SINGAPORE (ICIS)–Asian butadiene (BD) spot prices surged during the week because of the tight regional supply and the uptrend is expected to sustain in the near term, market sources said on Friday.

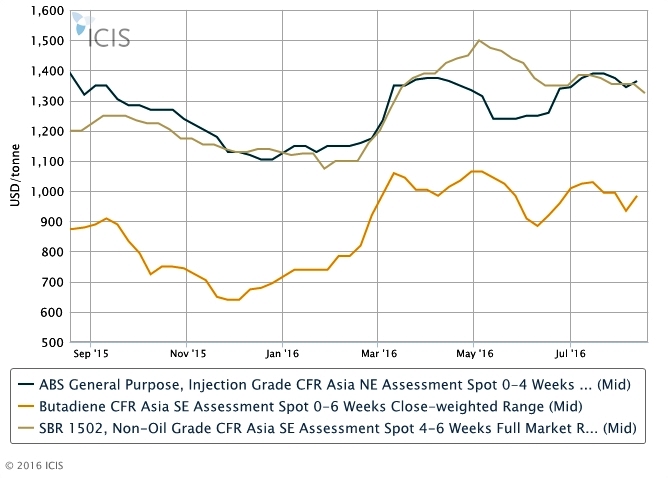

Asia BD prices rose by $40-60/tonne week-on-week to $1,000-1,050/tonne CFR (cost & freight) NE Asia in the week ended 12 August and the prices will extend the uptrend this week, according to ICIS.

The supply in Asia tightened because of a slew of cracker and BD unit shutdowns in South Korea, China, and Japan.

China’s Sinopec SABIC Tianjin Petrochemical shut down its 200,000 tonne/year BD unit on 14 August for over one month scheduled maintenance. Given that the plant has no downstream derivatives, buyers and end-users had to seek alternative source in the spot market, sources said.

Limited available supply came from South Korea as major domestic producers mainly focused on domestic market will conduct a BD unit turnaround from second half of September.

The BD supply in Japan were balanced-to-short amid the ongoing cracker maintenance from JX Nippon Oil & Energy and the upcoming cracker shutdown from Idemitsu Kosan in September.

No export materials from Taiwan were available amid the ongoing plant maintenance of a major Taiwanese producer since end July.

In the meantime, the absence of European cargoes for September loading also lent support to Asia BD prices as market participants said the tight supply in Europe and stronger local demand restricted the exports.

Few firm offers were heard from northeast Asian producers due to the supply crunch in the region, market sources said.

Selling indications were heard at around $1,150/tonne CFR NE Asia, while most importers in China, South Korea and Taiwan increased their buying indications to $1,050-1,100/tonne CFR NE Asia in order to secure cargoes.

In southeast Asia, supply also remained short as a major Indonesia producer Chandra Asri delayed the restart of its 100,000 tonne/year BD extraction unit on 19 August from the original 14 August.

And the company said it had no September cargoes due to the extended shutdown.

The 100,000 tonne/year BD extraction unit of Petrochemical Corp of Singapore (PCS) remained under maintenance from 11 July, and it is expected to restart in the coming week.

However, the company source said they may continue to focus on their term customers.

Malaysia’ Lotte Chemical Titan awarded a sales tender of spot BD cargo for early September loading at $1,050/tonne FOB (free on board) SE Asia within the week, market sources said.

The cargo was heard to move to northeast Asia as traders now preferred to bring the cargo to attractive northeast Asian market, sources said.

BD demand from acrylonitrile butadiene styrene (ABS) sector remained healthy in line with therising ABS prices while consumption from synthetic rubber sector was relatively weaker as thedownstream tyre plants operated at reduced rates due to the lull in demand during the hot summer season.

Looking forward, the tight supply is expected to sustain in coming weeks as the restrained supply may not east in the near future, sources said.

However, how long the uptrend can sustain remains a question.

“If the downstream derivatives could not pass on the cost, BD prices will crash,” a northeast Asian end-user said.