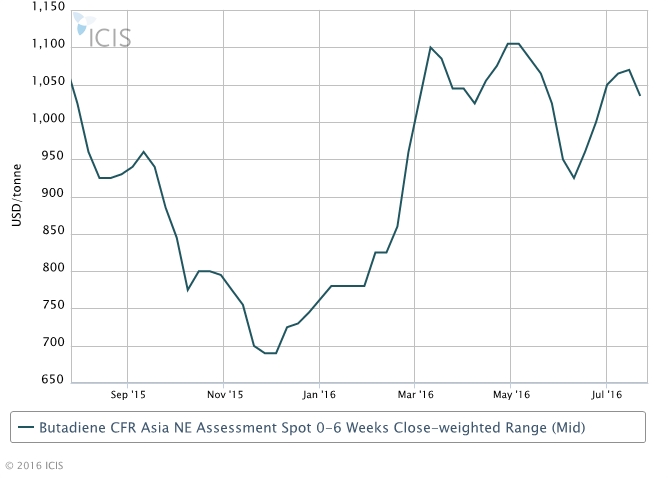

Prices snapped five consecutive weeks of gains on 22 July, shedding $30-40/tonne to $1,020-1,050/tonne CFR (cost and freight) northeast (NE) Asia, ICIS data showed.

Tight regional supply has eased this month following the restart of Shell’s Bukom cracker complex in Singapore after a prolonged shutdown. The complex houses a 155,000 tonne/year BD extraction unit.

Shell is expected to ship out BD cargoes to contract customers in Asia late this month or early August, market sources said.

Meanwhile, more than 20,000 tonnes of deep-sea cargoes from Europe, US, Brazil and the Middle East are expected to arrive in Asia in August and September.

With additional supply coming amid continued weakness in the downstream synthetic rubber market, BD buyers have retreated to the sidelines.

BD is a raw material for the production of synthetic rubbers, which go into tyres for the automotive industry.

“The downstream synthetic rubber market is really weak and it is difficult to support BD price above $1,000/tonne CFR NE Asia,” a buyer said.

Buying interest for spot cargoes in northeast Asia has dwindled as most end-users have largely covered requirements up to September, market sources said.

“The buyers have retreated and are showing very little interest, given the uncertain market outlook and weak crude prices,” a trader said.

Crude futures slumped by at least $1/bbl overnight, with Brent crude settling at $43.47/bbl, and US crude at $41.92/bbl.

From the key China market, buying interest for BD has largely evaporated, as Chinese customers had procured sufficient regional and deep-sea cargoes ahead of the G20 summit at Hangzhou city in Zhejiang province on 4-5 September.

Most petrochemical plants near Hangzhou in eastern China were ordered either to shut or reduce production from late August, as part of government measures to improve air quality during the G20 summit.

“The Chinese buyers are now just waiting and dare not commit to any purchases. There is too much uncertainty,” another trader said.

In South Korea and Taiwan, major consumers have bought sufficient deep-sea spot cargoes for August and September, anticipating a shortfall in production because of turnarounds at regional crackers.

Among producers with scheduled maintenance at their crackers in the next two months are Sinopec SABIC Tianjin in China; Formosa Petrochemical Co ( FPCC) in Taiwan; and SK Global in South Korea.

“We are covered for August and September and do not need to procure any additional spot product,” a major buyer said.

Focus article by Helen Yan